- Share.Market

- 5 min read

- Published at : 11 Aug 2025 12:06 PM

- Modified at : 11 Aug 2025 12:41 PM

The shares of ICICI Bank, Grasim Industries, RITES, and H.G. Infra Engineering are set for their record date on Tuesday, August 12, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

ICICI Bank Ltd. has announced a dividend of ₹4 per equity share. It has a dividend yield of 0.70% TTM.

ICICI Bank is one of India’s leading private sector banks with a strong domestic and international presence. It reported a robust performance for the quarter ended June 30, 2025 (Q1 FY26). Standalone profit after tax rose 15.5% year-on-year to ₹12,768 crore. Net interest income grew 10.6% to ₹21,635 crore, while non-interest income (excluding treasury) increased 13.7%. Deposits expanded 12.8% year-on-year to ₹16.09 lakh crore, with a healthy CASA ratio of 38.7%.

Over the last five years, this stock has given multibagger returns of more than 290%.

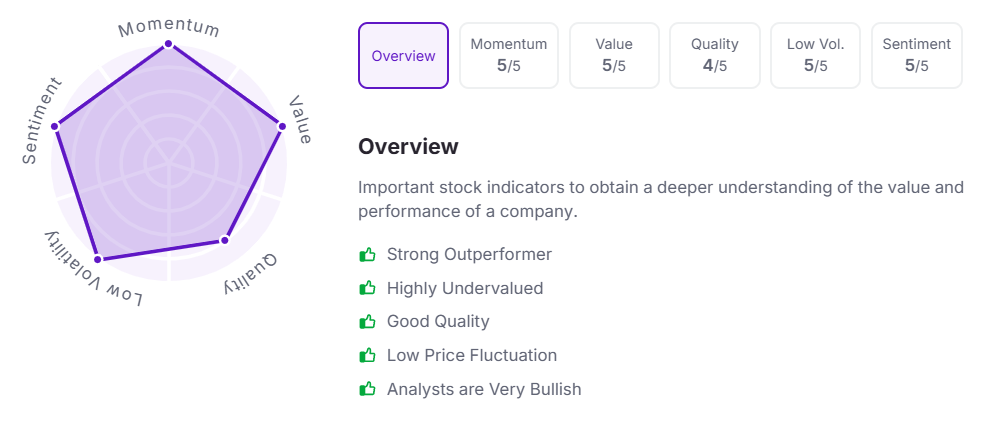

Let’s take a look at its Factor Analysis scores:

Grasim Industries Ltd. has announced a dividend of ₹10 per equity share.

Grasim Industries Limited, the flagship company of the Aditya Birla Group, is a leading diversified player with presence across cement, financial services, chemicals, paints, textiles, and B2B e-commerce, along with global leadership in cellulosic fibres. It reported consolidated revenue of ₹40,118 crore in Q1 FY26, up 16% year-on-year, with EBITDA rising 36% to ₹6,430 crore and PAT up 32% to ₹1,419 crore.

Over the last five years, this stock has given multibagger returns of more than 330%.

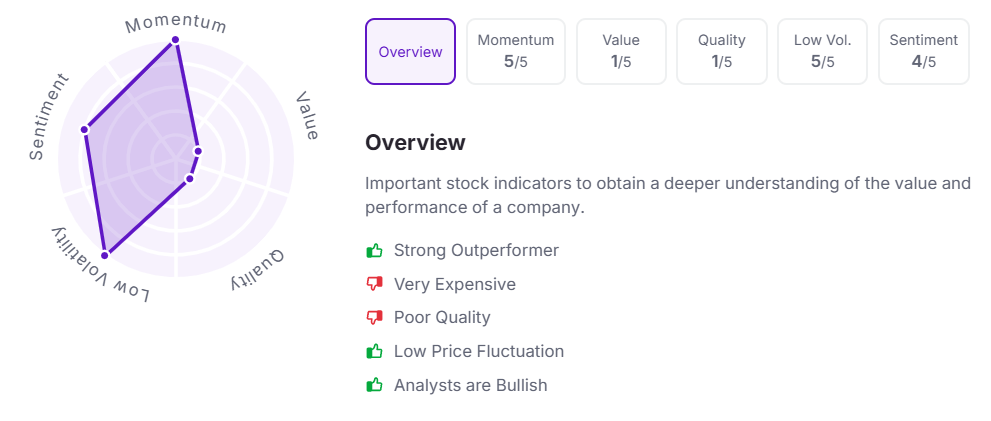

Let’s take a look at its Factor Analysis scores:

Rites Ltd. has announced an interim dividend of ₹1.30 per equity share. It has a high dividend yield of 2.50% TTM.

