- Share.Market

- 5 min read

- Published at : 25 Aug 2025 12:25 PM

- Modified at : 25 Aug 2025 01:22 PM

The shares of Gillette India, JBM Auto, Garware Technical Fibres, and Vedanta are set to trade ex-dividend on Tuesday, August 26, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Gillette India Ltd. has announced a final dividend of ₹47 per equity share. The record date for the same is August 26, 2025.

Gillette is a leading FMCG company known for its iconic brands Gillette and Oral-B, with a strong presence in daily-use categories and a reputation for delivering superior consumer products. For the quarter ended June 30, 2025, the company reported double-digit top-line and bottom-line growth, with sales up 10% and PAT up 26%. It has a dividend yield of 1.10% TTM.

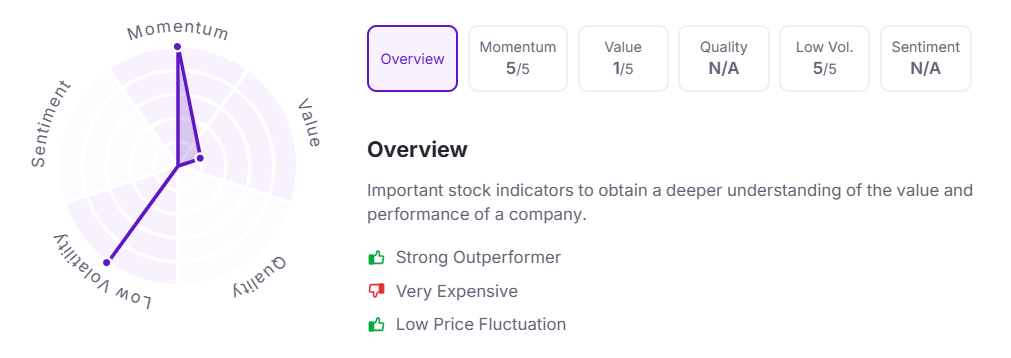

Let’s take a look at its Factor Analysis scores:

JBM Auto Ltd. has announced a final dividend of ₹0.85 per equity share. The record date for the same is August 27, 2025.

JBM Auto Limited, part of the $3 billion JBM Group, is a leading player in the automotive and electric vehicle space, with a strong presence across components, EV manufacturing, and sustainable mobility solutions. For the quarter ended March 31, 2025, the company reported consolidated revenues of ₹1,645.70 crore, up 10.75% year-on-year, while net profit rose 20.21% to ₹66 crore. It has a dividend yield of 0.10% TTM.

Over the last three and five years, this stock has given multibagger returns of more than 220% and 1,295%, respectively.

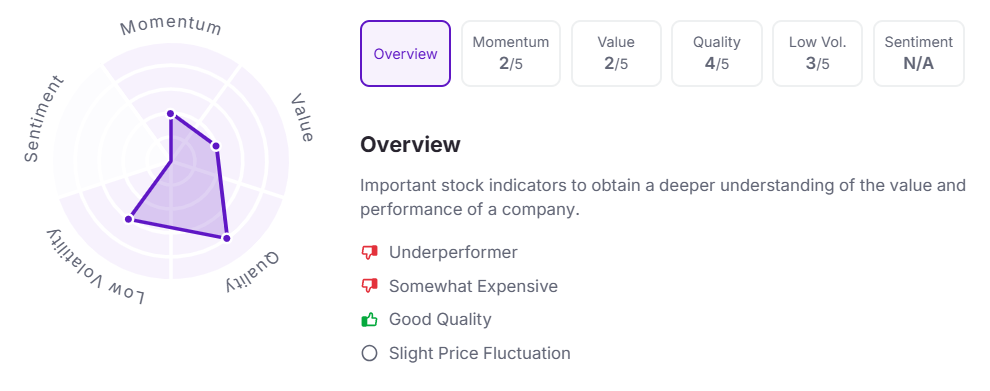

Let’s take a look at its Factor Analysis scores:

Garware Technical Fibres Ltd. has announced a final dividend of ₹1.50 per equity share. The record date for the same is August 26, 2025.

Garware Technical Fibres Ltd., a leading manufacturer of technical textiles with a strong presence across fisheries, aquaculture, agriculture, shipping, and geosynthetics, reported steady growth in its first quarter results for FY26. For the quarter ended June 30, 2025, consolidated net sales rose 9% year-on-year to ₹367.2 crore, while net profit after tax grew 13.5% to ₹53.1 crore. It has a dividend yield of 0.10% TTM.

Over the last five years, this stock has given multibagger returns of more than 180%.

Let’s take a look at its Factor Analysis scores:

Vedanta Ltd. has announced an interim dividend of ₹16 per equity share. The record date for the same is August 27, 2025.

Vedanta Limited, a global natural resources and technology company with operations spanning metals, minerals, oil & gas, and power, reported its strongest-ever first quarter performance for the period ended June 30, 2025. Consolidated revenue rose 6% year-on-year to ₹37,434 crore, while EBITDA hit a record high of ₹10,746 crore, up 5% from last year with margins at a 13-quarter peak of 35%. Adjusted PAT increased 13% to ₹5,000 crore, supported by record alumina and zinc production, higher power sales, and strong operational efficiencies, reaffirming the company’s growth momentum despite global market volatility. It has an extremely high dividend yield of 7.90% TTM.

Over the last five years, this stock has given multibagger returns of more than 245%.

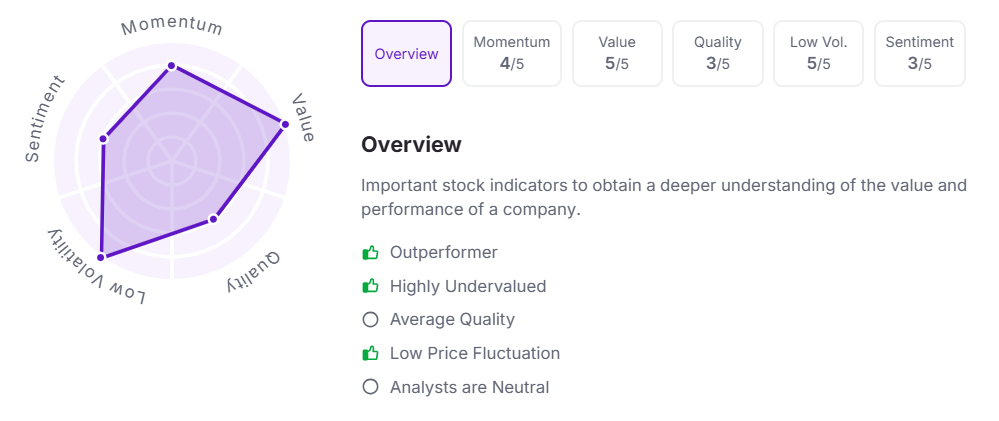

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:20 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.