- Share.Market

- 6 min read

- Published at : 20 Jun 2025 11:38 AM

- Modified at : 04 Dec 2025 07:37 AM

The shares of Hindustan Unilever, Kansai Nerolac Paints, Samvardhana Motherson International, Motherson Sumi Wiring India, Dalmia Bharat, and Kalpataru Projects International are set for their record date on Monday, June 23, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Hindustan Unilever Ltd., India’s largest FMCG company, has announced a final dividend of ₹24 per equity share.

HUL crossed ₹60,000 crore in revenue in FY25, with 2% sales growth and 5% rise in PAT. Despite a mixed pricing environment, volumes held steady, and margins remained strong at 23.5%. Growth was led by premium products, digital channels, and innovation, while the company sharpened its portfolio with the acquisition of Minimalist and decision to demerge the Ice Cream business.

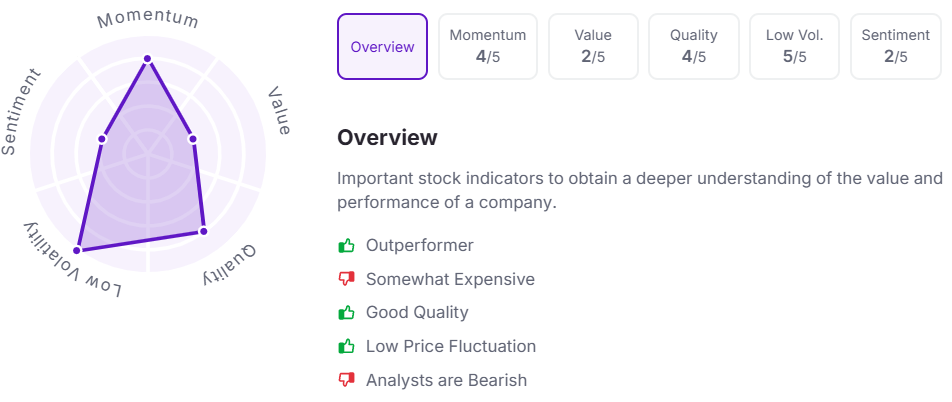

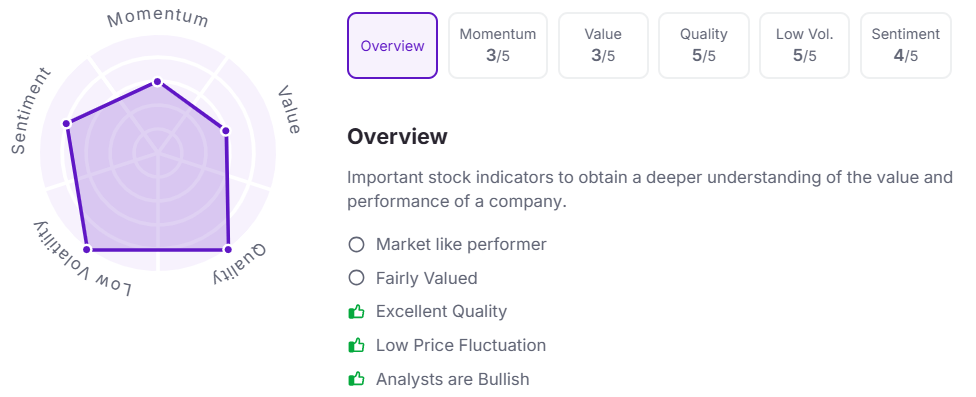

Let’s take a look at its Factor Analysis scores:

Dalmia Bharat Ltd., India’s fourth-largest cement maker by installed capacity, has announced a final dividend of ₹5 per equity share.

Dalmia Bharat reported FY25 revenue of ₹13,980 crore, down 4.8% YoY, with volumes up 2% to 29.4 MnT. EBITDA dropped 9% to ₹2,407 crore, impacted by soft pricing. The company hit 49.5 MTPA capacity and announced a 6 MTPA expansion targeting West India, while maintaining one of the industry’s lowest carbon footprints.

