- Share.Market

- 3 min read

- Published at : 25 Aug 2025 01:53 PM

- Modified at : 25 Aug 2025 02:31 PM

HDFC Bank and Karur Vysya Bank are set for their upcoming bonus issues. To be eligible, investors must have bought the shares before the ex-date and hold them at least till the record date.

HDFC Bank Ltd. has announced a bonus issue in the ratio of 1:1. This means that eligible shareholders will receive one bonus share for every share they own as on the record date.

HDFC Bank Limited, India’s largest private sector bank, was established in 1994 following RBI’s approval for private sector banks and has since grown into a leading financial institution with a strong domestic and international presence.

For the quarter ended June 30, 2025, the bank reported net revenue of ₹531.7 billion, including gains from the partial divestment of HDB Financial Services, compared to ₹405.1 billion a year ago. Net interest income rose 5.4% year-on-year to ₹314.4 billion, while profit after tax increased 12.2% to ₹181.6 billion, supported by steady credit performance and prudent provisioning.

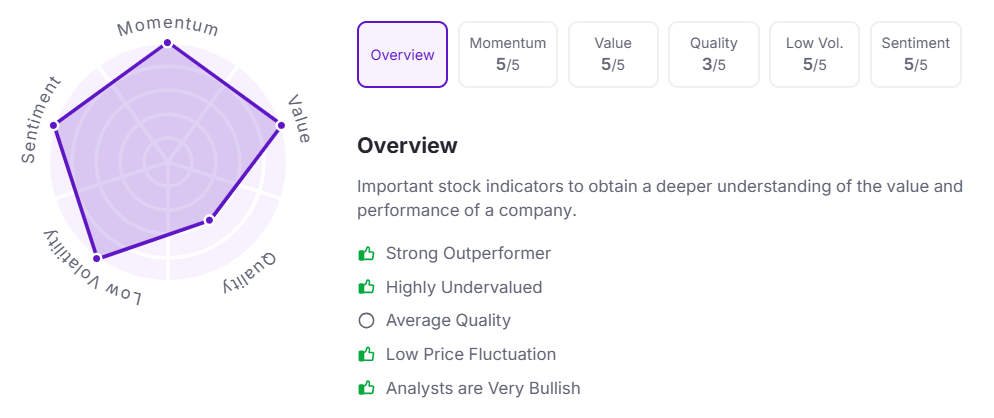

Let’s take a look at its Factor Analysis scores:

Karur Vysya Bank Ltd. has announced a bonus issue in the ratio of 1:5. This means that eligible shareholders will receive three one shares for every five shares they own as on the record date.

Karur Vysya Bank, one of India’s oldest private sector banks with over a century of operations, continues to strengthen its presence through a growing branch network and technology-driven banking solutions.

For the quarter ended June 30, 2025, the bank’s total business rose 15.27% year-on-year to ₹1,96,024 crore, with deposits at ₹1,06,650 crore and advances at ₹89,374 crore. Net profit increased 13.5% to ₹521 crore, supported by healthy loan book growth, strong asset quality with GNPA at 0.66%, and robust profitability ratios, marking another quarter of consistent performance.

Over the last three and five years, this bank has given multibagger returns of more than 315% and 635%, respectively.

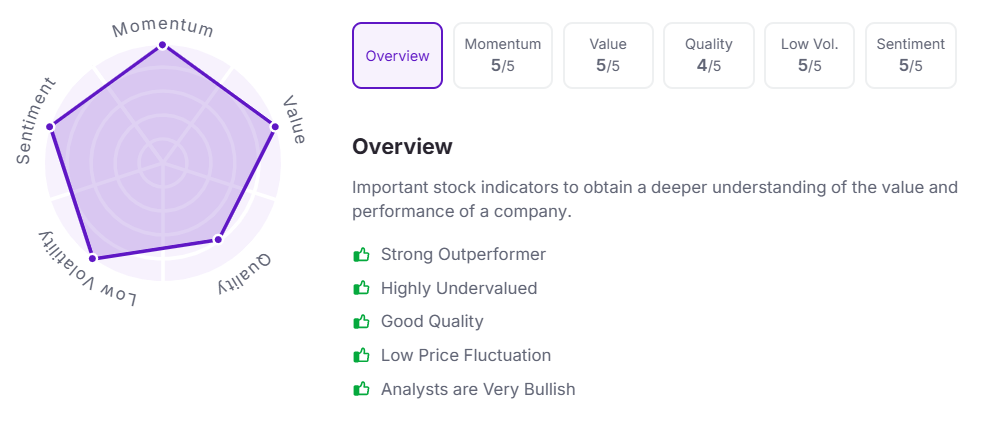

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 1:45 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.