- Share.Market

- 3 min read

- Published at : 26 Sep 2025 12:45 PM

- Modified at : 15 Nov 2025 11:49 AM

Hindustan Aeronautics Ltd. announced the signing of a massive contract with the Ministry of Defence (MoD) for the procurement of 97 Light Combat Aircraft (LCA) Mk1A for the Indian Air Force (IAF). The deal, valued at over ₹62,370 crore (excluding taxes), represents a landmark moment for India’s aerospace industry and a tremendous vote of confidence in HAL’s manufacturing capabilities.

The order includes 68 fighter aircraft and 29 twin-seat trainers, along with all associated equipment. Deliveries of these state-of-the-art jets are slated to commence during the 2027-28 fiscal year and will be completed over a period of six years. This significant contract is a major fillip to HAL’s order book, ensuring long-term revenue visibility and a rapid ramp-up in production.

The LCA Mk1A, the most advanced variant of the indigenously designed and manufactured fighter aircraft, is a flagship project for the Aatmanirbharta (self-reliance) initiative. This new batch of aircraft will feature an enhanced indigenous content exceeding 64%, a substantial increase over the previous 2021 contract.

HAL estimates that this six-year production run will generate close to 11,750 direct and indirect jobs per year. This massive employment opportunity will provide a crucial boost to the domestic aerospace and manufacturing sectors, fostering skills and capacity building across our entire supply chain.

Over the last three and five years, this stock has delivered multibagger returns of more than 290% and 1,145%, respectively.

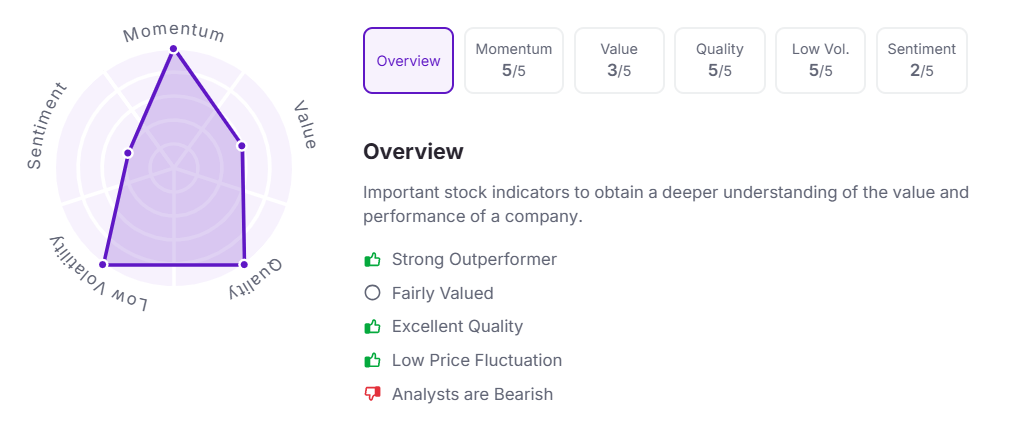

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:44 pm.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954