- Share.Market

- 2 min read

- Published at : 14 Nov 2025 11:40 AM

- Modified at : 15 Nov 2025 09:19 AM

The shares of Gopal Snacks are set for their record date on Monday, November 17, 2025. To be eligible for the upcoming buyback and dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

The FMCG company has announced the first interim dividend for the financial year 2025-26 of ₹0.25 per equity share.

Gopal Snacks Ltd. focused heavily on recovery during the second quarter (Q2 FY26) and demonstrated strong sequential performance, though it faced challenges compared to the same quarter last year.

The quarter saw revenue from operations increase by 17% from the preceding quarter (Q1 FY26), reaching ₹376 rores, however it fell 7% year-on-year compared to Q2FY25.

The company stabilized operations after the Rajkot fire incident. Despite this recovery, the quarterly sales figure was lower compared to Q2 FY25, a drop attributed primarily to ongoing Supply chain issues and the impact of the Custom duty levied on palm oil in September 2024.

Profit After Tax was down 11% year-on-year from Q2FY25 to ₹26 crore. Sequentially, profit was up 917% from Q1FY26. The reason for this jump was that the company received an Exceptional income of ₹19.99 Crores from its insurer as an Adhoc payment related to the restatement of fire-affected assets at the Rajkot facility.

Strategically, the quarter was marked by efforts to diversify and expand capacity, including the start of Trial Production at the new Modasa Namkeen Facility to serve as a key distribution hub , and entering long-term agreements for third-party manufacturing in Karnataka (Hiryur) and Uttarakhand (Kashipur) to reinforce its Southern and Northern market presence.

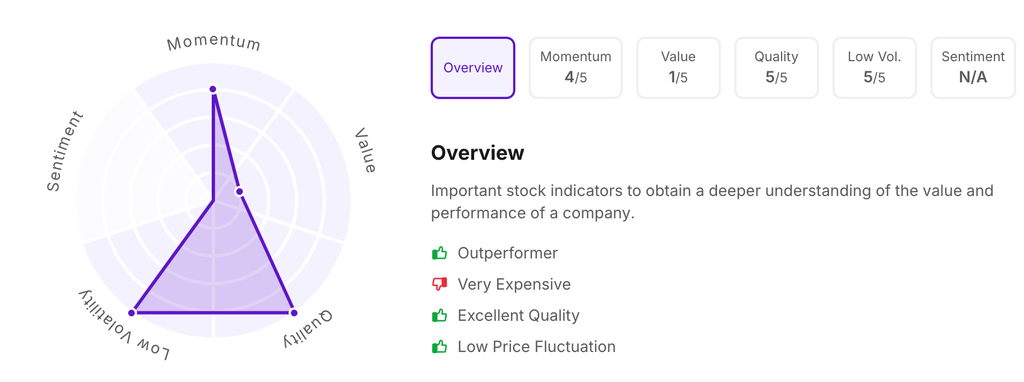

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:39 am.