- Share.Market

- 2 min read

- Published at : 03 Jun 2025 10:52 AM

- Modified at : 16 Jul 2025 07:56 PM

Coforge Ltd., a global digital services and solutions provider, has approved a stock split in the ratio of 1:5. This means that each existing equity share with a face value of ₹10 will be subdivided into 5 equity shares with a face value of ₹2 each. After the split, the total investment value will remain the same, but the number of shares one owns will increase proportionally.

The stock split aims to make shares more affordable, increasing their attractiveness to a wider range of investors. This move is expected to boost investor participation and improve the liquidity of the company’s shares in the market.

Coforge continues to deepen its industry-specific digital transformation offerings across financial services, insurance, travel, and healthcare. With a strategic focus on emerging technologies like AI, cloud, automation, and data engineering, Coforge is cementing its position as a trusted transformation partner. The company operates 30 global delivery centers across 23 countries, with a growing headcount and consistently low attrition, reflecting its strong employer brand. In

Coforge ended FY25 with a standout 32% constant currency revenue growth, reaching ₹12,051 crores, backed by broad-based demand across geographies and verticals. Q4FY25 alone saw revenue climb 47% y-o-y. The company signed a record $1.56 billion TCV deal in Q4. With 14 large deals signed in the year, strategic investments in GenAI, and continued delivery excellence, Coforge is strongly positioned to sustain its growth trajectory in FY26.

Over the last three years, this stock has given multibagger returns of over 125%.

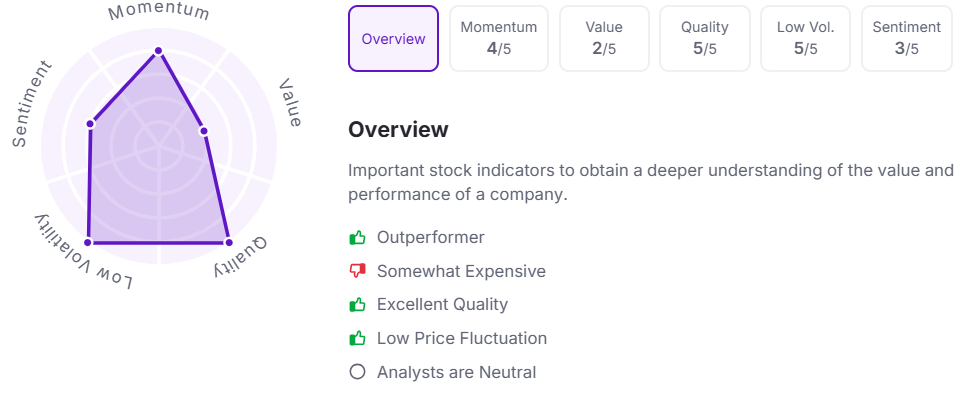

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.