- Share.Market

- 3 min read

- Published at : 31 Jul 2025 05:23 PM

- Modified at : 31 Jul 2025 05:23 PM

Shares of Emami Ltd. rallied up to 7%, reaching an intraday high of ₹611.80, on Thursday after the FMCG company posted a 9% year-on-year rise in consolidated profit for the June quarter of FY26, despite weather-led disruption in peak season categories.

Consolidated revenue stood at ₹904 crore in Q1FY26, broadly flat on a year-on-year basis amid a challenging demand environment. The topline was impacted by an unseasonal and shortened summer, which weighed on summer-centric categories.

Net profit rose 9% YoY to ₹164 crore, aided by cost efficiency and improved gross margins, which expanded by 170 basis points. Despite macro headwinds, the company’s core domestic business excluding talc and prickly heat powder (PHP) posted 6% revenue growth.

Emami’s PHP category, which had seen 54% growth in Q1FY25, declined 17% due to unfavourable weather. However, it maintained a 13% growth on a two-year CAGR basis and posted flat sales for the full summer season (January–June).

The company accelerated its innovation pipeline during the quarter, launching new variants under Navratna, Dermicool, and BoroPlus, alongside digital-first products on its Zanducare platform. International business grew modestly despite global uncertainties.

Management said it remains confident about consumption recovery in the coming quarters, supported by easing inflation, better monsoon, and innovation-led brand strategies. Quick commerce scaled nearly 3x YoY, reflecting gains from its omnichannel push.

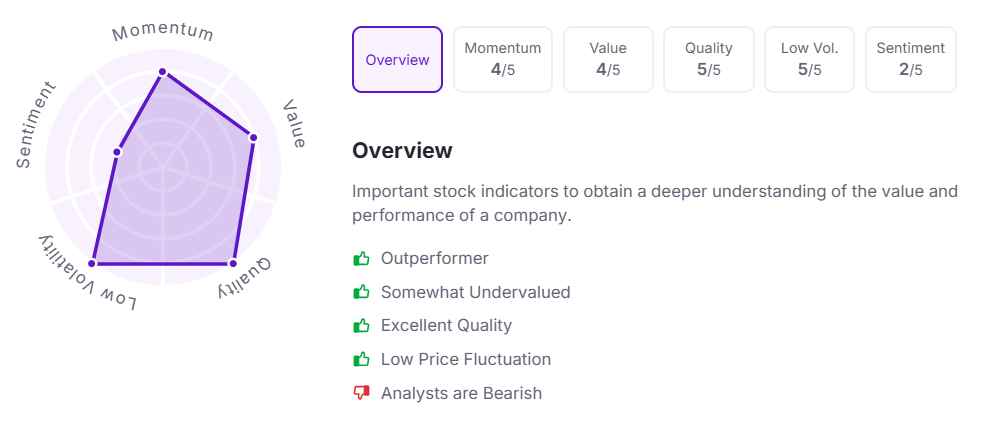

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.