- Share.Market

- 5 min read

- Published at : 26 Jun 2025 11:22 AM

- Modified at : 16 Jul 2025 07:59 PM

The shares of HDFC Bank, Bajaj Finserv, Bajaj Holdings, and Cipla are set for their record date on Friday, June 27, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

HDFC Bank Ltd., one of India’s leading private sector banks, has announced a dividend of ₹22 per equity share.

HDFC Bank was among the first to receive RBI approval in 1994. As of March 31, 2025, it operates 9,455 branches and 21,139 ATMs across 4,150 cities, with 51% of branches in semi-urban and rural areas.

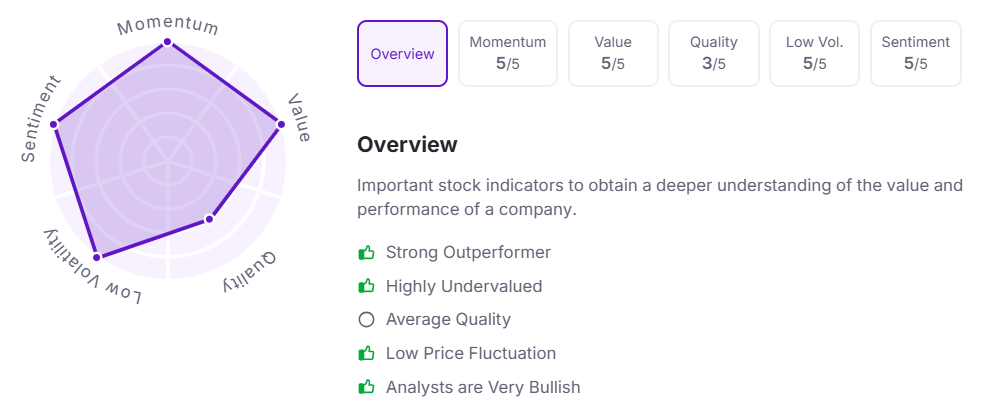

Let’s take a look at its Factor Analysis scores:

Bajaj Finserv Ltd. has announced a final dividend of ₹1 per equity share.

Bajaj Finserv is one of India’s most diversified financial services groups, with a legacy of over 100 years. It provides simple financial solutions across loans, insurance, investments, and more, serving crores of customers daily. As the holding company for Bajaj Finance, Bajaj Allianz General and Life Insurance, and other digital-first ventures, it is focused on innovation, digital transformation, and expanding its reach through technology-led platforms.

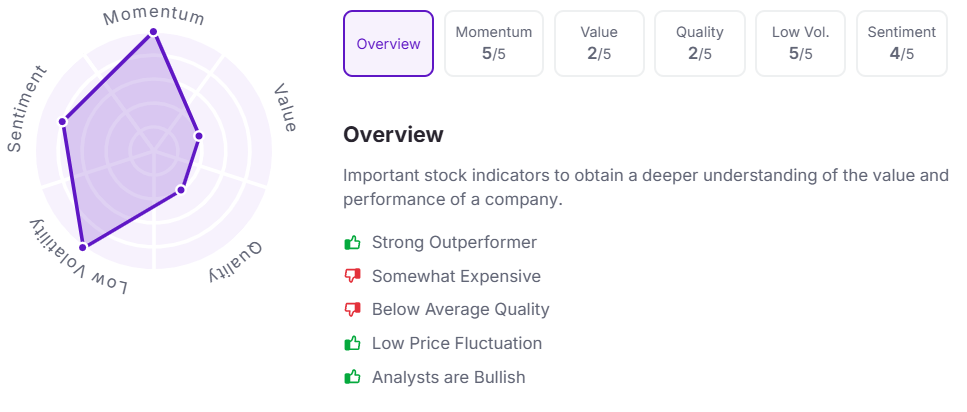

Let’s take a look at its Factor Analysis scores:

Bajaj Holdings & Investment Ltd. has announced a final dividend of ₹28 per equity share. It has a dividend yield of 0.60%.

Bajaj Holdings & Investment Limited, formerly Bajaj Auto Ltd., became a separate entity after a 2007 demerger, retaining investment and financial assets while transferring manufacturing to the new Bajaj Auto and strategic businesses to Bajaj Finserv. BHIL now holds over 30% each in Bajaj Auto and Bajaj Finserv, benefiting from their growth while supporting them with capital when needed. Registered as a systemically important NBFC, BHIL serves as the flagship holding company of the Bajaj Group, which includes Bajaj Auto, Bajaj Finserv, and Bajaj Finance.

Over the last three years, this stock has given multibagger returns of more than 195%.

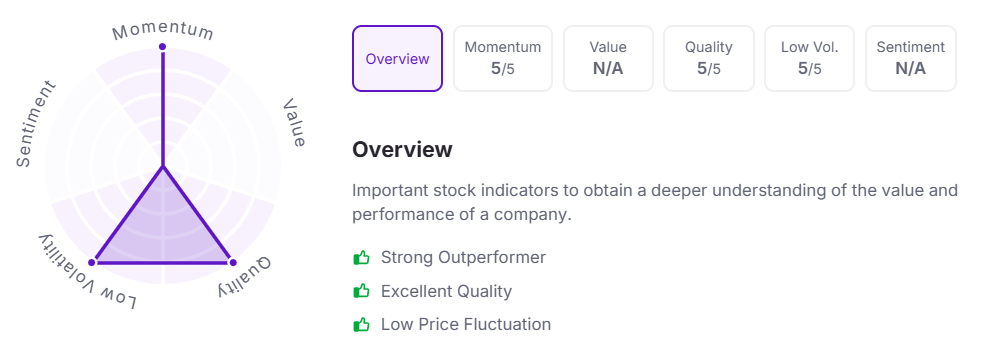

Let’s take a look at its Factor Analysis scores:

Cipla Ltd. has announced a final dividend of ₹13 and a special dividend of ₹3.00 per equity share. Its current dividend yield is 0.90% TTM.

Cipla is a global pharmaceutical company with a presence in over 80 countries and a portfolio of 1,500+ products across 50+ dosage forms. In FY25, the company reported 8% revenue growth and an EBITDA margin of 25.9%, with strong performance across India, the US, Africa, and emerging markets. Cipla continues to focus on brand leadership, pipeline investments, and deepening market presence.

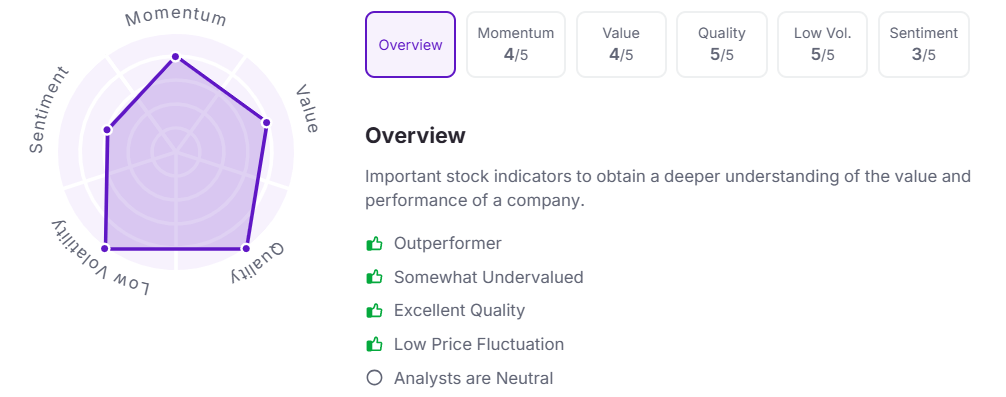

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:20 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.