- Share.Market

- 3 min read

- Published at : 23 Jul 2025 03:13 PM

- Modified at : 23 Jul 2025 03:13 PM

Shares of

ideaForge Technology Ltd. fell as much as 8% reaching an intraday low of ₹500.10, following the announcement of its Q1 FY26 results, even as the company reported significant business wins and operational highlights during the quarter.

Revenue for the quarter stood at ₹127.8 crore, down 85% from ₹861.9 crore in Q1 FY25.

The EBITDA loss widened to ₹151.4 crore in Q1 FY26, compared to a positive EBITDA of ₹84.6 crore a year ago, marking a 279% year-on-year swing. The steep operating loss further weighed on profitability.

Net loss for the quarter came in at ₹235.6 crore, compared to a net profit of ₹11.7 crore in Q1 FY25. This represented a 2,114% year-on-year decline in profitability.

The unmanned aerial vehicle (UAV) maker secured an emergency procurement order worth ₹137 crore from the Indian Army for mini-UAVs. These UAVs were actively deployed in Operation Sindoor, showcasing their battlefield-readiness and resilience in high-stakes environments. CEO Ankit Mehta highlighted that the deal followed rigorous evaluations and reaffirmed ideaForge’s positioning as a trusted defence partner.

In addition to domestic milestones, ideaForge participated in global defence exhibitions such as DSEI Japan, Xponential (USA), Paris Air Show, and IDET in the Czech Republic. The company also announced a strategic collaboration with HFCL to expand its UAV footprint in international markets.

Looking ahead, the company expects tailwinds from the government’s next cycle of emergency procurement, a ₹1 lakh crore R&D fund, and the upcoming phase of the PLI scheme for drone manufacturers. Management reiterated its commitment to innovation and long-term value creation.

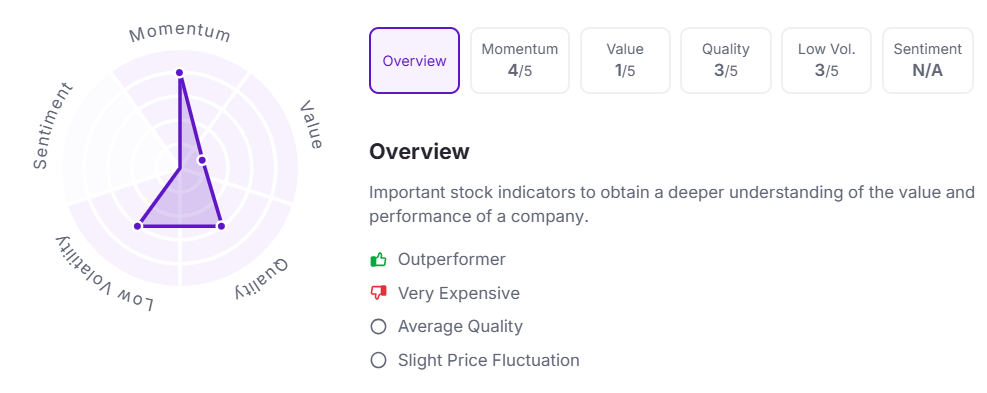

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:10 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.