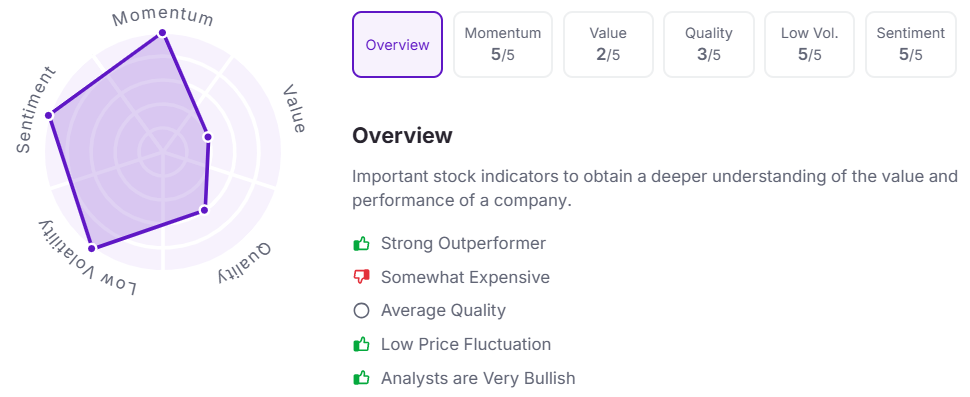

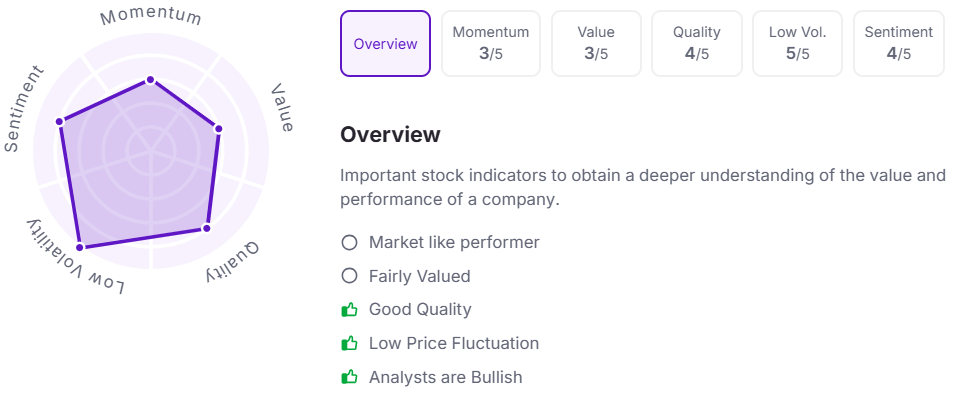

Let’s take a look at its Factor Analysis scores:

Kansai Nerolac Paints Ltd., one of India’s top paint makers, has announced a final dividend of ₹2.50 and a special dividend of ₹1.25 per equity share.

Kansai Nerolac Paints reported FY25 revenue of ₹7,496.7 crore, up 1.4% YoY, while PAT declined amid soft discretionary demand and forex volatility. Automotive and Performance Coatings drove growth, and decorative volumes began to recover.

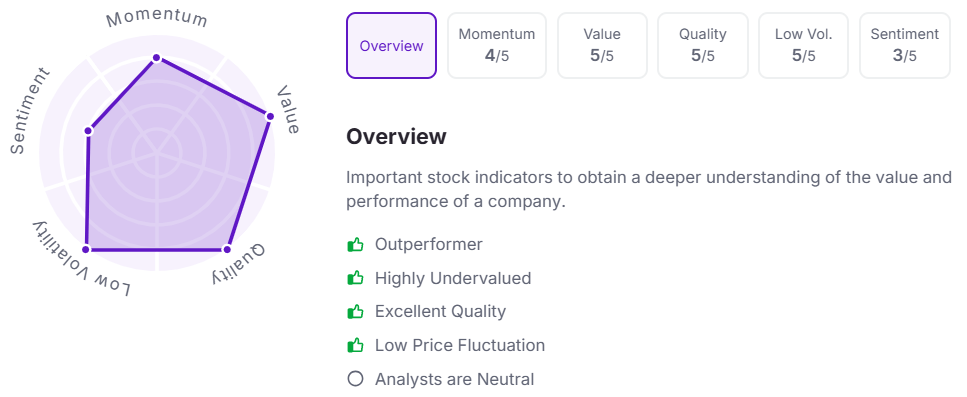

Let’s take a look at its Factor Analysis scores:

Samvardhana Motherson International Ltd., India’s largest auto ancillary and a top global auto supplier, has announced a final dividend of ₹0.35 per equity share.

Motherson reported record revenue of ₹1,13,663 crore in FY25, up 15% YoY, with PAT surging 40% to ₹3,803 crore. Powered by 23 acquisitions and a USD 88+ billion order book, the company outpaced the industry while reducing leverage to a five-year low.

Let’s take a look at its Factor Analysis scores:

Motherson Sumi Wiring India Ltd., India’s leading wiring harness maker for passenger vehicles, has announced a final dividend of ₹0.35 per equity share.

Motherson Sumi Wiring reported record FY25 revenue of ₹9,062 crore (ex-Greenfields), up 8.8% YoY, with a 10.5% rise in EBITDA. The company remained debt-free, achieved 42% ROCE, and supplied to 9 of India’s top 10 selling PV models. EVs contributed 4% to Q4 revenue as capacity expansion continued.

Let’s take a look at its Factor Analysis scores:

Kalpataru Projects International Ltd., a leading global infra EPC firm, has announced a final dividend of ₹9 per equity share.

Kalpataru Projects posted record FY25 revenue of ₹22,316 crore, up 14% YoY, with PBT rising 17% and PAT reaching ₹567 crore. Strong execution and order wins drove performance, taking the order book to an all-time high of ₹64,495 crore, while net debt fell to its lowest in 12 quarters.

Over the last three years, this stock has given multibagger returns of more than 220%.

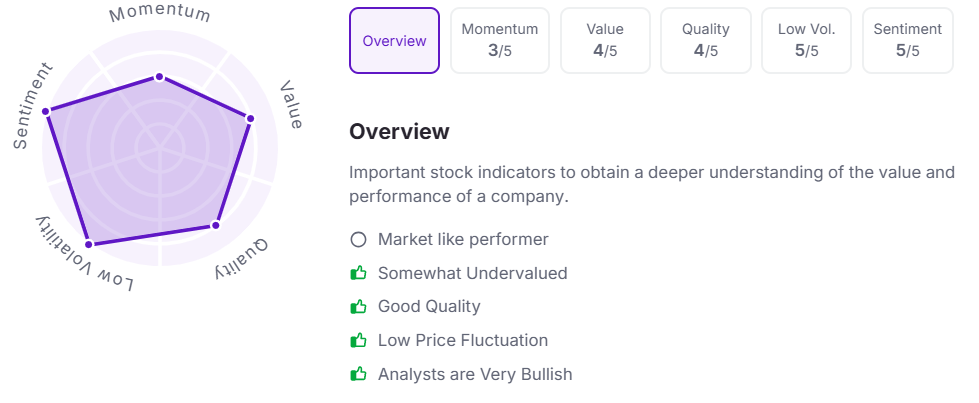

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:35 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.