- Share.Market

- 6 min read

- Published at : 17 Sep 2025 12:48 PM

- Modified at : 17 Sep 2025 12:49 PM

The shares of Hindustan Copper, SJVN, Poly Medicure, and Gujarat Mineral Development Corporation are set for their record date on Thursday, September 18, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Hindustan Copper Ltd. has announced a final dividend of ₹1.46 per equity share. It has a current dividend yield of 0.30% TTM.

Hindustan Copper Limited (HCL) is India’s only company engaged in copper ore mining, holding all operating mining leases for the metal in the country. It’s a ‘Mini-Ratna’ Central Public Sector Enterprise under the Ministry of Mines. The company focuses on the exploration, mining, and beneficiation of copper ore.

In the first quarter of the fiscal year 2025-26, Hindustan Copper Limited reported a Profit Before Tax (PBT) of ₹179.36 crore, marking a 16.37% increase compared to the same period in the previous year. The Profit After Tax (PAT) also rose by 18.40% to ₹134.28 crore. The company’s revenue from operations for the quarter was ₹516.37 crore, up from ₹493.60 crore in the June 2024 quarter.

Over the last three and five years, this stock has given multibagger returns of more than 145% and 690%, respectively.

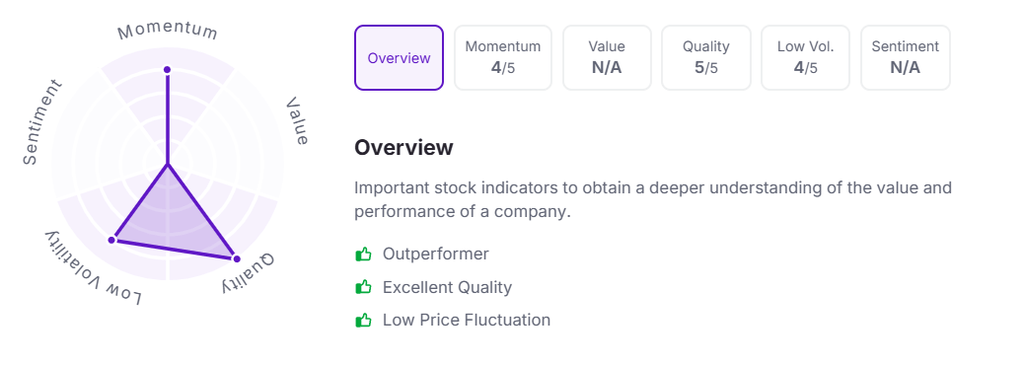

Let’s take a look at its Factor Analysis scores:

SJVN Ltd. has announced a final dividend of ₹0.31 per equity share. It has a current dividend yield of 1.20% TTM.

SJVN Limited is a ‘Navratna’ Central Public Sector Enterprise operating under the Ministry of Power, Government of India. As a joint venture between the Indian government and the government of Himachal Pradesh, the company is primarily engaged in power generation and transmission, with a portfolio that includes hydro, thermal, solar, and wind projects across various states in India and Nepal.

For the quarter ended June 30, 2025, SJVN’s total income was ₹97,159 lakh. This is an increase from the total income of ₹95,847 lakh in the same quarter of the previous year. The company’s profit for the period was ₹22,777 lakh, and the profit attributable to the owners of the parent company was ₹22,486 lakh.

Over the last three and five years, this stock has given multibagger returns of more than 190% and 300%, respectively.

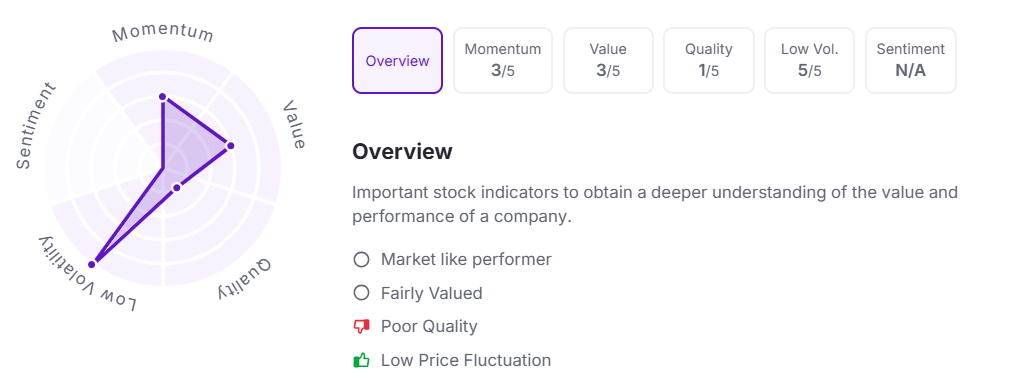

Let’s take a look at its Factor Analysis scores:

Poly Medicure Ltd. has announced a final dividend of ₹3.50 per equity share. It has a current dividend yield of 0.10% TTM.