RITES Limited, a Navratna and Schedule ‘A’ Central Public Sector Enterprise under the Ministry of Railways, is a leading transport infrastructure consultancy and engineering company with five decades of experience and operations in over 55 countries. In Q1 FY26, the company reported consolidated revenue of ₹512 crore and PAT of ₹91 crore, with operational profit up 7.9% year-on-year on improved execution. The order book stood at ₹8,790 crore after securing over 150 orders worth ₹451 crore during the quarter.

Over the last five years, this stock has given multibagger returns of more than 100%.

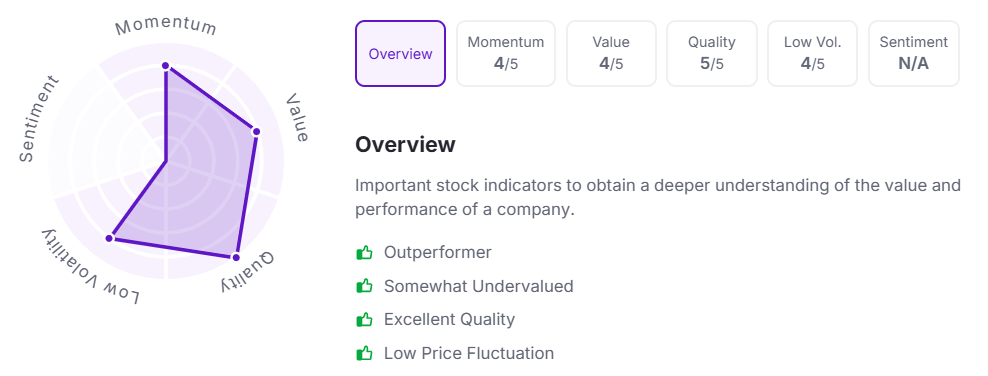

Let’s take a look at its Factor Analysis scores:

HG Infra Engineering Ltd. has announced a final dividend of ₹2 per equity share. It has a dividend yield of 0.20% TTM.

HG Infra Engineering is a leading infrastructure development company with over two decades of expertise in executing EPC and HAM projects across roads, highways, railways, metro, and solar sectors. With a pan-India presence in over 15 states, a fleet of 3,000+ modern equipment, and a track record of 28+ active projects, the company serves marquee clients like MoRTH, NHAI, DMRC, and Indian Railways.

Over the last five years, this stock has given multibagger returns of more than 445%.

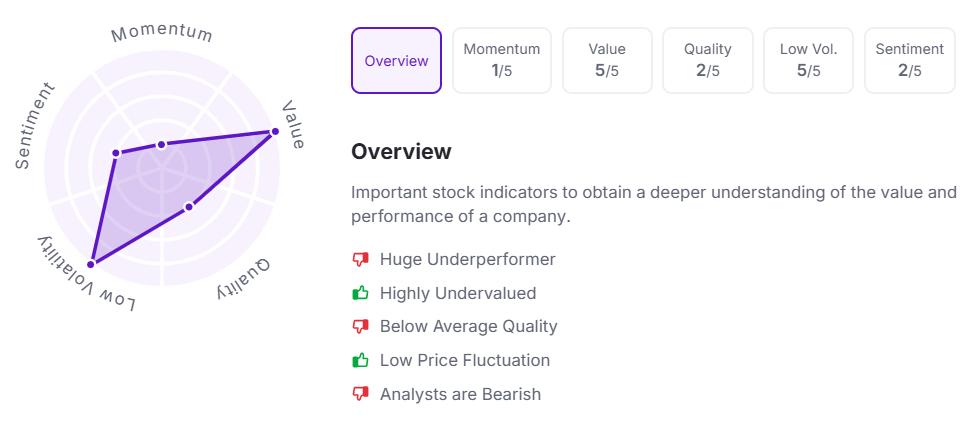

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:00 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.