- Share.Market

- 5 min read

- Published at : 09 Sep 2025 11:33 AM

- Modified at : 09 Sep 2025 12:33 PM

The shares of Force Motors, Gujarat State Petronet, Astra Microwave Products, and Campus Activewear are set for their record date on Wednesday, September 10, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Force Motors Ltd. has announced a dividend of ₹40 per equity share.

Force Motors Limited is India’s largest van maker and a fully integrated automobile company specializing in the engineering, development, and manufacture of vehicles, aggregates, and components.

For Q1FY26, the company reported revenue from operations of ₹2,29,725 lakh, up from ₹1,88,490 lakh in the same quarter last year. Net profit for the period stood at ₹10,135 lakh compared with ₹6,609 lakh in Q1FY25, reflecting strong growth momentum.

Over the last three and five years, this stock has given multibagger returns of more than 1,235% and 235%, respectively.

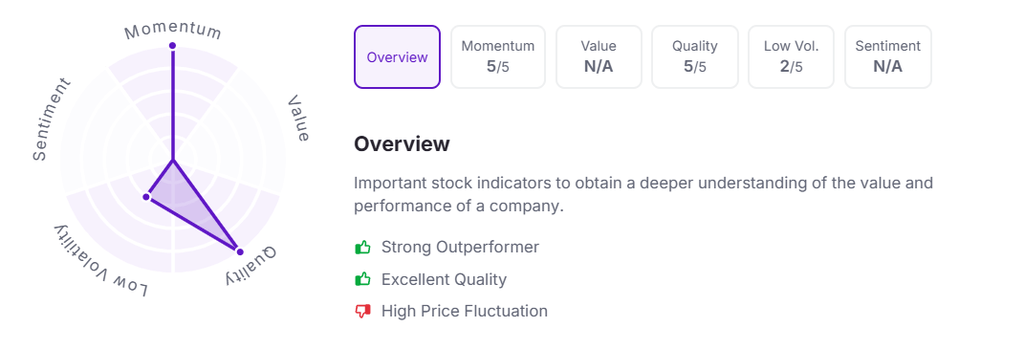

Let’s take a look at its Factor Analysis scores:

Gujarat State Petronet Ltd. has announced a final dividend of ₹5 per equity share.

Gujarat State Petronet Limited (GSPL), incorporated in 1998, is a leading natural gas transportation company with a pipeline network of about 2,692 km across Gujarat, certified under ISO 9001:2015, ISO 14001:2015, and OHSAS 18001:2007.

For Q1FY26, the company reported gross income of ₹4,402 crore compared with ₹4,961 crore in Q1FY25. Profit before tax stood at ₹626 crore versus ₹712 crore a year earlier, while net profit came in at ₹465 crore against ₹527 crore in the same quarter last year.

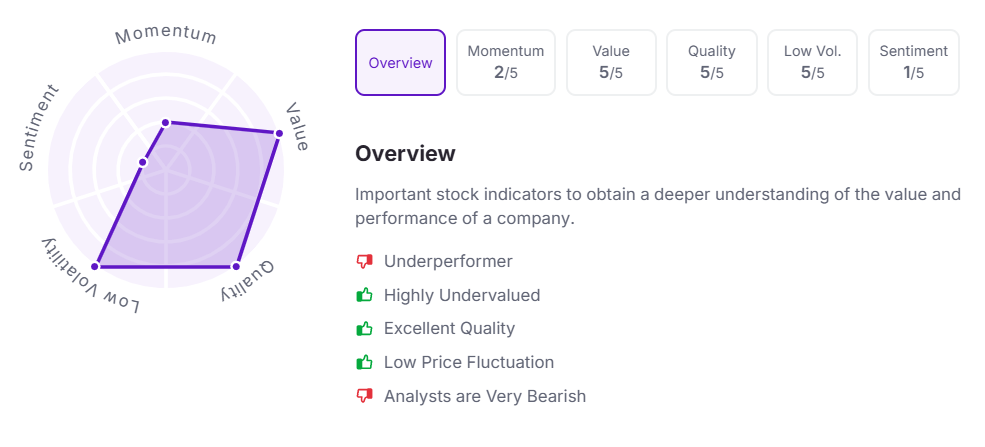

Let’s take a look at its Factor Analysis scores:

Astra Microwave Products Ltd. has announced a final dividend of ₹2.20 per equity share.

