- Share.Market

- 2 min read

- Published at : 29 Dec 2025 01:15 PM

- Modified at : 30 Dec 2025 12:13 PM

Shares of Hindustan Copper were trading nearly 8% higher, at ₹524.00 per share during Tuesday’s early trades. In fact, the stock gained nearly 50% in the past 8 trading sessions, after copper prices reached fresh record highs in both Indian and International markets.

Hindustan Copper Ltd. is the only company in India engaged in copper ore mining and holds all the operating mining leases for copper ore in the country.

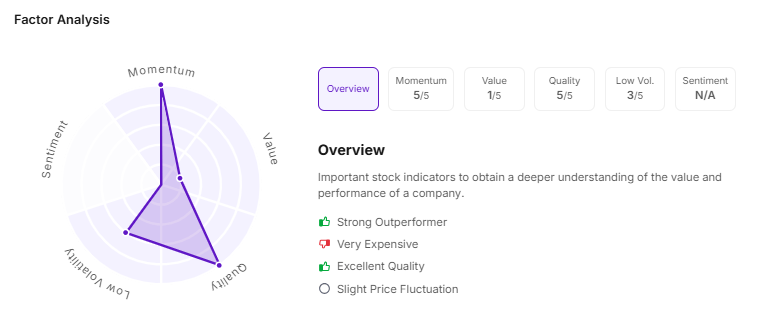

Let’s take a look at the company’s Factor Analysis:

Copper gained nearly 50% this year and touched an all time high of $12,960 per tonne on the London Metal Exchange (LME), led by rising demand and supply disruptions.

What led to the rally in Copper?

Rising Demand

Capital expenditure, stabilized industrial activity and policy support for infrastructure, power grids and renewable energy in China is increasing the demand for copper, steel, aluminium and zinc.

Apart from this, demand is driven by the increasing needs of electric vehicles (EVs), renewable energy, and advancements in artificial intelligence (AI).

Supply Disruptions

While the demand remains strong, the supply for copper is constrained, with very little inventory available. Mining disruptions, higher energy costs and stricter environmental norms have constrained fresh capacity additions.

Moreover, copper continues to face underinvestment in new mines, long gestation periods, and declining ore grades. These constraints are now sending its price upwards.