- Share.Market

- 7 min read

- Published at : 11 Jun 2025 12:03 PM

- Modified at : 16 Jul 2025 08:08 PM

The shares of TRENT, ICICIPRULI, TATACHEM, JKLAKSHMI, and ETHOSLTD are set for their record date on Thursday, June 12, 2025. To be eligible for the upcoming dividends and rights issue, investors must have bought the shares before the ex-date and hold them at least till the record date.

Trent Ltd. has announced a final dividend of ₹5 per equity share.

Trent Limited, part of the Tata Group, continues to strengthen its presence in India’s organized retail landscape with a diversified and fast-growing portfolio. As of FY25-end, Trent operated 1,043 fashion stores, including 248 Westside and 765 Zudio outlets, alongside a growing presence in emerging lifestyle and grocery segments.

In Q4FY25, Trent reported a 28% YoY increase in standalone revenue to ₹4,334 crore, with profit before tax (PBT) rising 39% to ₹453 crore. For the full year, standalone revenue grew 44% YoY to ₹17,624 crore and PBT surged 56% to ₹2,077 crore. Consolidated revenue reached ₹18,141 crore, up 40% YoY, while consolidated PBT rose 56% to ₹2,030 crore. Overall, FY25 marked a year of robust growth, network expansion, and improved profitability across Trent’s portfolio.

Over the last three years, this stock has given multibagger returns of more than 420%.

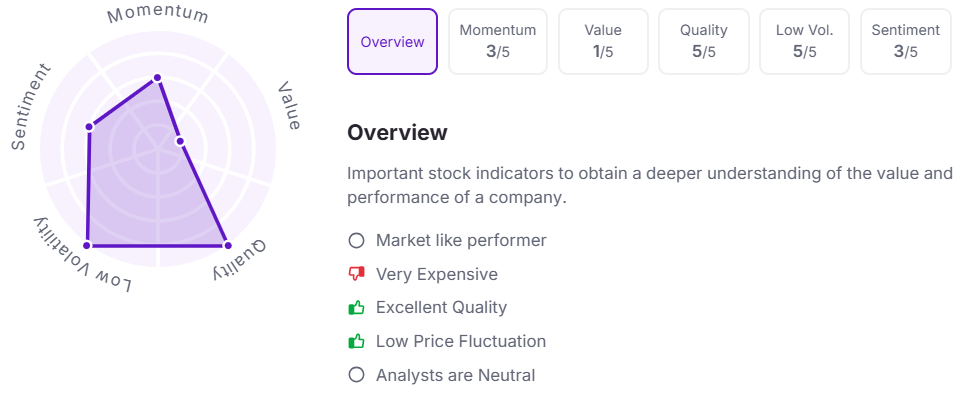

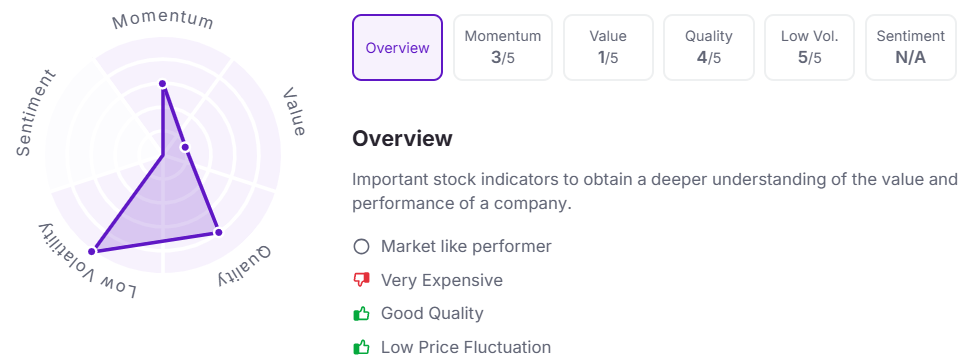

Let’s take a look at its Factor Analysis scores:

ICICI Prudential Life Insurance Company Ltd. has announced a final dividend of ₹0.85 per equity share. Its current dividend yield is 0.10%.

