- Share.Market

- 5 min read

- Published at : 01 Sep 2025 11:59 AM

- Modified at : 01 Sep 2025 12:47 PM

The shares of Deepak Fertilisers & Petrochemicals Corporation, Ratnamani Metals & Tubes, Gujarat Narmada Valley Fertilizers & Chemicals, and Ion Exchange India are set for their record date on Tuesday, September 02, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Deepak Fertilisers & Petrochemicals Corporation Ltd. has announced a dividend of ₹10 per equity share. It has a dividend yield of 0.60% TTM.

Deepak Fertilisers and Petrochemicals Corporation Ltd. is one of India’s leading producers of industrial chemicals, mining chemicals, and fertilisers. In Q1FY26, the company posted 17% revenue growth and a 22% PAT rise, led by strong gains in specialty fertilisers and mining chemicals, which together lifted specialty products to 25% of group revenue.

Over the last five years, this stock has given multibagger returns of more than 730%.

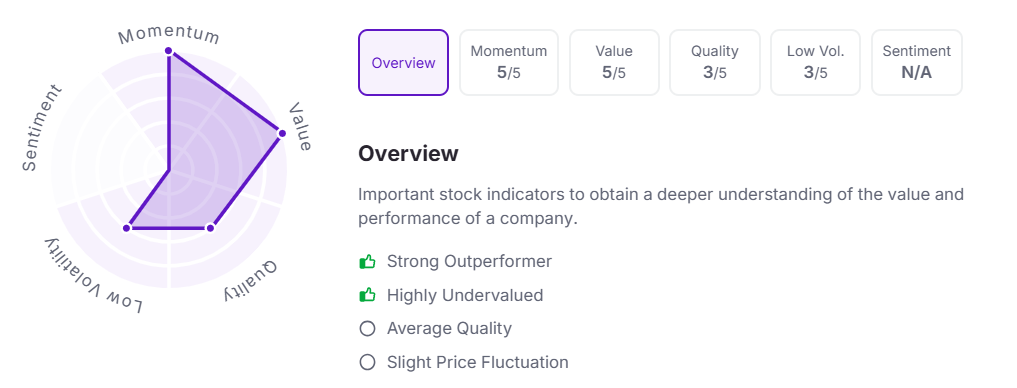

Let’s take a look at its Factor Analysis scores:

Ratnamani Metals & Tubes Ltd. has announced a final dividend of ₹14 per equity share.

Ratnamani Metals & Tubes Ltd., founded in 1983, is a leading manufacturer of critical tubing and piping solutions catering to industries such as oil & gas, petrochemicals, power, defense, and aerospace. Over the decades, it has built a reputation for quality and customer focus, with a global clientele across public and private sectors.

In Q1 FY26, the company reported total income of ₹1,097 crores and a net profit of ₹144 crores, compared to ₹105 crores in the same quarter last year.

Over the last five years, this stock has delivered multibagger returns of more than 200%.

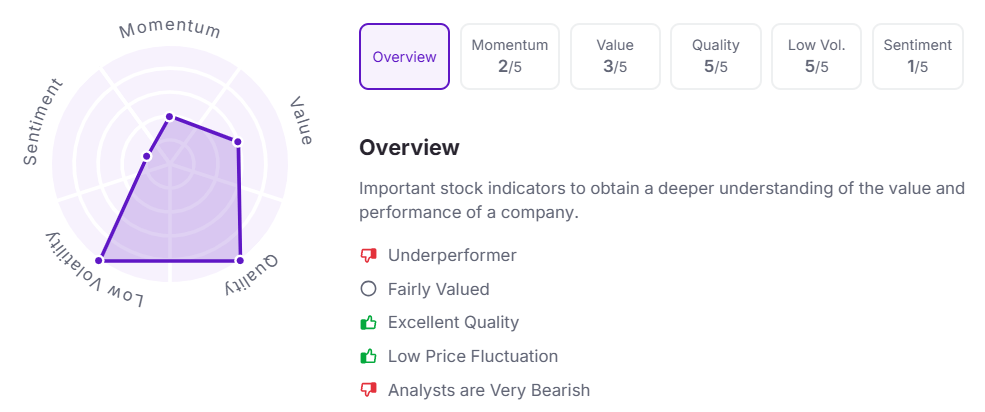

Let’s take a look at its Factor Analysis scores:

Gujarat Narmada Valley Fertilizers & Chemicals Ltd. has announced a final dividend of ₹18 per equity share. It has a high dividend yield of 3.20% TTM.

Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), a joint sector enterprise promoted by the Government of Gujarat, operates one of the world’s largest ammonia-urea complexes and has built a strong presence in chemicals alongside fertilisers.

In Q1FY26, the company reported operating revenue of ₹1,601 crore and PAT of ₹78 crore, lower than last year due to the planned annual turnaround at its Bharuch complex, which impacted volumes, costs, and margins. Despite this, GNFC secured an extension of anti-dumping duty on aniline till 2030 and highlighted improved cash flows from timely subsidy receipts.

Over the last five years, this stock has delivered multibagger returns of more than 160%.

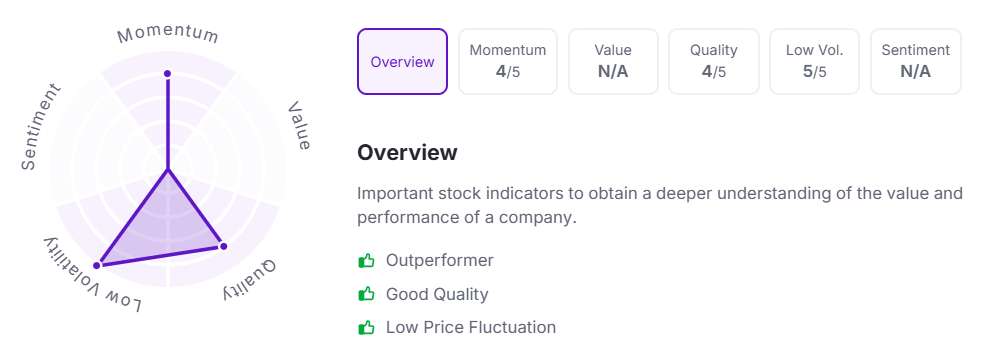

Let’s take a look at its Factor Analysis scores:

Ion Exchange (India) Ltd. has announced a dividend of ₹1.50 per equity share. It has a dividend yield of 0.40% TTM.

Ion Exchange (India) Ltd., Asia’s largest environment solutions provider, delivers comprehensive water and environmental management solutions across industries, institutions, municipalities, and communities, with a presence spanning over 1 lakh installations worldwide.

In FY25, the company reported operating income of ₹27,371 million, EBITDA of ₹2,939 million, and PAT of ₹2,083 million, supported by its strong global footprint, state-of-the-art manufacturing facilities, and leadership in advanced water and wastewater treatment technologies.

Over the last three and five years, this stock has given multibagger returns of more than 119% and 117%, respectively.

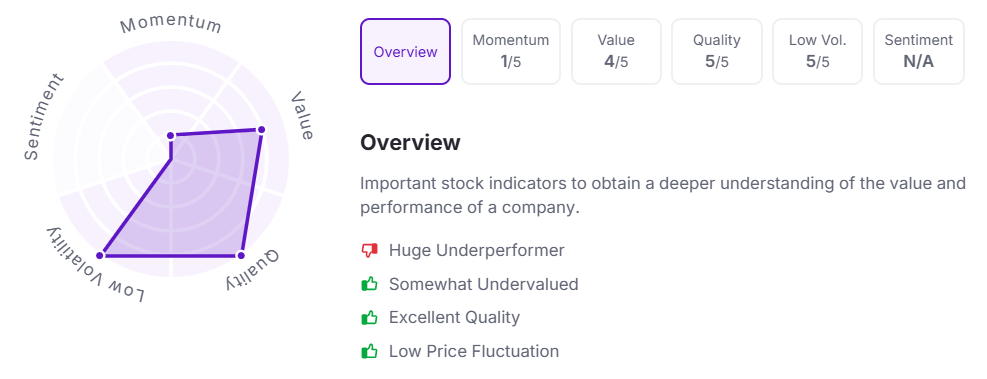

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:55 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.