- Share.Market

- 2 min read

- Published at : 05 Nov 2025 05:16 PM

- Modified at : 15 Nov 2025 10:02 AM

Grasim Industries Ltd. announced its consolidated financial results for the second quarter ended September 30, 2025, demonstrating strong double-digit growth across key metrics driven by its core sectors and new, scaling businesses, positioning itself for the ‘Viksit Bharat’ agenda.

The company’s revenue for Q2 FY26 stood at ₹39,900 crore, marking an increase of 17% year-over-year (YoY). This robust top-line performance was largely driven by significant growth in the Building Materials and Chemicals businesses.

Performance of Building Materials Segment:

- The Building Materials segment, which includes Cement, Paints, and B2B E-commerce, reported a revenue of ₹22,253 crore, an increase of 28% YoY.

- Paints (Birla Opus): The total capacity of the Paints business reached 1,332 MLPA with the commissioning of the sixth plant at Kharagpur in October 2025. This new capacity gives Birla Opus the second largest capacity share in the Indian Decorative Paints industry at approximately 24%.

- B2B E-commerce (Birla Pivot): The business continued its strong growth momentum with revenue increasing 15% quarter-on-quarter (QoQ) , driven by the addition of new customers, healthy repeat orders, and an increasing contribution from diverse product categories.

The Chemicals business reported a revenue of ₹2,399 crore , an increase of 17% YoY. Segment EBITDA grew by 34% YoY to ₹365 crore , largely driven by higher volume growth in Chlorine Derivatives and better ECU (Electrochemical Unit) realisations. The Cellulosic Staple Fibre business saw its specialty sales volume share rise to 24% , boosted by higher exports during the quarter.

The Financial Services business, held through subsidiary Aditya Birla Capital, saw its total lending portfolio (NBFC and HFC) grow 29% YoY to ₹1,77,855 crore. Total Assets Under Management (AUM) across AMC, life insurance, and health insurance grew by 10% YoY to ₹5,50,240 crore.

Grasim Industries is positioned to benefit considerably from India’s broad-based economic momentum. The company’s diverse portfolio, underpinned by strategic capital deployment and expansion across key sectors, including infrastructure, domestic manufacturing, and a formalised financial system, creates a strong foundation for sustained demand and continued participation in the next chapter of India’s growth.

Over the last five years, this stock has delivered mutlibagger returns of more than 265%.

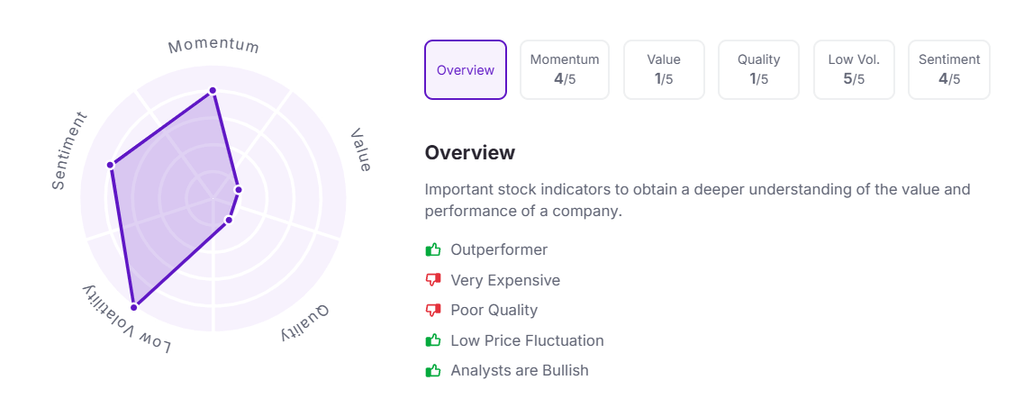

Let’s take a look at its Factor Analysis scores: