- Share.Market

- 3 min read

- Published at : 05 Aug 2025 04:22 PM

- Modified at : 05 Aug 2025 05:12 PM

Shares of Godfrey Phillips India Ltd. rallied 10% to hit the upper circuit at ₹9,881.50, following the announcement of a bonus issue and a sharp year-on-year surge in quarterly profits.

For the quarter ended June 30, 2025, Godfrey Phillips posted a net profit of ₹356.28 crores, marking a 25.1% YoY growth. Revenue from operations rose 33.4% YoY to ₹1,813 crores, driven by strong performance in its core cigarette and tobacco segment.

The cigarette and tobacco business contributed ₹1,781 crores in revenue, up from ₹1,338 crores in the same quarter last year, maintaining its position as the company’s dominant vertical. The ‘Others’ segment, which includes confectionery and export businesses, reported revenue of ₹32 crores.

Segment-level results also showed sustained momentum, with operating profit from the core tobacco segment at ₹299.4 crores and ₹7.9 crores from the Others segment, contributing the bulk of the ₹307.3 crores total segment result.

The board has recommended a final dividend of ₹60 per equity share for FY25 along with a 2:1 bonus issue, under which shareholders will receive two fully paid-up equity shares of ₹2 each for every one share held.

As of June 30, 2025, the company’s total assets stood at ₹3,611 crores and capital employed at ₹2,985 crores. The restructuring of the business to focus on core tobacco and FMCG operations has improved both profitability and efficiency.

Founded as part of Modi Enterprises, KK Modi Group, Godfrey Phillips is one of India’s largest FMCG companies with a stronghold in tobacco products. Its flagship brands include Four Square, Red & White, Stellar, and Cavanders, along with Marlboro, which it manufactures and distributes in India under a licensing arrangement with Philip Morris.

The company has also built a growing confectionery and export business, with presence in over 1 million retail outlets and a network of 800+ distributors supported by 9,000+ sales personnel.

Over the last three and five years, the company has delivered multibagger returns of more than 730% and 975%, respectively.

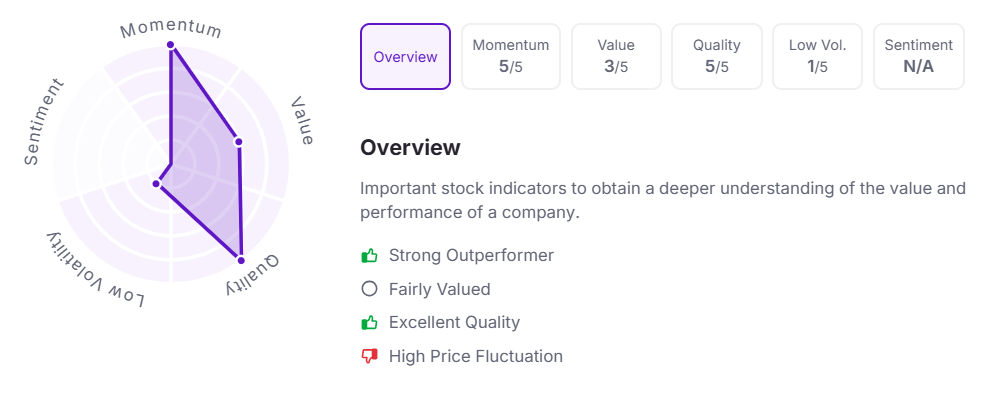

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.