- Share.Market

- 6 min read

- Published at : 05 Sep 2025 11:48 AM

- Modified at : 08 Sep 2025 09:41 AM

The shares of Housing & Urban Development Corporation, Titagarh Rail Systems, Birla Corporation, and HFCL are set to trade ex-dividend on Monday, September 08, 2025, with their record date on Tuesday, September 09, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Housing and Urban Development Corporation Ltd. has announced a final dividend of ₹1.05 per equity share. It has a high dividend yield of 3.20% TTM.

Housing and Urban Development Corporation Limited (HUDCO), a public sector financial institution established in 1970, plays a key role in financing housing and urban infrastructure projects across India with a focus on sustainable development.

For the quarter ended June 30, 2025, the company reported revenue from operations of ₹2,937.3 crore, compared to ₹2,820.9 crore in the previous quarter and ₹2,844.9 crore in the same quarter last year. Profit for the period stood at ₹712.6 crore, against ₹731.5 crore in the preceding quarter and ₹513.2 crore a year earlier.

Over the last three and five years, this stock has delivered multibagger returns of more than 415% and 475%, respectively.

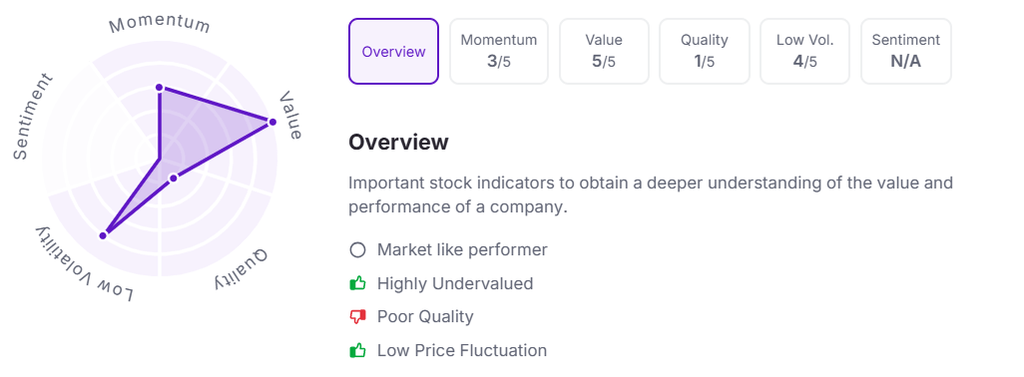

Let’s take a look at its Factor Analysis scores:

Titagarh Rail Systems Ltd. has announced a dividend of ₹1 per equity share.

Titagarh Rail Systems Limited is a leading provider of comprehensive mobility solutions in India, specializing in passenger and freight rail systems with a strong presence in metros, semi high-speed trains, propulsion equipment, and wagons.

In Q1FY26, the company reported standalone revenue of ₹679 crore, impacted by lower wagon dispatches due to a shortage of wheelsets from the Rail Wheel Factory. Despite this temporary setback, Titagarh maintained its leadership in wagon deliveries, secured fresh orders worth ~₹2,469 crore, and expanded its order book to ~₹26,000 crore. The company also advanced its metro and Vande Bharat projects, strengthened its design capabilities, and undertook strategic steps such as land acquisition and business restructuring to support long-term growth.

Over the last three and five years, this stock has given multibagger returns of more than 405% and 1,815%, respectively.

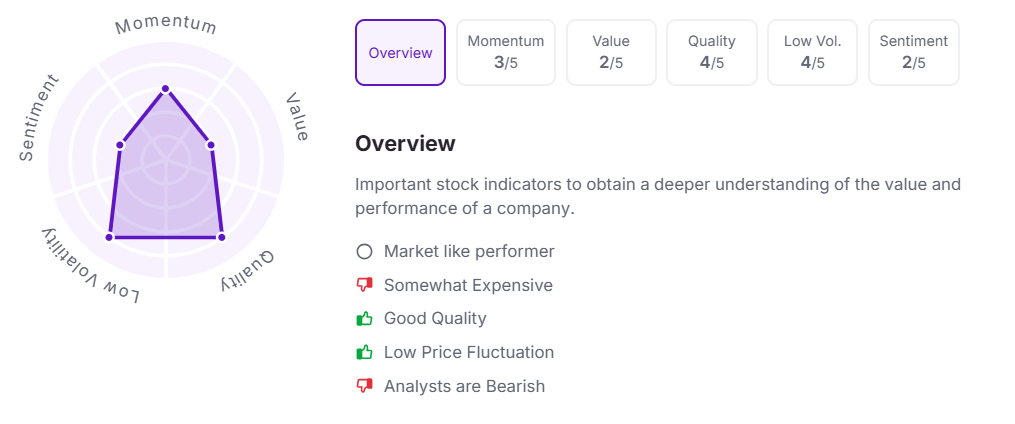

Let’s take a look at its Factor Analysis scores:

Birla Corporation Ltd. has announced a final dividend of ₹10 per equity share.

