- Share.Market

- 4 min read

- Published at : 11 Jul 2025 10:36 AM

- Modified at : 16 Jul 2025 06:58 PM

The shares of Craftsman Automation, Persistent Systems, and R R Kabel are set for their record date on Monday, July 14, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Craftsman Automation Ltd. has announced a dividend of ₹5 per equity share.

Craftsman Automation is a leading engineering solutions provider specializing in precision manufacturing, powertrain components, and aluminium castings for automotive, industrial, and engineering applications. It has scaled its aluminium casting capacity from ~30,000 TPA to over 100,000 TPA in five years, tapping into the rising demand for lightweight components driven by EV adoption, emission norms, and fuel efficiency mandates.

Craftsman Automation reported strong 58% y-o-y revenue growth in both Q4 and FY25, driven by robust demand across powertrain, aluminium products, and industrial engineering segments. However, despite the top-line surge, profit after tax (PAT) declined 5% YoY in Q4 and 40% YoY for the full year, reflecting margin pressures or higher costs.

Over the last three years, this stock has given multibagger returns of more than 135%.

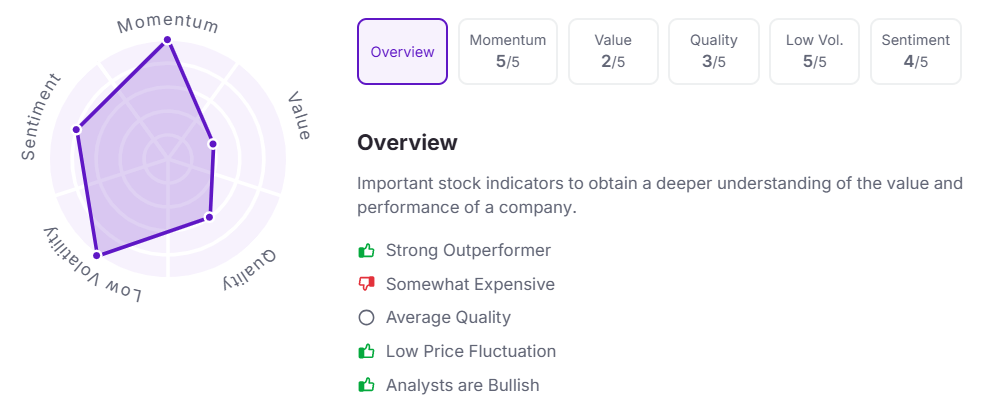

Let’s take a look at its Factor Analysis scores:

Persistent Systems Ltd. has announced a final dividend of ₹15 per equity share. Its current dividend is 0.40%.

Persistent Systems is a global technology services company specializing in digital engineering, cloud, data, AI, and enterprise modernization solutions. With over 24,500 employees across 19 countries, the company serves clients across industries including BFSI, healthcare, software, and hi-tech.

Persistent Systems reported a strong performance in FY25, with revenue rising 21.6% year-on-year to ₹1,19,387 million, backed by robust demand across digital and AI-led services. Net profit surged 28% to ₹14,002 million. For Q4FY25, revenue stood at ₹32,421 million, up 5.9% QoQ and 25.2% YoY.

Over the last three years, this stock has given multibagger returns of more than 230%.

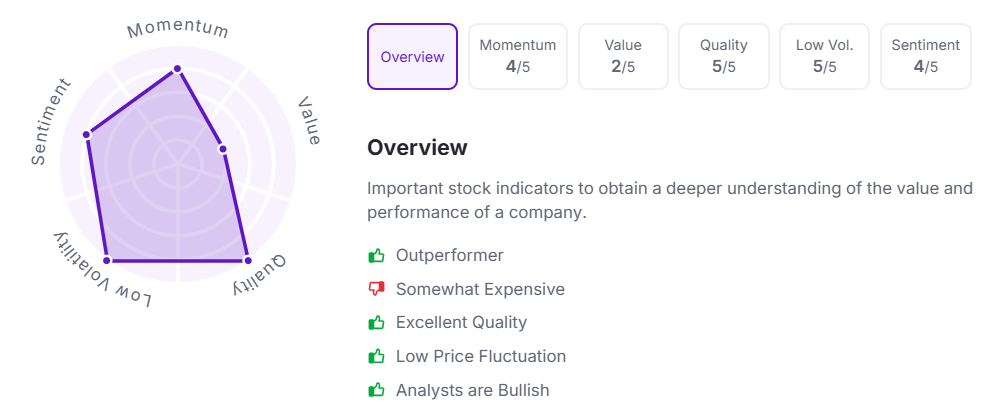

Let’s take a look at its Factor Analysis scores:

R R Kabel Ltd. has announced a final dividend of ₹3.50 per equity share. It has a dividend yield of 0.20%.

RR Kabel Ltd. is one of India’s leading consumer electrical companies and the country’s top exporter of wires and cables. With a legacy of over 25 years, the company has built a strong presence across residential, commercial, industrial, and infrastructure segments.

RR Kabel delivered a solid financial performance in Q4 FY25, with revenue rising 26.4% year-on-year to ₹2,217.8 crore. Profit after tax rose 64% YoY to ₹129.1 crore. For the full year FY25, RR Kabel reported 15.5% revenue growth and 4.5% net profit growth, along with margin and profitability improvements, highlighting strong execution across both core and emerging business segments.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 10:35 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.