- Share.Market

- 5 min read

- Published at : 06 Nov 2025 12:34 PM

- Modified at : 15 Nov 2025 10:00 AM

The shares of Hindustan Unilever, NTPC, Bharat Petroleum Corporation, Shriram Finance, Godrej Consumer Products, and Dabur India are set for their record date on Friday, November 7, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

The FMCG company has announced an interim dividend of ₹19 per equity share. It has a dividend yield of 1.00% TTM.

In Q2FY26, Hindustan Unilever Ltd. reported an Underlying Sales Growth (USG) of 2% and a flat Underlying Volume Growth (UVG). Turnover for the quarter stood at ₹16,061 crores. The Profit After Tax (PAT) grew by 4% to ₹2,694 crores , primarily driven by a one-off positive impact from the resolution of prior years’ tax matters. The quarter’s performance reflected a transitory impact of GST changes and prolonged monsoon conditions in parts of the country.

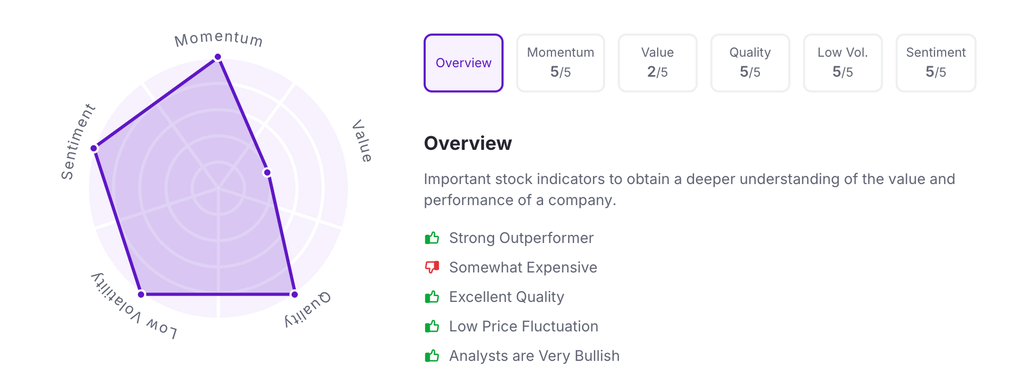

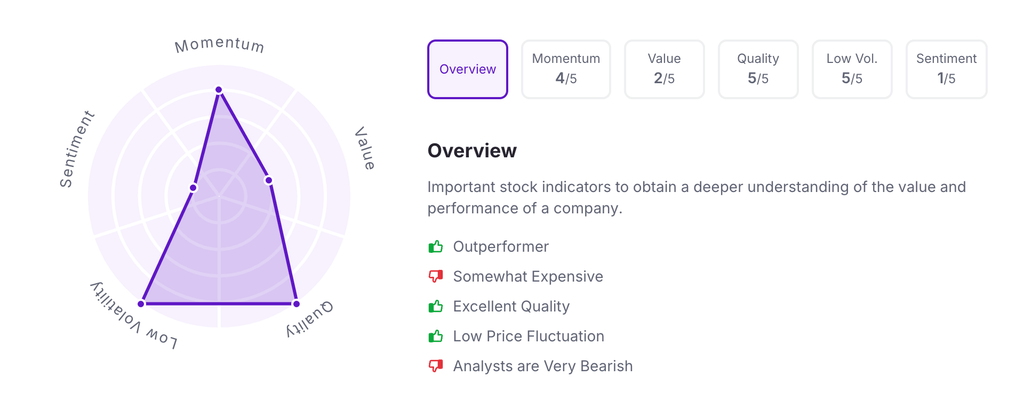

Let’s take a look at its Factor Analysis scores:

The power company has announced an interim dividend of ₹2.75 per equity share. It has a dividend yield of 1.80% TTM.

For the quarter ended September 30, 2025, NTPC Ltd. reported Total income of ₹45,262.10 crore. The Profit after tax was ₹5,225.30 crore , which is a decrease compared to ₹5,380.25 crore in the corresponding quarter of the previous year.

Over the last five years, this stock has given multibagger returns of more than 270%.

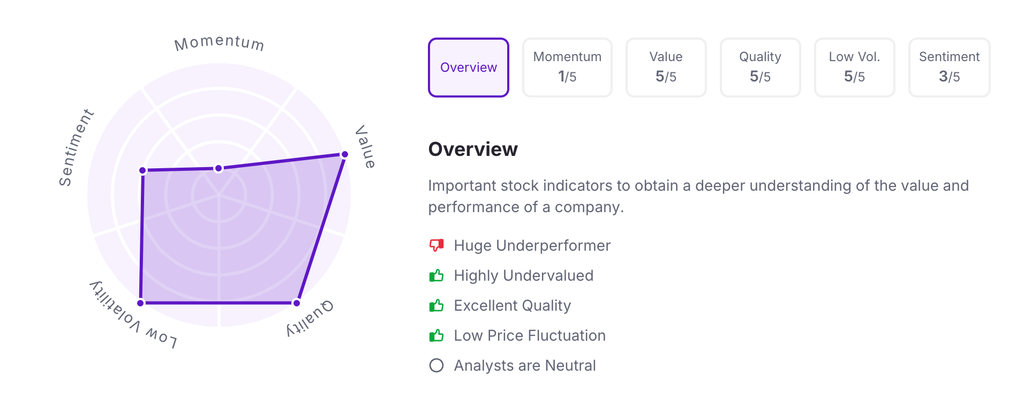

Let’s take a look at its Factor Analysis scores:

The oil and gas company has announced an interim dividend of ₹7.50 per equity share. It has a dividend yield of 2.70% TTM.

