- Share.Market

- 3 min read

- Published at : 26 May 2025 03:33 PM

- Modified at : 16 Jul 2025 07:47 PM

Shares of GE Vernova T&D India Ltd. were locked in a 10% upper circuit on Monday, May 26, after the company reported a strong set of earnings for the March quarter, announced post-market hours on Friday.

The power transmission and distribution major reported a 26% YoY increase in revenue, which rose to ₹1,150 crores in Q4FY25. Profit after tax surged to ₹186.5 crores, compared to ₹66.3 crores in the same quarter last year. For the full year, revenue rose 36% to ₹4,292 crores, while PAT increased to ₹608 crores from 181 crores. The company’s order book almost doubled year-on-year, closing FY25 with ₹10,780 crores worth of bookings.

Order momentum was equally robust. GE Vernova booked ₹2,991 crores worth of orders during the quarter, more than double the ₹1,335 crores booked in Q4FY24, reflecting strong demand across utilities, renewable projects, and industrial clients. Major wins included 765 kV and 400 kV equipment orders from Power Grid Corporation of India, Sterlite Group, Adani, and Jindal Group. The company also secured export orders for AIS and GIS equipment across Europe, Southeast Asia, and Africa, highlighting its growing international footprint.

The company also achieved several execution milestones during the year, commissioning 765 kV and 400 kV transformers and substations for key clients such as PowerGrid, Doosan, Renew Power, Tata Power Solar, and Adani. These wins further reinforce its position as a preferred partner for grid infrastructure projects.

The board recommended a dividend of ₹5 per equity share, subject to shareholder approval.

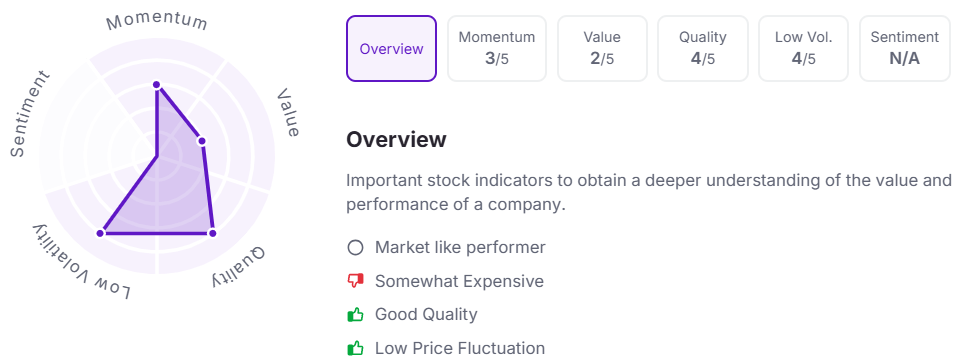

Over the last three years, this stock has given exceptional multibagger returns of more than 2000%. Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.