- Share.Market

- 3 min read

- Published at : 22 Sep 2025 05:07 PM

- Modified at : 22 Sep 2025 05:07 PM

Garden Reach Shipbuilders & Engineers Ltd. has signed five strategic Memorandums of Understanding (MoUs) with key partners in the shipbuilding, port, and infrastructure sectors. The agreements were finalized at the ‘Samudra Se Samriddhi’ Mission in Bhavnagar, an event launched by Prime Minister Narendra Modi to propel India toward its goal of becoming one of the world’s top five shipbuilding nations by 2047.

The MoUs create a structured framework for GRSE and its partners, which include Deendayal Port Authority, The Shipping Corporation of India, and Modest Infrastructure Private Limited, to jointly develop projects. These collaborations will focus on newbuild construction (including low-emission vessels), ship repair, port infrastructure, and multi-modal logistics. The agreements are considered a critical step in creating an integrated ecosystem to support India’s “Aatmanirbhar Bharat” (self-reliant India) vision in the maritime sector.

Post the announcement, shares og GRSE surged over 5%, reaching an intraday high of ₹2,760.00 apiece.

About the Company

Garden Reach Shipbuilders & Engineers Ltd. is a Mini-Ratna Category I Defense Public Sector Undertaking under the Ministry of Defence. With a legacy dating back to 1884, the company holds the unique distinction of having built the highest number of warships for the Indian Navy and Coast Guard.

Q1 FY26 Results

GRSE began the fiscal year with strong financial performance in Q1 FY26. The company reported a 30% year-on-year growth in revenue from operations, which rose to ₹1,310 crore. Profitability also saw a notable increase, with EBITDA growing by 42% and Profit After Tax (PAT) increasing by 38% over the same quarter last year. The results put the company in a strong position to maintain its growth trajectory.

Over the last three and five years, this stock has given multibagger returns of more than 665% and 1,425% respectively.

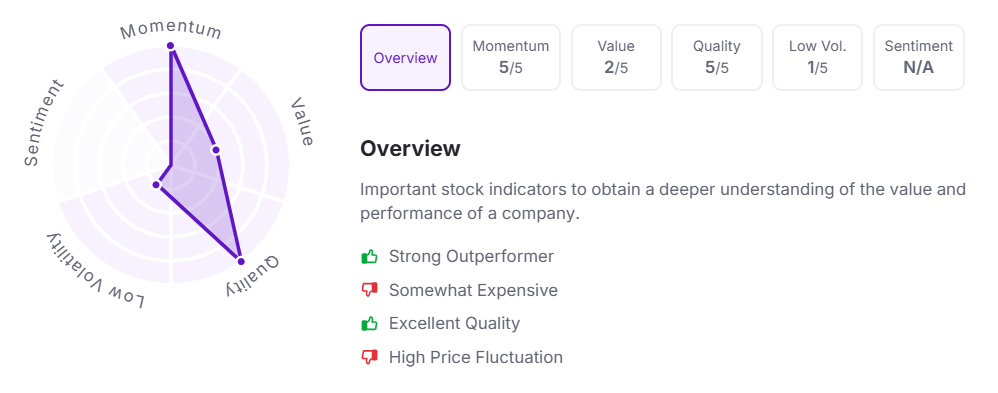

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.