For Q2FY26, Bharat Petroleum Corporation Ltd. reported Profit after tax of ₹6,443 crores. This represents a significant surge compared to the ₹2,397 crores reported in the same quarter last year. The increase was supported by a robust rise in the Gross Refining Margin (GRM) for BPCL, which rose to US$10.78/bbl from US$4.41/bbl in the corresponding period of the previous year.

The company also saw a Marketing Inventory Gain of ₹895 crores, a turnaround from a loss of ₹1,113 crores in the year-ago quarter.

Over the last five years, this stock has given multibagger returns of more than 100%.

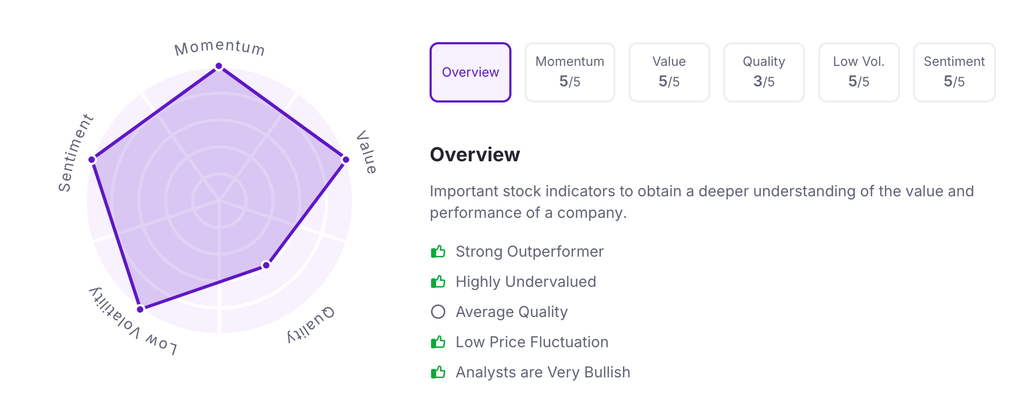

Let’s take a look at its Factor Analysis scores:

The retail NBFC has announced an interim dividend of ₹ per equity share. It has a dividend yield of 1.30% TTM.

For the second quarter ended September 30, 2025, Shriram Finance Ltd. reported a Profit after tax of ₹2,307.18 crores. This marked an 11.39% increase compared to the ₹2,071.26 crores reported in the same period of the previous year. Total Assets under Management (AUM) grew by 15.74% year-on-year, standing at ₹2,81,309.46 crores as of September 30, 2025. The Net Interest Income was ₹6,266.84 crores, up by 11.77%.

Over the last five years, this stock has given multibagger returns of more than 370%.

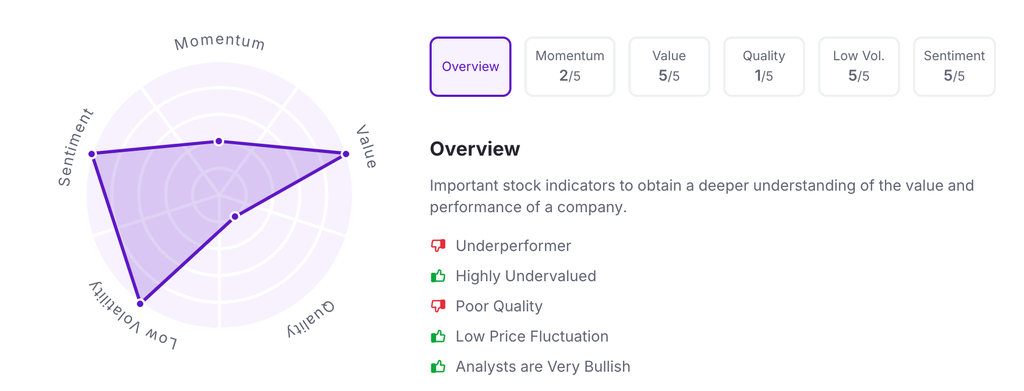

Let’s take a look at its Factor Analysis scores:

Dabur India Ltd. announced an interim dividend of ₹2.75 per equity share. It has a dividend yield of 1.50% TTM.

For the second quarter of 2025-26, Dabur reported a 6.5% year-on-year increase in Net Profit at ₹453 Crore (up from ₹425 Crore). The company achieved a Revenue of ₹3,191 Crore, marking a 5.4% growth over the previous year. Despite transitional GST headwinds, the company’s India business reported market share gains across 95% of the portfolio.

Furthermore, the board approved the launch of Dabur Ventures, an investment platform with a capital allocation of up to ₹500 Crores, to invest in high-potential, new-age digital-first businesses.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:30 pm.