- Share.Market

- 6 min read

- Published at : 09 Jun 2025 11:17 AM

- Modified at : 16 Jul 2025 08:00 PM

The shares of Asian Paints, Indian Bank, Tata Investment Corp, and Vesuvius India are set for their record date on Tuesday, June 10, 2025. To be eligible for the upcoming corporate actions, investors must have bought the shares before the ex-date and hold them at least till the record date.

Asian Paints Ltd. has announced a final dividend of ₹20.55 per equity share. Its current dividend yield is 1.40%. The company had previously announced an interim dividend of ₹4.25 and a final dividend of ₹28.50 per equity share on 19 November 2024 and 11 June 2024, respectively.

Asian Paints is one of India’s largest paint and home décor companies and one of the top eight coatings companies globally. With a presence in over 60 countries and 26 manufacturing facilities, the company operates under various brands including Berger, Apco, and SCIB.

Asian Paints reported a weak Q4 FY25, with consolidated revenue declining 4.3% YoY and net profit falling 44.9%, hit by muted domestic coatings demand, challenges in the home décor segment, and impairment-related exceptional losses. Despite macro headwinds, the company remains cautiously optimistic about recovery.

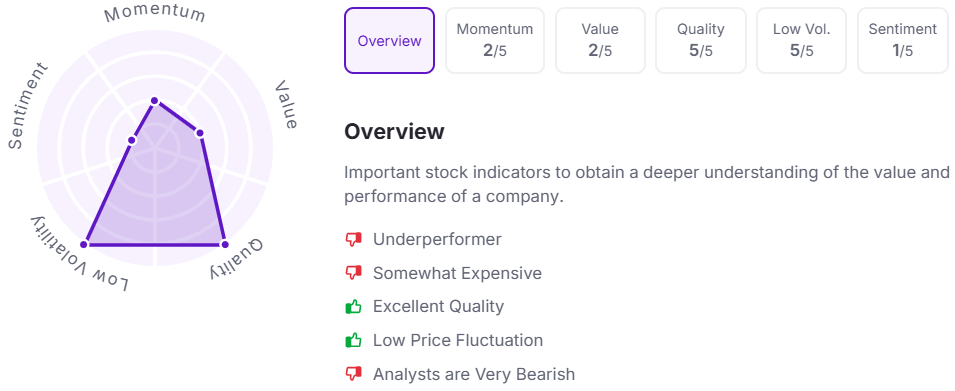

Let’s take a look at its Factor Analysis scores:

Indian Bank has announced a final dividend of ₹16.25 per equity share. The company had previously announced a final dividend of ₹12 per equity share on 07 June 2024.

Indian Bank is a prominent public sector bank in India, with a strong nationwide presence through over 5,900 branches and 14,600+ business correspondents. The bank offers a comprehensive range of financial services and has been increasingly focused on digital transformation, growing mobile and UPI users, and expanding credit card and PoS penetration.

Indian Bank reported a robust financial performance in FY25, with net profit rising 35% YoY and operating profit up 13% to ₹18,998 crore. Net Interest Income grew 8% YoY, while cost-to-income ratio improved by 115 bps. Strong growth was seen in RAM advances (up 13%) and total deposits (up 7%).

Over the last three years, this stock has given multibagger returns of more than 295%.

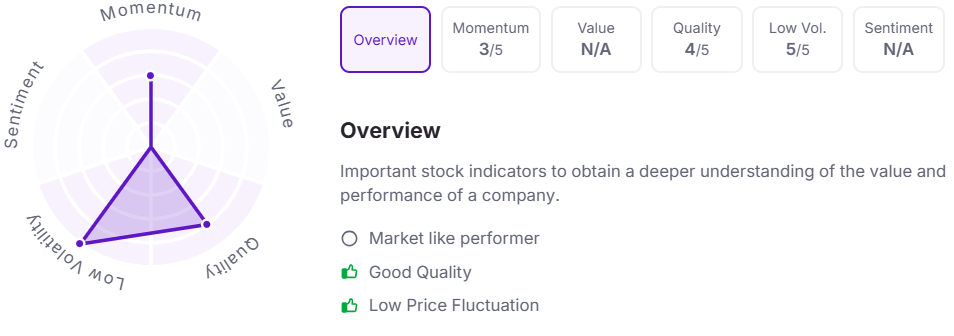

Let’s take a look at its Factor Analysis scores:

Tata Investment Corporation Ltd. has announced a final dividend of ₹27 per equity share. Its current dividend yield is 0.40%. The company had previously announced a final dividend of ₹28 per equity share on 18 June 2024.

Tata Investment Corporation is a non-banking financial company (NBFC) under the Tata Group, primarily engaged in long-term investments in equity, debt, and related securities. Established in 1937 and listed since 1959, TICL was originally set up to promote small and medium enterprises. Over the decades, it evolved into a diversified investment holding company with a strong portfolio spanning across industries.

Over the last three years, this stock has given multibagger returns of more than 380%.

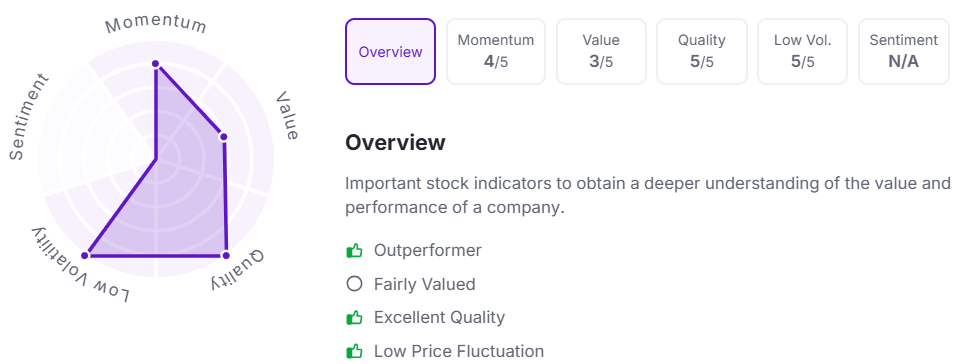

Let’s take a look at its Factor Analysis scores:

Vesuvius India Ltd. has approved a stock split in the ratio of 10:1. This means that each existing equity share with a face value of ₹10 will be subdivided into 10 equity shares with a face value of ₹1 each. After the split, the value of total investment will remain the same, but the number of shares one owns will increase in proportion.

The stock split aims to make shares more affordable, increasing their attractiveness to a wider range of investors. This move is expected to boost investor participation and improve the liquidity of the company’s shares in the market.

Vesuvius is a global leader in developing and manufacturing high-technology products and solutions for the steel and foundry casting industries. With a presence across six continents and 54 production sites, the company combines innovation, service, and operational flexibility to deliver consistent growth. Its business model is built on technology leadership, customer proximity, and a strong focus on sustainability, efficiency, and value-added services.

Over the last three years, this stock has given multibagger returns of more than 450%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:15 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.