- Share.Market

- 5 min read

- Published at : 14 Jul 2025 10:31 AM

- Modified at : 16 Jul 2025 11:22 PM

The shares of IDBI Bank, Mahindra & Mahindra Financial Services, and Aditya Birla Real Estate are set for their record date on Tuesday, July 15, 2025.

To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

IDBI Bank Ltd. one of the largest scheduled commercial banks, has announced a dividend of ₹ 2.1 per equity share.

IDBI Bank Limited operates with a vast network of branches and ATMs across India and a presence in Dubai. It is currently under the ownership and management of Life Insurance Corporation of India (LIC) and the Government of India.

IDBI Bank reported mixed performance in Q4FY25, with operating profit rising 46.29% YoY, despite a marginal 0.17% decline in interest earned. For the full year FY25, the bank posted a 9.35% rise in interest earned, a 14.45% increase in operating profit, and a solid 31.65% jump in net profit, reflecting sustained improvement in core earnings and profitability.

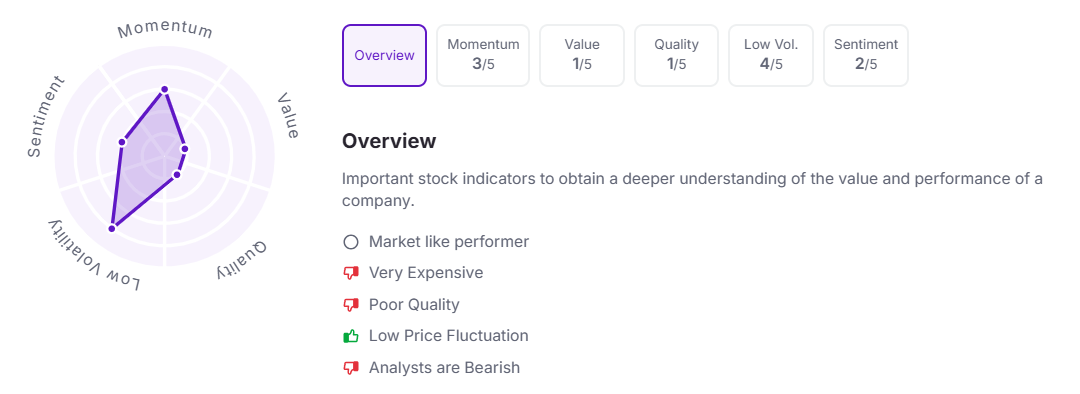

Let’s take a look at its Factor Analysis scores:

Mahindra & Mahindra Financial Services Ltd. has announced a final dividend of ₹6.50 per equity share.

Mahindra & Mahindra Financial Services, a leading NBFC under the Mahindra Group, operates through 1,350+ branches, 6,000+ dealer partners, and 10+ OEM tie-ups, catering to over 11 million customers across India. With an AUM exceeding ₹1.19 lakh crore in FY25, it continues to dominate rural and semi-urban financing, backed by deep distribution, strong OEM relationships, and a wide product portfolio.

In Q4FY25, Mahindra Finance reported a 13% YoY increase in income to ₹4,897 crore, but Net Profit declined 32% YoY to ₹456 crore due to higher provisions and rising operating costs. For the full year, disbursements rose 4% YoY to ₹60,741 crore, income grew 16%, and Net Profit improved 16% to ₹2,261 crore, reflecting stable annual growth despite Q4 pressures. SME loan disbursals jumped 48%, highlighting its strategic shift towards diversified lending and business expansion.

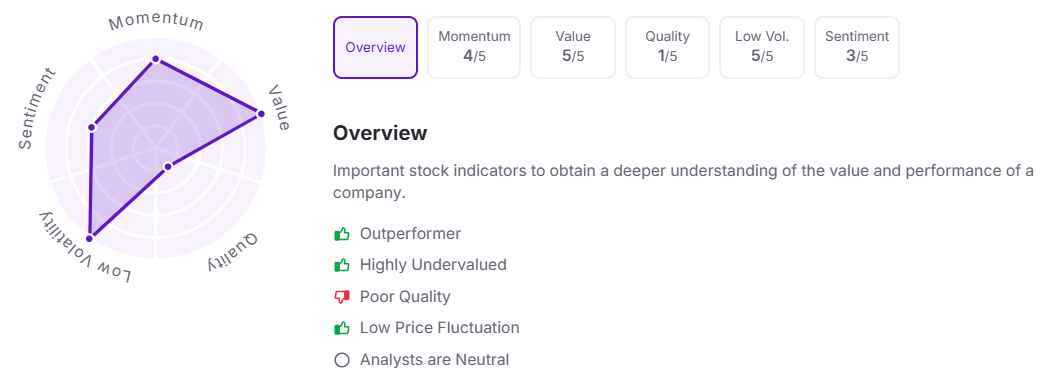

Let’s take a look at its Factor Analysis scores:

Aditya Birla Real Estate Ltd. has announced a final dividend of ₹2 per equity share.

Aditya Birla Group is a global business group with strong roots in real estate and paper manufacturing. It has over 180,000 employees across 40+ countries, serving 300 million+ customers. With ₹70 billion+ invested over 15 years, it runs 130+ partnerships and has a solid track record of growth and stability.

In Q4FY25, the company’s turnover declined sharply by 51% YoY. However, it rebounded 94% QoQ from Q3’s low of ₹204 crore, indicating early signs of recovery. Net profit for the quarter turned negative, a 188% YoY fall anda 320% QoQ decline.

For FY25, turnover rose 11% YoY. However, the company reported a net loss of ₹149 crore for the full year, reversing from a ₹128 crore profit in FY24, reflecting a challenging year marked by pressure on profitability.

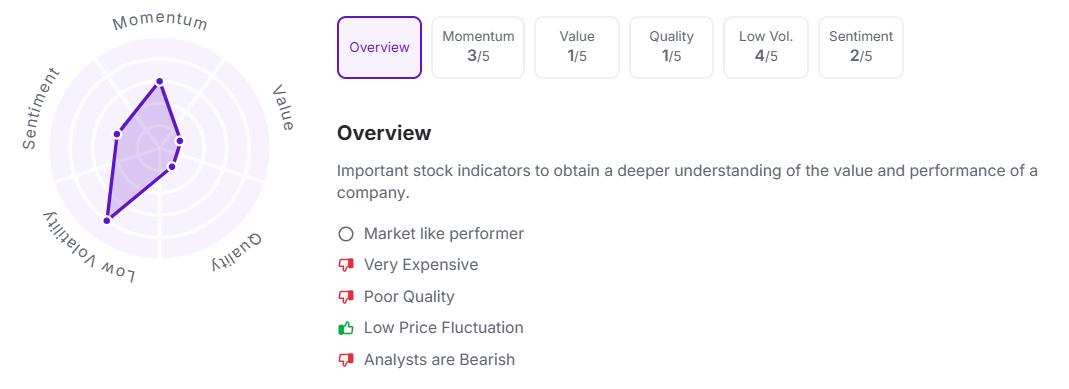

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 10:30 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.