- Share.Market

- 3 min read

- Published at : 22 Sep 2025 04:54 PM

- Modified at : 22 Sep 2025 04:56 PM

Hindustan Copper Ltd. has taken a significant step toward boosting its domestic copper production with the execution of a 20-year mining lease deed for its Rakha Copper Mine. The deed, signed with the District Commissioner (DC) of Jamshedpur on September 19, 2025, is a crucial step toward reopening and expanding the strategically important mine.

The move marks a major milestone in HCL’s efforts to increase its copper output, a metal that is seeing surging demand driven by the global transition to renewable energy and electric vehicles. The reopening of the Rakha mine is expected to contribute to the company’s ambitious plan to triple its mining capacity from the current 4 MTPA to 12 MTPA by 2030-31, strengthening India’s self-reliance in the critical mineral sector.

Post the announcement, shares of Hindustan Copper surged over 8%, reaching an intraday high of ₹305.40 apiece.

About the Company

Hindustan Copper Limited (HCL) is a Mini-Ratna, Category-I Central Public Sector Enterprise and the only company in India engaged in copper ore mining. It holds all the operating mining leases for copper ore in the country and operates mines in Malanjkhand, Khetri, and Ghatsila.

Q1 FY26 Results

The company posted a strong financial performance for the first quarter of FY26. Profit Before Tax (PBT) grew by more than 16% to Rs. 179.36 crore, while Profit After Tax (PAT) increased by over 18% to Rs. 134.28 crore. The results were supported by a moderate increase in revenue from operations, which rose to Rs. 516.37 crore.

Over the last three and five years, this stock has given multibagger returns of more than 155% and 745% respectively.

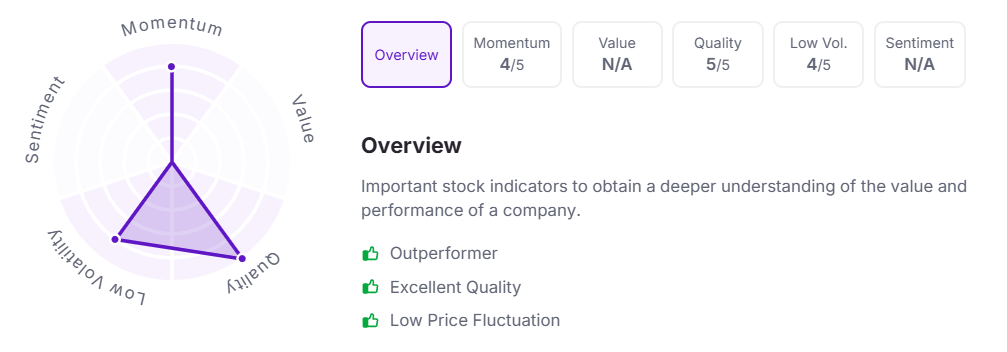

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.