- Share.Market

- 3 min read

- Published at : 06 Nov 2025 07:06 PM

- Modified at : 15 Nov 2025 09:55 AM

Shares of the integrated logistics provider Delhivery Ltd. plunged by over 8% following the announcement of its Q2FY26 results, reaching an intraday low of ₹436.40 apiece.

Delhivery reported a consolidated net loss of ₹50.38 crore in Q2 FY26, swinging from a profit of ₹10.20 crore in the corresponding period last year. This reported loss was primarily driven by the inclusion of one-time integration costs related to the acquisition of Ecom Express.

Consolidated revenue from operations for the quarter stood at ₹2,559.3 crore, reflecting a strong 16.9% rise year-on-year (YoY) compared to ₹2,189.7 crore in the year-ago period. Revenue from services (excluding Ecom Express) rose 16% to ₹2,546 crore.

The Express Parcel segment was a key growth driver, with shipment volumes surging 32% YoY to 246 million orders in Q2 FY26. This volume growth was fueled by strong festive demand, organic client growth, and the consolidation of Delhivery’s share of business with clients following the Ecom acquisition. Revenue for the segment grew 24% YoY to ₹1,611 crore.

The Part Truck Load (PTL) business also demonstrated healthy growth, with tonnage increasing 12% YoY to 477,000 metric tonnes. This volume growth led to a 15% YoY revenue increase in the segment. The service EBITDA margin for PTL improved significantly to 8.5%, compared to 2.9% in the corresponding period last year.

The company incurred ₹90 crore in integration costs related to the Ecom Express acquisition during Q2 FY26. This cost impacted the net loss figure, though the overall integration expenses are expected to remain within the earlier guidance of ₹300 crore. Delhivery noted that volume momentum remains strong, carrying into Q3 FY26 due to festive demand.

Revenue from Supply Chain Services declined to ₹170 crore from ₹197 crore a year ago. Truckload revenue similarly slipped to ₹150 crore from ₹158 crore, and Cross Border Services revenue fell to ₹38 crore from ₹59 crore.

Delhivery highlighted progress in its new logistics verticals, with the “Rapid” initiative having 20 active stores in 3 cities and securing its first B2B client. Separately, the company announced a leadership change in its finance team, with Vivek Pabari set to take over as Chief Financial Officer from Amit Agarwal, effective January 1, 2026.

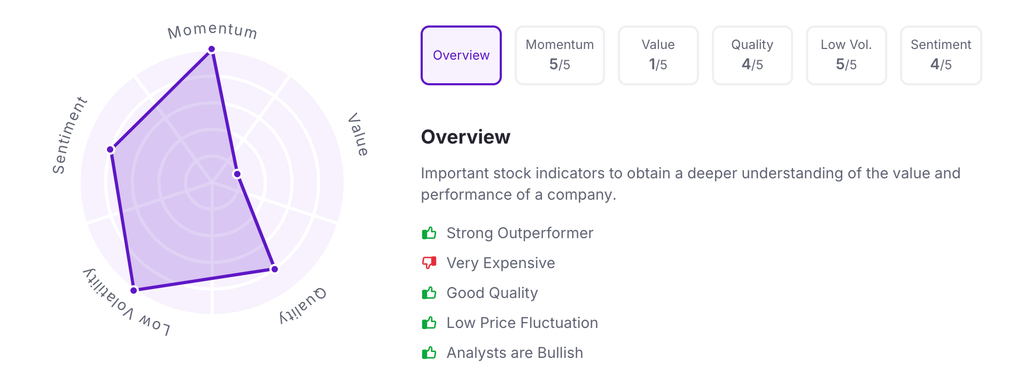

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.