- Share.Market

- 3 min read

- Published at : 11 Aug 2025 02:49 PM

- Modified at : 11 Aug 2025 02:49 PM

HBL Engineering Ltd. shares rallied as much as 14%, reaching an intraday high of ₹691.00, after the company posted a sharp improvement in performance for the quarter ended June 30, 2025 (Q1FY26) and announced the reappointment of its Chairman and Managing Director.

The company’s total income rose 18.2% year-on-year to ₹621.41 crore from ₹525.59 crore in Q1FY25. Sequentially, it was up 30.7% from ₹475.58 crore in Q4FY25. Profit after tax surged 86.1% YoY to ₹141.23 crore from ₹75.85 crore and was nearly triple the ₹52.32 crore recorded in the previous quarter.

Revenue from Industrial Batteries stood at ₹337.38 crore versus ₹333.66 crore in Q1FY25. Defence & Aviation Batteries contributed ₹73.65 crore compared to ₹92.16 crore, while the Electronics segment posted a strong rise to ₹180.40 crore from ₹87.30 crore a year ago.

The Board approved the reappointment of Dr. Aluru Jagadish Prasad as Chairman and Managing Director for a five-year term starting October 1, 2025, subject to shareholder approval. Dr. Prasad, the promoter of HBL, has led the company since inception, driving its growth from ₹3 crore turnover in 1989 to over ₹2,200 crore. He has been instrumental in building HBL into a research-driven engineering company with a strong presence in industrial batteries, defence and aviation batteries, and electronics, as well as railway safety systems like TCAS (Kavach).

HBL provides battery and engineering solutions to customers in over 80 countries, with long-standing relationships with Indian Railways, the Indian Air Force, and the Indian Navy. The company is also focusing on new opportunities in eMobility, leveraging its expertise in motors and battery systems.

Over the last three and five years, this stock has given multibagger returns of more than 720% and 4,330%, respectively.

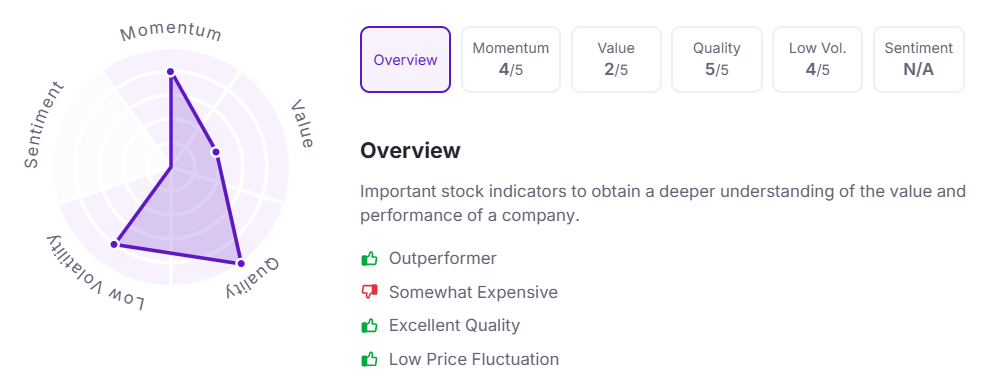

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 2:48 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.