- Share.Market

- 3 min read

- Published at : 16 May 2025 02:41 PM

- Modified at : 16 Jul 2025 07:36 PM

Crompton Greaves Consumer Electricals, a leading player in the Indian consumer electricals space, surged more than 6% after the company reported a strong financial performance for FY25. With broad-based growth across segments, it saw a turnaround in its subsidiary Butterfly Gandhimathi Appliances. Known for its wide portfolio of fans, pumps, lighting, and kitchen appliances, Crompton continues to strengthen its position through innovation and margin-led growth.

Financial Performance

In Q4FY25, revenue grew 5% y-o-y to ₹2,061 crores. PAT rose 29% to ₹172 crores, supported by steady performance in core categories.

For FY25, consolidated revenue rose 8% y-o-y to ₹7,028 crores. EBITDA grew 24% to ₹888 crores, while net profit increased 28% to ₹564 crores.

Segment Highlights

The Electrical Consumer Durables (ECD) segment remained the growth driver, with revenue up 12% to ₹6,010 crores for FY25. Pumps and appliances performed particularly well, with air coolers growing over 50% and mixer grinders over 30%. Fan sales remained flat due to an extended winter and delayed summer, though the premium fan segment showed signs of recovery.

The lighting segment posted muted top-line growth of 2% for the year, reaching ₹1,018 crore. However, EBIT grew 14%, driven by better pricing and an improved product mix in B2C lighting.

Butterfly Gandhimathi Appliances, Crompton’s kitchen appliances subsidiary, reported a sharp turnaround. Q4FY25 revenue rose 12% to ₹865 crore. In Q4FY25, EBIT jumped nearly to ₹11 crores from a loss of ₹24 crores in Q4FY24, aided by stronger gross margins, better cost control, and focused marketing across key categories.

Strategic Focus

Crompton continued to sharpen its focus on category growth, premiumisation, and product innovation. The company invested in expanding its presence in modern retail and alternative channels, which delivered double-digit growth. It also strengthened its innovation pipeline with in-house technology platforms across BLDC, air coolers, mixer grinders, and induction cooktops.

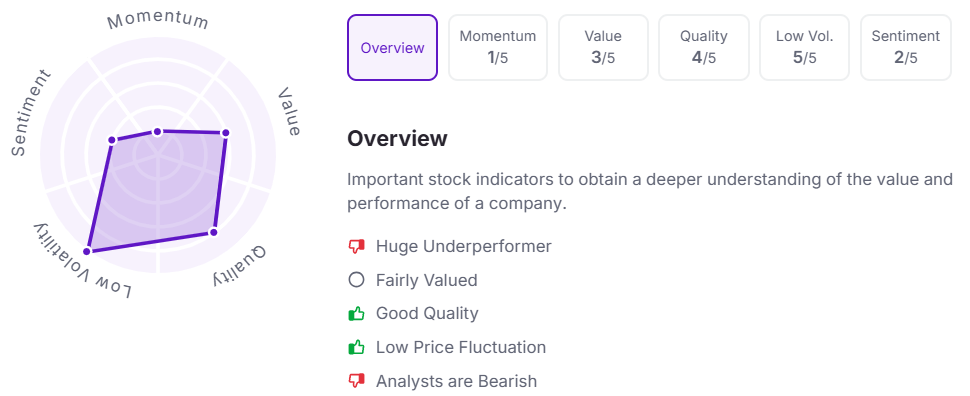

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 2:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.