- Share.Market

- 3 min read

- Published at : 26 May 2025 06:34 PM

- Modified at : 16 Jul 2025 07:48 PM

reported robust growth for the nine-month financial year ended March 31, 2025, following a change in its financial year cycle. The company posted sales of ₹2,235 crore, up 12%, and a 41% jump in Profit After Tax to ₹418 crore compared to the same nine-month period last year.

Following the announcement, the shares of Gillette surged to an intraday high of ₹9,877 apiece.

The growth was broad-based, with the Grooming segment leading performance, supported by a focused product portfolio, consistent innovation, and sharp retail execution. In the March quarter (Q3FY25), the company registered sales of ₹767 crore, up 13% YoY, while PAT surged 60% YoY to ₹159 crore, reflecting strong operating leverage and productivity interventions across the business.

This marks the first reporting cycle since Gillette India transitioned its financial year from July–June to April–March. The current FY25 thus covers a 9-month period from July 1, 2024 to March 31, 2025, and results have been benchmarked against the comparable 9-month period from the previous year.

The company announced a final dividend of ₹47 per share, bringing the total dividend payout for the fiscal to ₹112 per share, including an interim dividend of ₹65, subject to shareholder approval.

Gillette also advanced its innovation pipeline during the year with upgraded Mach 3 razors, enhanced Gillette Guard offerings, and sustained brand education efforts for Venus. In oral care, the launch of the iO3 electric toothbrush extended the benefits of powered oral hygiene to more Indian households. The company also continued its social impact initiatives through P&G Shiksha, now in its 20th year, having impacted over 50 lakh children across India.

With strong brand equity, disciplined execution, and sustained consumer relevance, Gillette India enters the new fiscal year well-positioned to drive continued value creation.

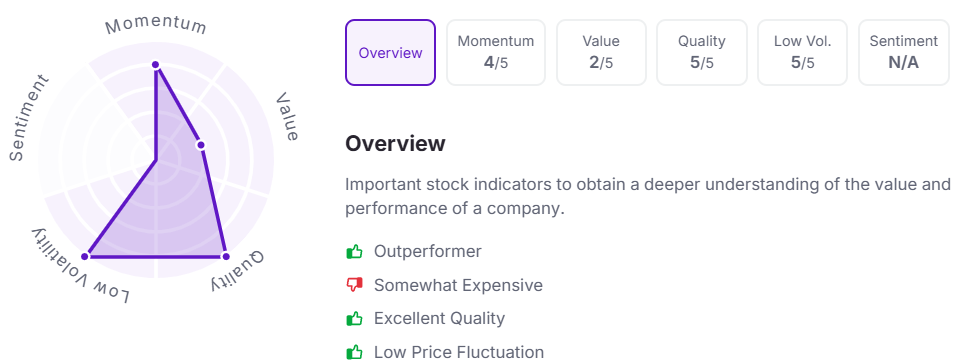

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.