- Share.Market

- 3 min read

- Published at : 28 Aug 2025 04:18 PM

- Modified at : 28 Aug 2025 04:18 PM

Shares of Dr. Agarwal’s Eye Hospital Ltd. fell as much as 18%, reaching an intraday low of ₹4,231.00, after the company announced its merger with Dr. Agarwals Health Care Ltd., the group’s flagship eye care chain.

The boards of both companies approved a scheme of amalgamation to consolidate operations under a single entity. As per the proposed share exchange ratio, shareholders of Dr. Agarwal’s Eye Hospital Limited (AEHL) will receive 23 equity shares of Dr. Agarwal’s Health Care Limited (AHCL) (₹1 face value) for every 2 equity shares of AEHL (₹10 face value) held, excluding AHCL’s existing stake. The transaction also includes a preferential issue worth approximately ₹70 crore by AEHL, at an issue price of ₹5,270 per share.

The merger is designed to streamline decision-making, unify capital allocation, and create operational efficiencies across the group’s eye care businesses. Management stated that the combined entity will benefit from a stronger balance sheet, simplified governance, and an integrated growth strategy.

Dr. Adil Agarwal, CEO of AHCL, emphasized that the merger is a “strategic milestone” to unlock long-term value and strengthen the group’s position as India’s largest eye care service chain, with over 230 facilities in India and 19 overseas centers.

Advisors to the transaction include Kotak Investment Banking, Motilal Oswal, PwC Business Consulting Services, and Trilegal. The scheme is subject to shareholder and regulatory approvals.

Over the last three and five years, AEHL has given mutlibagger returns of more than 455% and 1,640%, respectively.

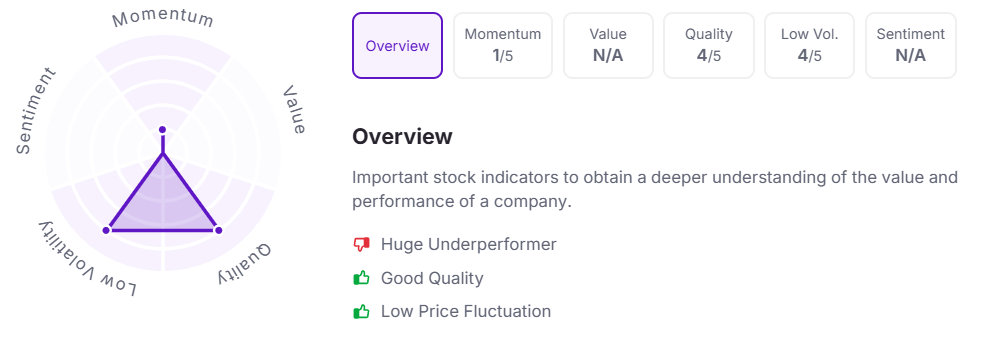

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.