- Share.Market

- 3 min read

- Published at : 05 Nov 2025 05:02 PM

- Modified at : 15 Nov 2025 10:03 AM

Deepak Fertilisers & Petrochemicals Corporation Ltd. has announced its unaudited consolidated financial results for the second quarter (Q2) ended September 30, 2025.

The company’s revenue for Q2 FY26 increased by 9% year-over-year (YoY) to ₹3,006 crore (compared to ₹2,747 crore in Q2 FY25). This revenue growth was primarily driven by higher sales volumes across its Croptek, Technical Ammonium Nitrate (TAN), and Isopropyl Alcohol (IPA) segments.

Net Profit (PAT) for Q2 FY26 remained flat at ₹214 crore. Operating EBITDA for Q2 FY26 declined by 6% YoY to ₹464 crore. The Operating EBITDA margin fell to 15% from 18% in Q2 FY25.

The divergence in performance between Deepak Fertiliser’s key business segments defined the quarter:

- Fertiliser Business Strength: The Crop Nutrition Business (Fertilisers) delivered robust performance, reflecting a strong 36% YoY growth in Q2. The innovative specialty product, Croptek, reported exceptional sales volume growth of 54% YoY. The share of specialty products within the Crop Nutrition Business reached 28% of the segment’s revenue in Q2 FY26.

- Mining Chemicals (TAN): The TAN business showed strength in volume, with overall sales volume increasing by 29% YoY and revenue increasing by 23%. However, sales volume did see a sequential decline of 7% due to the typical monsoon impact on coal demand.

- Chemical Segment Headwinds: The overall Chemicals segment experienced a 21% YoY decline. This was primarily due to volatility in the IPA and Ammonia businesses. The IPA business faced a dynamic quarter due to global trade realignments and pricing volatility. A sharp correction in benzene and acetone prices and the impact of anti-dumping duties on China led to increased US imports and margin pressure.

The company’s strategic focus remains centered on accelerating its transition from commodity to specialty products, as evidenced by the outperformance of its Croptek solution and the strong growth in its fertiliser segment.

With strategic capital expenditure projects like the Gopalpur TAN and Dahej Nitric Acid facilities progressing on schedule for commissioning by the end of FY26 , the company is laying the foundation for enhanced capacity and value creation.

Despite facing temporary pricing and supply headwinds in the Chemicals segment during Q2, the successful forward integration achieved through the acquisition of Platinum Blasting Services positions the company to enhance its leadership in mining solutions across Australia and India.

The execution of these strategic initiatives is poised to drive sustainable, profitable growth in the coming quarters.

Over the last 5 years, this stock has delivered multibagger returns of more than 940%.

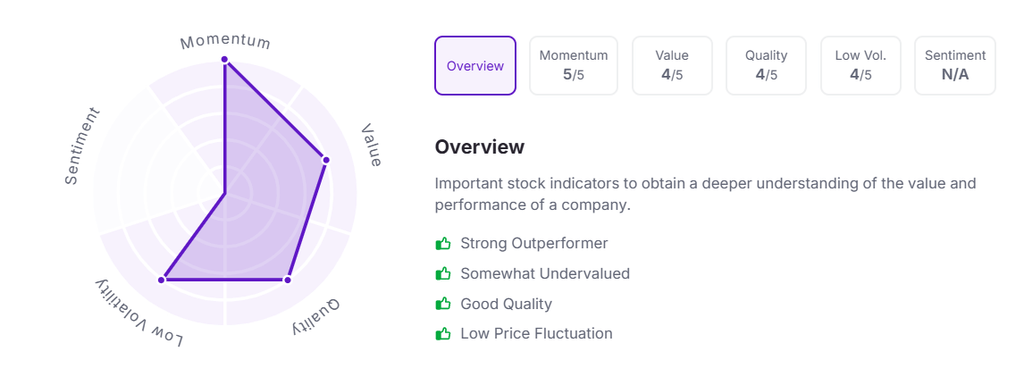

Let’s take a look at its Factor Analysis scores: