- Share.Market

- 5 min read

- Published at : 24 Jul 2025 10:51 AM

- Modified at : 24 Jul 2025 10:51 AM

The shares of HDFC Bank, LIC India, Divi’s Laboratories, and Zydus Lifesciences, and Info Edge are set for their record date on Friday, July 25, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

HDFC Bank Ltd. has announced a special dividend of ₹5 per equity share.

HDFC Bank, one of India’s leading private sector banks, was among the first to receive RBI approval in 1994. As of March 31, 2025, it operates 9,455 branches and 21,139 ATMs across 4,150 cities, with 51% of branches in semi-urban and rural areas.

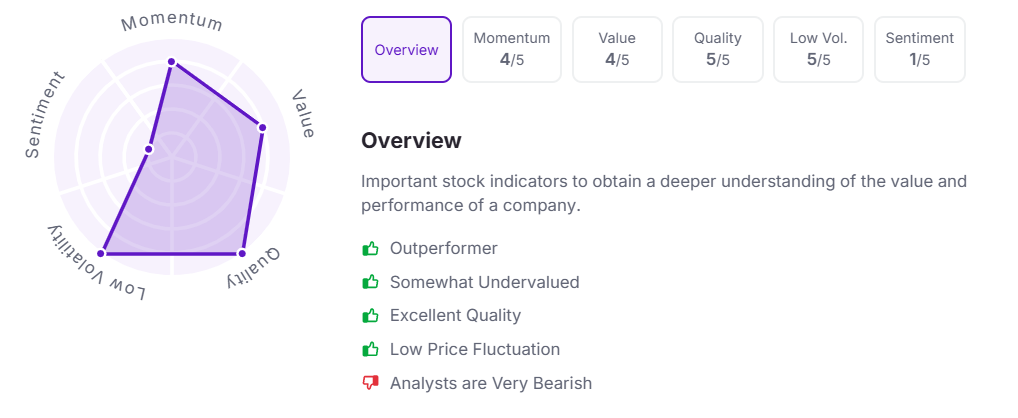

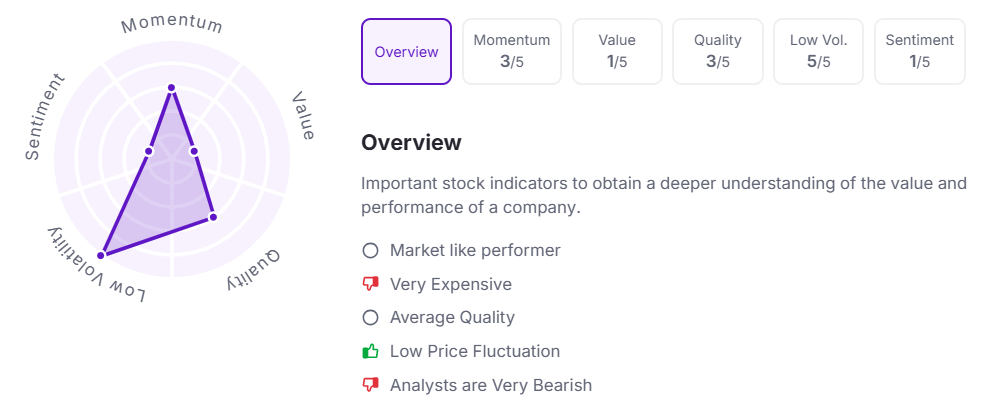

Let’s take a look at its Factor Analysis scores:

Life Insurance Corporation of India has announced a final dividend of ₹12 per equity share.

LIC is the world’s 3rd strongest insurance brand, with a 57% market share in first-year premiums and 65.8% in policies sold (FY25). It covers 89% of Indian districts and sold ~1.78 crore individual policies. Its AUM stands at ₹54.5 lakh crore, and death claim settlement ratio at 99.41%.

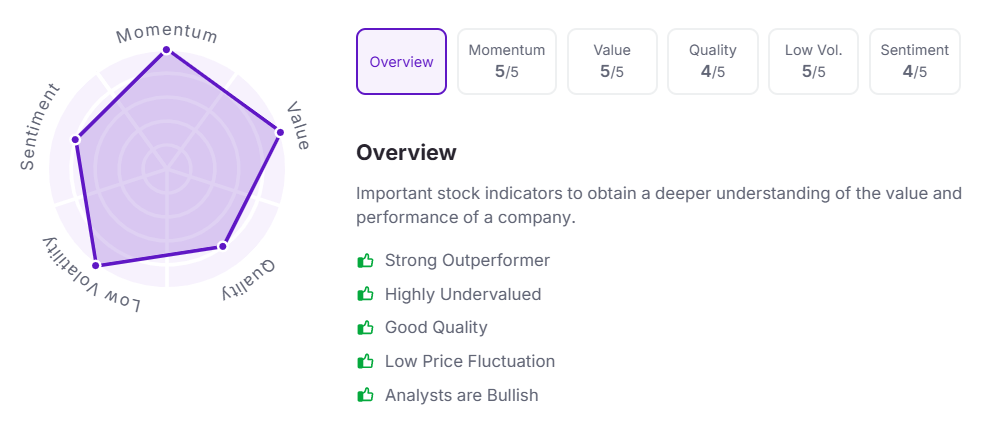

Let’s take a look at its Factor Analysis scores:

Divi’s Laboratories Ltd. has announced a final dividend of ₹30 per equity share. It has a dividend yield of 0.60%.

Divi’s is one of India’s top pharmaceutical companies and among the world’s top 3 API manufacturers. With over 30 years of expertise, it supplies high-quality APIs and intermediates to 100+ countries. The company operates advanced USFDA and EU GMP-inspected plants in Hyderabad and Vizag, and employs over 20,000 professionals. Divi’s reported ~$1.1 billion revenue in FY25.

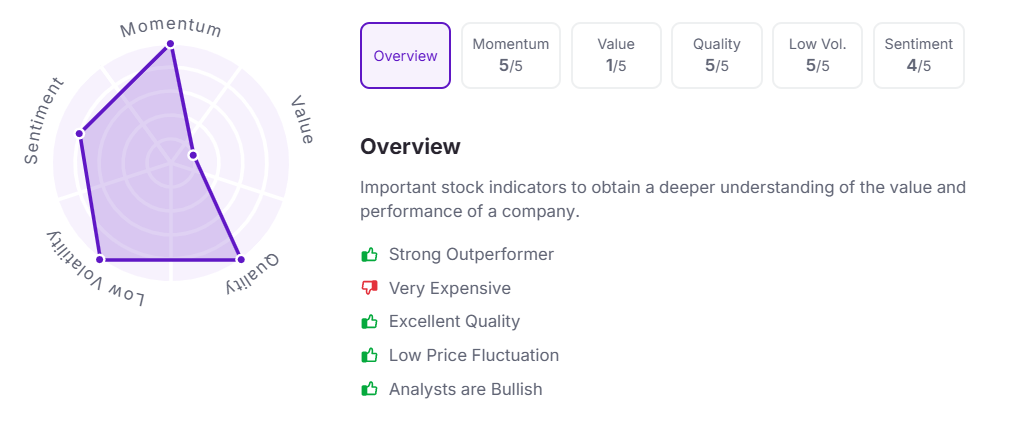

Let’s take a look at its Factor Analysis scores:

Zydus Lifesciences Ltd. has announced a final dividend of ₹11 per equity share.

Zydus Lifesciences is a leading Indian pharmaceutical company with a strong global presence. In FY25, revenue rose 19% YoY to ₹2.32 lakh crore, while net profit grew 23% to ₹47,451 crore. Q4 revenue was up 18% with strong gains in US formulations and India’s wellness segment.

Over the last three years, this stock has given multibagger returns of more than 175%

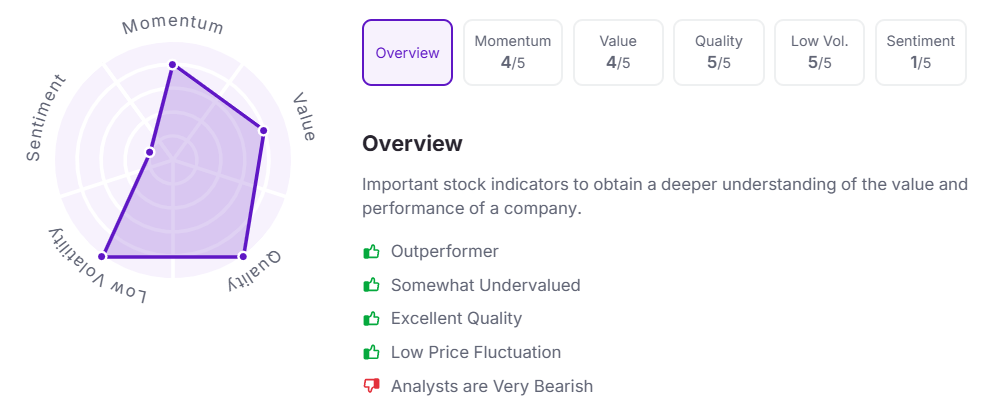

Let’s take a look at its Factor Analysis scores:

Info Edge (India) Ltd. has announced a final dividend of ₹3.6 per equity share.

Info Edge is one of India’s leading consumer internet companies, known for platforms like Naukri, 99acres, Jeevansathi, and Shiksha.

In Q4 FY25, standalone billings rose 19% YoY to ₹983.8 crore, with strong growth across recruitment and non-recruitment segments.

Revenue grew to ₹687.1 crore, while operating profit stood at ₹231.5 crore with a margin of 33.7%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 10:50 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.