Astra Microwave Products Limited, founded in 1991 by a team of experienced scientists, is a leading player in Defence, Aerospace, and Space Electronics systems, sub-systems, and components, with strong in-house R&D and advanced test facilities.

For Q1FY26, the company posted revenue of ₹200 crore, up from ₹155 crore in Q1FY25, with EBITDA rising to ₹41 crore from ₹24 crore and margins improving to 20.5% from 15.5%. Net profit more than doubled to ₹16 crore against ₹7 crore last year, supported by strong execution and operational efficiencies, while the consolidated order book stood at ₹2,236 crore as of June 30, 2025.

Over the last three and five years, this stock has given multibagger returns of more than 195% and 735%, respectively.

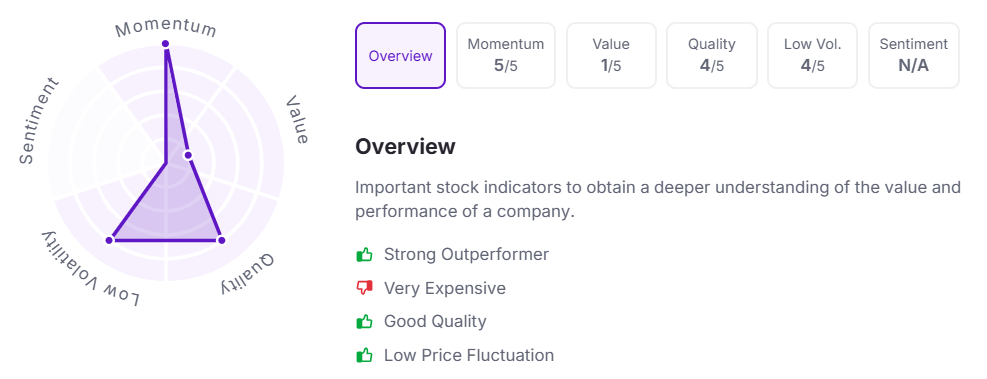

Let’s take a look at its Factor Analysis scores:

Campus Activewear Ltd. has announced a final dividend of ₹0.30 per equity share.

Campus Activewear is India’s largest sports and athleisure footwear brand with a strong omnichannel presence across retail and online platforms, backed by five in-house manufacturing facilities and a wide distributor network. In Q1FY26, the company reported revenues of ₹343.3 crore, up 1.2% year-on-year, while EBITDA stood at ₹55.4 crore with a margin of 15.9%. Net profit came in at ₹22.2 crore compared with ₹25.4 crore a year earlier, with margins impacted by higher depreciation costs despite gross margin improvements.

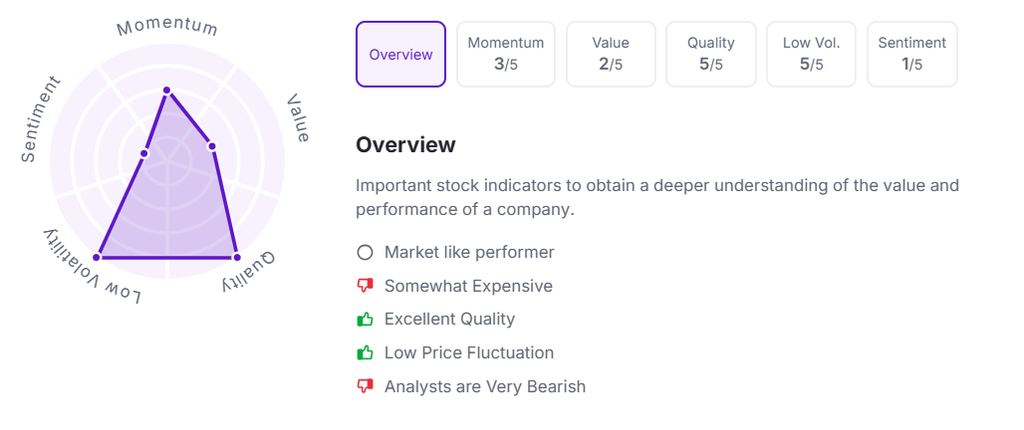

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:30 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.