ICICI Prudential Life Insurance is one of India’s leading private life insurers, promoted by ICICI Bank and Prudential Corporation Holdings. Since starting operations in 2001, the company has built a strong presence across protection and savings products, catering to over 9 crore lives as of March 2025.

In FY2025, ICICI Prudential Life reported a 39.6% year-on-year rise in Profit After Tax to ₹1,189 crore, supported by healthy growth in both protection and annuity businesses. Value of New Business rose 6.4% to ₹2,370 crore, while APE crossed ₹10,000 crore for the first time, up 15% year-on-year. Persistency remained strong at 89.1%, and the solvency ratio stood at a healthy 212.2%.

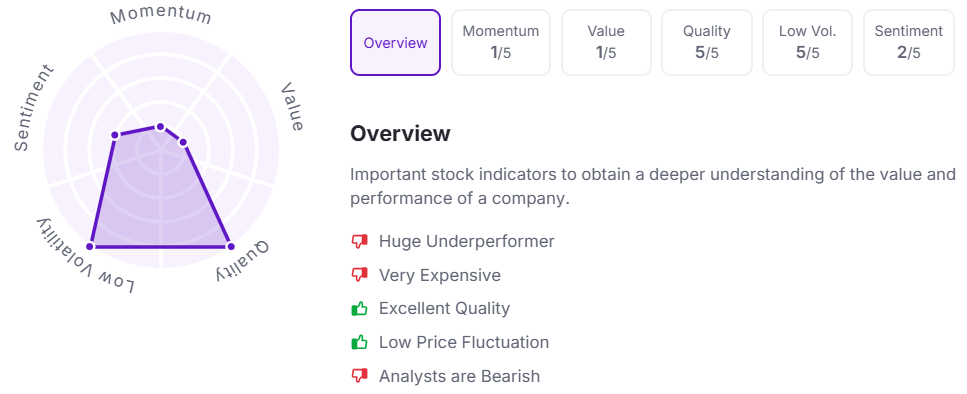

Let’s take a look at its Factor Analysis scores:

Tata Chemicals Ltd. has announced a final dividend of ₹11 per equity share. Its current dividend yield is 1.60%.

Tata Chemicals Limited, a part of the US$165 billion Tata Group, is a global leader in basic and specialty chemistry, supplying essential materials to industries like glass, detergents, chemicals, and crop protection. With manufacturing operations and R&D capabilities spread across India, the UK, and the US, the company also holds a strong foothold in agri-inputs through its subsidiary Rallis India.

In Q4FY25, Tata Chemicals reported a modest 1% YoY increase in consolidated revenue to ₹3,509 crore, but EBITDA declined to ₹327 crore due to continued pricing pressure across geographies. The company posted a consolidated net loss of ₹12 crore (before exceptional items), impacted by margin compression and weak demand in key international markets. For FY25, consolidated revenue stood at ₹14,887 crore, slightly lower than last year, while PAT from continuing operations was ₹479 crore. The year also saw the commissioning of new capacities: 230kT soda ash and 140kT bicarb in India, and 70kT pharma-grade salt in the UK.

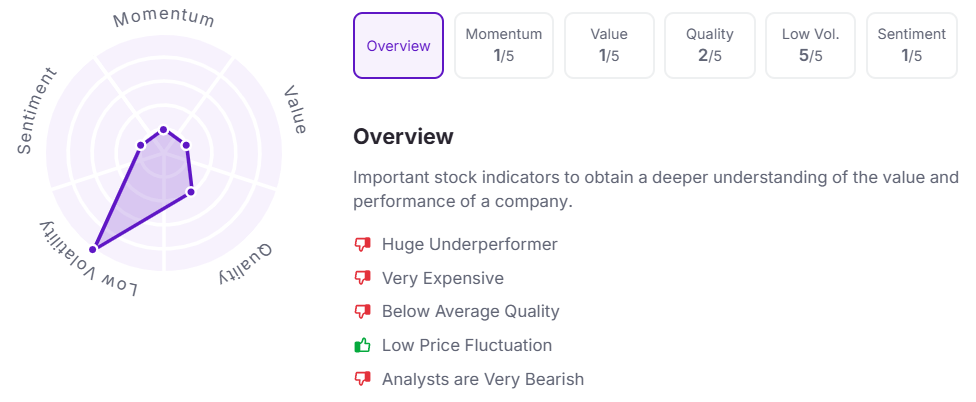

Let’s take a look at its Factor Analysis scores:

JK Lakshmi Cement Ltd. has announced a dividend of ₹6.5 per equity share. Its current dividend yield is 0.50%.

