- Share.Market

- 3 min read

- Published at : 05 Sep 2025 03:22 PM

- Modified at : 05 Sep 2025 03:22 PM

Shares of Gujarat Mineral Development Corporation Ltd.

surged over 12%, reaching an intraday high of ₹514.30, after the Union Cabinet approved a ₹1,500 crore incentive scheme to develop battery and e-waste recycling capacity for the extraction of critical minerals.

The scheme, part of the National Critical Mineral Mission (NCMM), aims to boost domestic recycling and recovery of critical minerals like lithium, cobalt, nickel, and rare earths from secondary sources such as e-waste, lithium-ion battery scrap, and catalytic converters from end-of-life vehicles.

It will run for six years from FY26 to FY31, providing both capital and operational subsidies. Large entities will be eligible for up to ₹50 crore in incentives, while smaller recyclers, including startups, can access up to ₹25 crore. The government expects the scheme to generate 270 kilo tonnes of annual recycling capacity, producing 40 kilo tonnes of critical minerals, attracting ₹8,000 crore of investment, and creating about 70,000 jobs.

Impact on GMDC

As a state-owned mining major with interests in bauxite, manganese, silica sand, and other industrial minerals, GMDC stands to benefit from a policy push that strengthens India’s critical mineral value chain. The scheme creates new opportunities in recycling-based extraction, complementing GMDC’s ongoing diversification and growth strategy.

About the Company

Gujarat Mineral Development Corporation Ltd. (GMDC) is one of India’s leading mining and mineral processing companies and the country’s No.1 merchant seller of lignite and No.2 producer of lignite. A state-owned PSU under the Government of Gujarat, GMDC has been engaged in mineral development for over five decades, with operations spanning lignite, bauxite, fluorspar, manganese, silica sand, limestone, bentonite, and ball clay.

It caters to diverse industries such as textiles, chemicals, ceramics, captive power, glass, and cement, and also has a presence in thermal and renewable energy projects, including wind and solar.

For Q1FY26, GMDC reported revenue from operations of ₹733 crore compared to ₹818 crore in Q1FY25. Profit before tax stood at ₹225 crore against ₹250 crore last year, while EBITDA margin was stable at 30%. On the operational front, lignite sales volume stood at 19.8 lakh MT with sales value of ₹649 crore, while bauxite sales volume rose to 1.4 lakh MT with sales value of ₹34 crore.

Over the last three and five years, this stock has delivered multibagger returns of more than 205% and 985%, respectively.

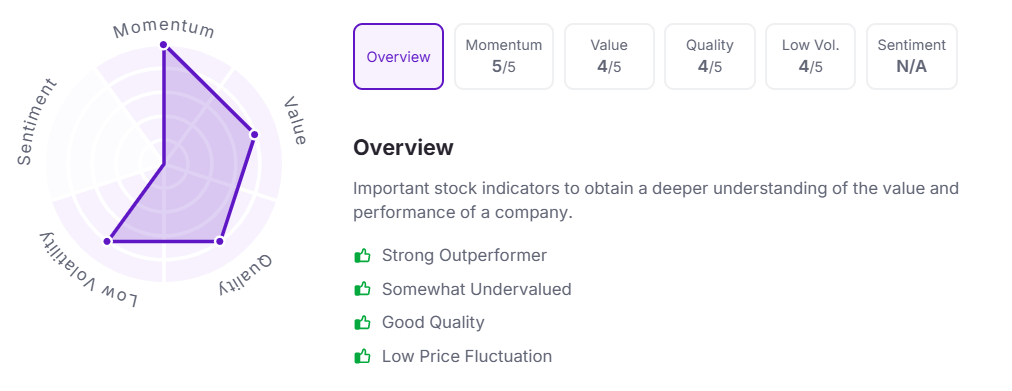

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:13 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.