- Share.Market

- 4 min read

- Published at : 25 Jul 2025 04:17 PM

- Modified at : 25 Jul 2025 04:17 PM

Cipla Ltd. reported a strong first quarter for FY26 with net profit rising 10% YoY to ₹1,298 crore, driven by robust growth across key markets and continued operational strength. Revenue from operations came in at ₹6,957 crore, up 4% YoY, while EBITDA stood at ₹1,778 crore with margins steady at 25.6%.

India Crosses ₹3,000 Crore Mark, Led by Chronic Therapies and New Launches

For the first time, Cipla’s India business crossed ₹3,000 crore in Q1, growing 6% YoY. The prescription portfolio maintained its #2 rank in chronic therapies, which now contribute 61.5% of the mix. Respiratory, Urology, Cardiac, Anti-diabetes, and Anti-infectives all outpaced market growth.

The newly launched Voltido Trio in the respiratory segment gained rapid traction, reinforcing Cipla’s leadership in the space. Cipla holds all top six spots in India’s respiratory market, with Foracort ranked as the single largest brand in Indian pharma.

Trade Generics and Consumer Health Maintain Upward Momentum

The Trade Generics business delivered strong growth, backed by execution strength and expansion into orthopaedics. The company now has two brands with trailing twelve-month (TTM) revenue over ₹100 crore and five brands in the ₹50–100 crore range.

In Consumer Health, Cipla continued to scale anchor brands like Nicotex, Omnigel, and Cipladine, each holding the #1 rank in their segments. The segment sustained its growth trajectory and supported overall EBITDA delivery.

US Business Stays Resilient Amid Base Pressure, Pipeline Builds Up

Cipla’s North America business posted $226 million in revenue, slightly down YoY due to a high base. Yet, product momentum remained strong. Albuterol retained the #1 position in the US MDI market with a 19.5% share, while Lanreotide continued to gain share in its segment.

The launch of Nano Paclitaxel vials and Nilotinib Capsules strengthens Cipla’s oncology and complex generics presence. A key milestone this quarter was the company entering into a biosimilar partnership in the US, with commercialization expected in Q2FY26.

Africa Outpaces Market, South Africa Grows at 1.5x the Industry Rate

The One Africa business delivered 11% growth in USD terms. In South Africa, Cipla maintained its #2 rank in the prescription market, growing 1.5 times faster than the broader market. Growth was driven by strong tender performance, portfolio leverage, and new product introductions across key therapies.

Emerging Markets and Europe Post Consistent Gains

Revenue from emerging markets and Europe rose 8% YoY in USD terms, with growth seen across both distribution and B2B verticals. This performance reflects Cipla’s focused strategy of deepening market presence and optimizing regional portfolios.

Post announcing the results, shares of Cipla gained up to 3%, reaching an intraday high of ₹1,553.70 apiece.

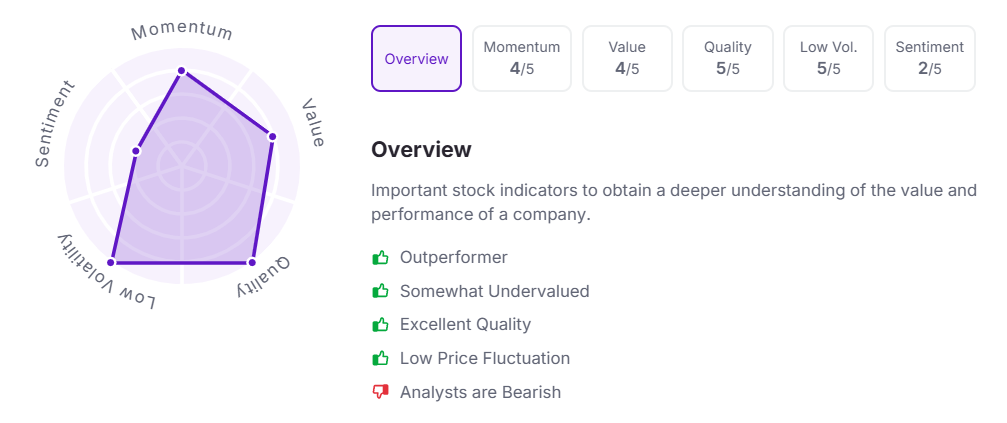

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.