JK Lakshmi Cement is a leading cement manufacturer with a strong presence in northern, western, and eastern India. With integrated plants in Rajasthan and Chhattisgarh, and grinding units across Gujarat, Haryana, and Odisha, the company has a total cement capacity of around 16.4 million tonnes per annum.

In FY25, the company reported a standalone net profit of ₹361.45 crore, down from ₹424.32 crore in FY24, primarily due to softer pricing. Full-year revenue stood at ₹5,697.97 crore, while EBITDA was ₹760.65 crore. For Q4FY25, standalone net profit came in at ₹137.96 crore on revenue of ₹1,738.82 crore. Consolidated revenue for the year was ₹6,192.62 crore with a PAT of ₹301.99 crore. Despite pricing pressure, profitability improved sequentially due to better product mix, higher volumes, and lower fuel costs.

Let’s take a look at its Factor Analysis scores:

Ethos Ltd. has announced a Rights Issue in the ratio 4:43, meaning that eligible shareholders can apply for 4 rights equity shares for every 43 fully paid-up equity shares held. Each rights share is priced at ₹1,800, which includes a face value of ₹10 and a premium of ₹1,790.

The issue will open on Friday, June 20, 2025, and close on Thursday, July 3, 2025. This is the last day shareholders can apply for the rights equity shares.

Ethos Watches is India’s largest luxury watch retail chain, with a network of 73 boutiques across 26 cities and a portfolio of over 70 premium and luxury watch brands. Known for its authenticity and customer trust, Ethos is positioned as a go-to destination for genuine timepieces in a market plagued by counterfeits and grey imports. Beyond watches, the company is steadily expanding into luxury lifestyle and jewellery, with upcoming brand-exclusive boutiques like Messika.

Ethos delivered a strong financial performance in FY25, with consolidated revenue growing 25.3% year-on-year to ₹1,251.6 crore, driven by brand strength and store expansion. Q4FY25 revenue rose 23.3% YoY to ₹311.3 crore. EBITDA for the year grew 22.3% to ₹214.4 crore, with EBITDA margin at 16.8%, slightly lower than the previous year due to continued investments in talent and infrastructure for new boutiques. The company opened 14 new stores during FY25, entered three new cities, and expanded its airport footprint with a second duty-free outlet in Bengaluru.

Over the last three years, this stock has given multibagger returns of more than 275%.

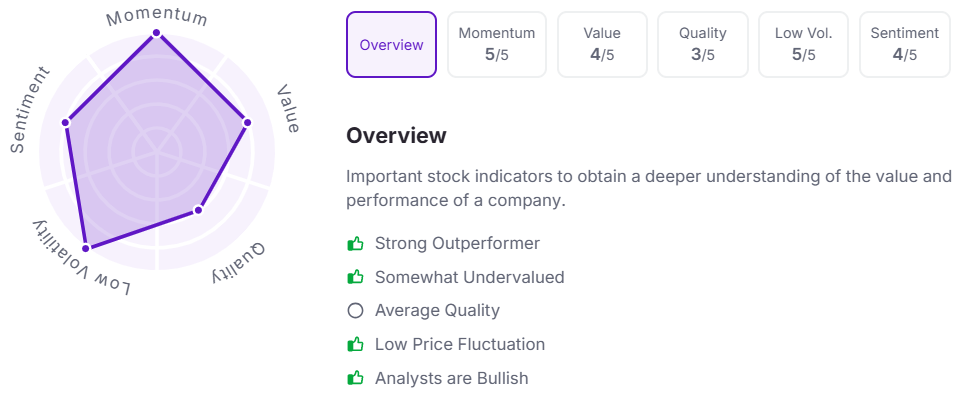

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.