- Share.Market

- 3 min read

- Published at : 29 Sep 2025 06:30 PM

- Modified at : 15 Nov 2025 11:43 AM

Shares of Hindustan Unilever Ltd. fell today after the FMCG giant issued a business update projecting near flat to low-single digit consolidated growth for the quarter ending September 30, 2025 (Q2 FY26). The subdued forecast is attributed to a transitory impact stemming from the recent GST rate rationalization.

The company stated that the government’s reform, which reduced the GST rate to 5% from the previous 12% or 18% on approximately 40% of its portfolio, including essential products like Toilet Soap, Toothpaste, Shampoo, and Foods, is fundamentally a positive step expected to increase disposable income and drive long-term demand.

However, the immediate transition created significant disruption at distributors and retailers. To clear existing inventories with old prices, channel partners postponed placing new orders, and consumers delayed their pantry buying in anticipation of receiving new stock reflecting the lower prices.

HUL confirmed that this disruption led to a short-term impact on sales for September. Given the existing pipeline inventory in distribution channels, the company expects this temporary drag to continue into October as well.

HUL emphasized that this is a “one-off, transitory impact,” and anticipates a robust recovery starting November, when prices stabilize and are underpinned by rising disposable incomes and ongoing portfolio transformation actions. The detailed Q2 results are scheduled for Board approval on October 23, 2025.

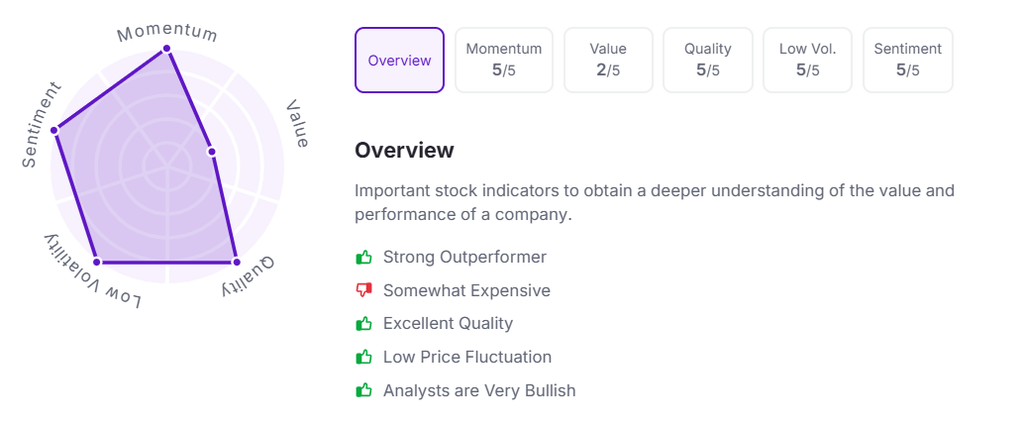

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 3:30 pm.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954