Birla Corporation Limited, the flagship of the MP Birla Group, operates in cement and jute with 10 cement plants across India and an installed capacity of 20 million tons under the MP Birla Cement brand.

In Q1 FY26, the company reported consolidated revenue of ₹2,486 crore, up 13% year-over-year, with net profit surging 264% to ₹120 crore. EBITDA grew 38% to ₹379 crore, supported by higher cement sales, lower operating costs, and a turnaround in the jute business. Cement volumes rose 9% to 4.79 mt, led by strong growth in premium products like Perfect Plus and Unique Plus, while the jute division delivered a cash profit of ₹6.4 crore against a loss last year, aided by strong domestic and export sales.

Over the last five years, this stock has given multibagger returns of more than 110%.

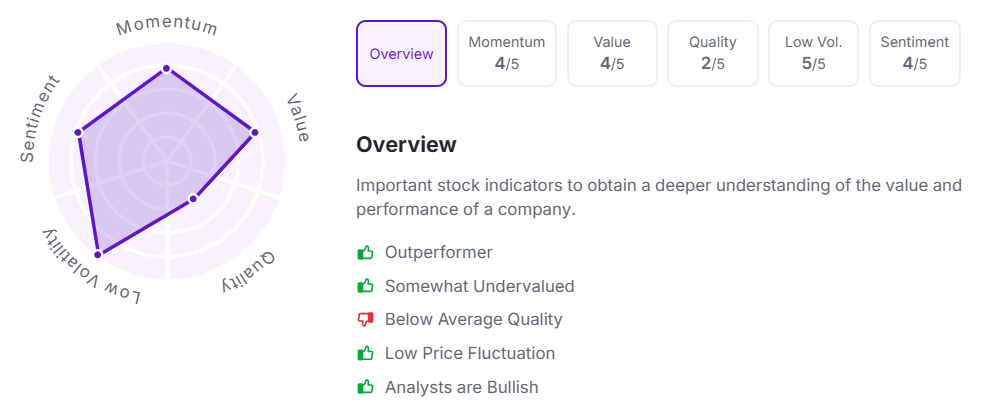

Let’s take a look at its Factor Analysis scores:

HFCL Ltd. has announced a final dividend of ₹0.10 per equity share. It has a high dividend yield of 0.30% TTM.

HFCL Limited, a leading technology enterprise in telecom and defence, has built a strong presence in optical fibre cables, telecom equipment, and indigenous defence solutions, backed by decades of R&D and global integration expertise.

In Q1FY26, the company posted revenue of ₹871 crore, up 9% sequentially, with EBITDA recovering sharply to ₹42.9 crore from a loss in the previous quarter. While PAT remained negative at ₹29.3 crore, operational performance improved meaningfully, supported by a rebound in the optical fibre cable business, new orders in telecom and defence, and rising exports. HFCL’s order book stood at ₹10,480 crore, reflecting robust demand visibility and setting the stage for a stronger FY26.

Over the last five years, this stock has given multibagger returns of more than 110%.

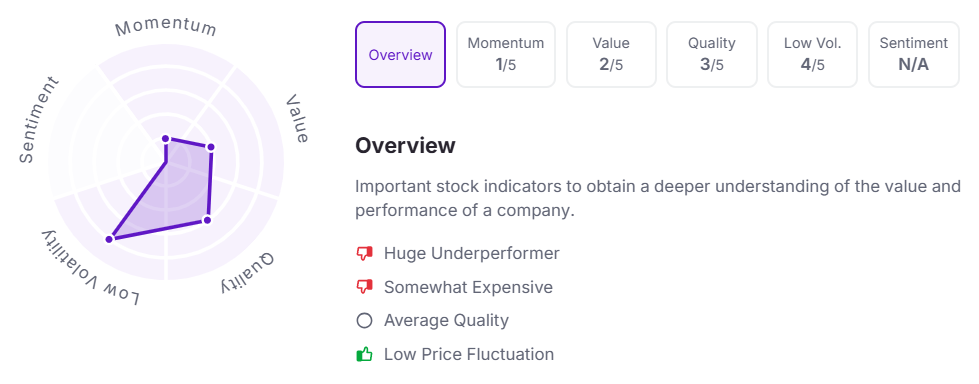

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:45 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.