Poly Medicure Limited is a prominent Indian medical device company with a strong presence in the medical consumables market. The company manufactures and exports a wide range of medical devices to over 125 countries, holding a portfolio of over 200 products.

In Q1 FY26, Polymed’s consolidated revenue grew by 4.8% year-over-year. The company’s Profit After Tax (PAT) increased by 25.5% to ₹93.1 crore, and the Gross Profit Margin expanded to 68.4%. The domestic market showed strong performance with a 20.1% revenue growth.

Over the last three and five years, this stock has given multibagger returns of more than 110% and 300%, respectively.

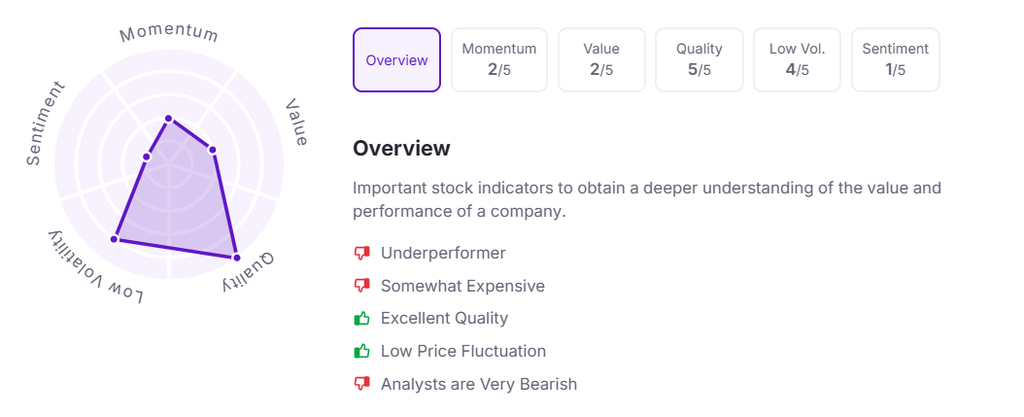

Let’s take a look at its Factor Analysis scores:

Gujarat Mineral Development Corporation Ltd. has announced a final dividend of ₹10.10 per equity share. It has a current dividend yield of 1.70% TTM.

Gujarat Mineral Development Corporation (GMDC) is a State Public Undertaking of the Government of Gujarat and is India’s second-largest Lignite-producing company. It focuses on mining lignite and other minerals from deposit-rich areas and sells them to various high-growth industries.

In Q1 FY26, GMDC reported a mixed performance with a dip in revenue but a steady operational performance. The company’s revenue from operations stood at ₹733 crore, a decline from ₹818 crore in Q1 FY25. Despite this, the Profit Before Tax (PBT) was ₹225 crore, compared to ₹250 crore in the previous year.

Over the last three and five years, this stock has given multibagger returns of more than 260% and 1,085%, respectively.

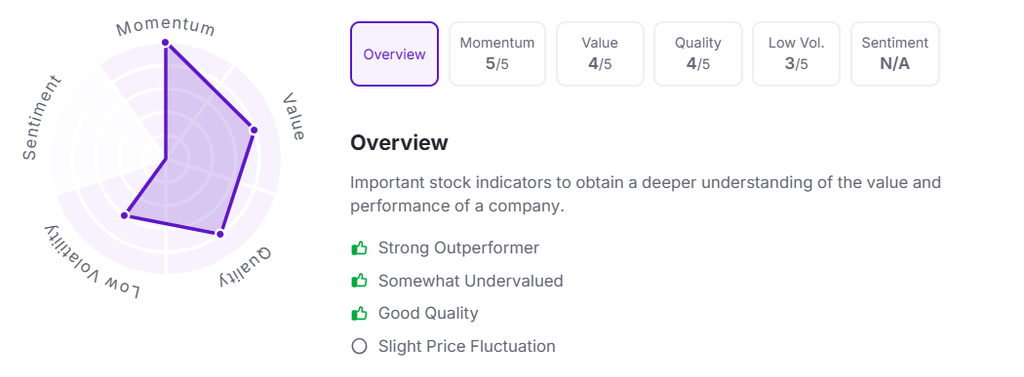

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:47 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.