- Share.Market

- 3 min read

- Published at : 09 Jul 2025 11:13 AM

- Modified at : 16 Jul 2025 07:10 PM

The shares of Dr Reddy’s Laboratories and LMW are set for their record date on Wednesday, July 09, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Dr. Reddy’s Laboratories Ltd. has announced a final dividend of ₹8 per equity share. Its current dividend yield is 0.60%.

Dr. Reddy’s is a global pharmaceutical company headquartered in India, with a diverse portfolio spanning generics, biosimilars, and proprietary products. In FY25, the company deepened its global presence through strategic collaborations, securing exclusive rights for key biosimilars in the US and Europe, expanding its footprint in Southeast Asia, and launching new therapies in India.

Dr. Reddy’s Laboratories reported its highest-ever quarterly revenue and profit in Q4FY25, with revenue rising 20% YoY to ₹8,506 crore and PAT increasing 22% YoY to ₹1,594 crore. On a full-year basis, FY25 revenue grew 17% YoY to ₹32,554 crore, while PAT stood at ₹5,654 crore, up 2%.

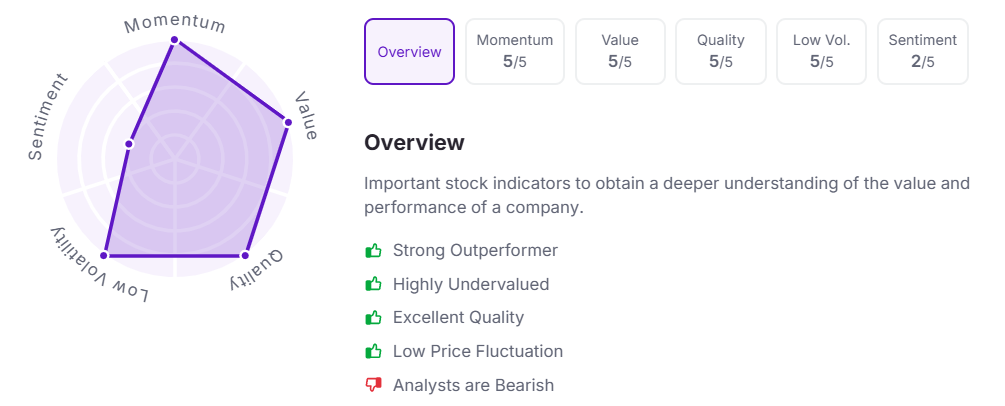

Let’s take a look at its Factor Analysis scores:

LMW Ltd. has announced a final dividend of ₹30 per equity share. Its current dividend yield is 0.50%.

LMW is a diversified engineering company with core operations in textile machinery, machine tools, and aerospace components.

The company reported a challenging year with consolidated revenue dropping 37% YoY to ₹2,909 crore in FY25, led by a 48% decline in the Textile Machinery Division (TMD). Q4 revenue stood at ₹809 crore. TMD posted a net profit of ₹16 crore for FY25, sharply down from ₹314 crore in FY24, amid muted order inflows and capacity utilization around 50%. The Machine Tool Division (MTD) held relatively steady, delivering ₹1,003 crore in FY25 revenue with ~9% margins and 70% capacity utilization. Overall, the company continues to focus on cost controls, selective investments, and operational discipline.

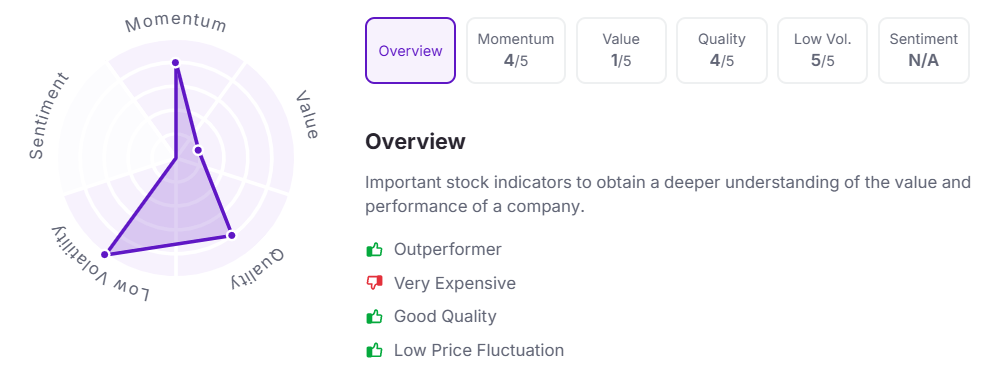

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:10 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.