- Share.Market

- 3 min read

- Published at : 25 Nov 2025 12:09 PM

- Modified at : 25 Nov 2025 12:50 PM

The shares of HDFC Asset Management Company and Power Finance Corporation are in focus for their upcoming bonus issue and dividend. They are set for their record date on Wednesday, November 26, 2025. Investors who wish to be eligible must have bought the shares before the ex-date and hold them at least till the record date.

The asset management company has announced a bonus issue in the ratio of 1:1. This means that eligible shareholders will receive one bonus share for every share they own as on the record date, Wednesday, November 26, 2025.

For Q2FY26, HDFC Asset Management Company Ltd. reported Revenue from Operations of ₹1,026 crore, up 16% year-on-year, and a Profit after Tax of ₹717.9 crore, up 24%. The company processed Systematic transactions worth ₹4,510 crore in September 2025. Its distribution network covers 98% of Indian pincodes, supported by 280 offices and over 1,03,000 empanelled distribution partners.

Over the last five years, this stock has delivered multibagger returns of more than 110%.

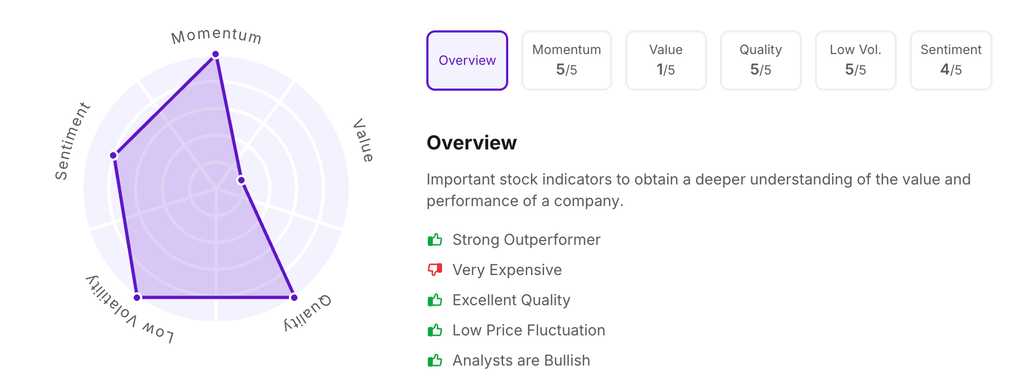

Let’s take a look at its Factor Analysis scores:

The power company has announced an interim dividend of ₹3.65 per equity share. It has a high dividend yield of 4.40% TTM.

For Q2FY26, Power Finance Corporation Ltd. reported Revenue from Operations of ₹28,890.24 crore, up 12.32% y-o-y, and a Profit After Tax of ₹7,834.39 crore, up 8.59%. The company’s Consolidated Loan Asset Book registered approximately 10% y-o-y growth to ₹11,43,369 crore as of September 30, 2025. The company demonstrated a continued focus on the clean energy transition, with the renewable loan book seeing a substantial 32% y-o-y growth.

Over the last five years, this stock has given multibagger returns of more than 330%.

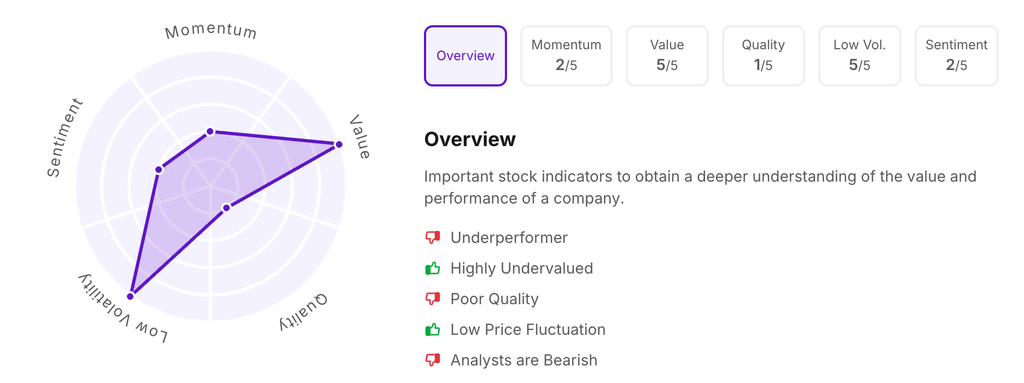

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:00 pm.