- Share.Market

- 3 min read

- Published at : 30 Jun 2025 11:20 AM

- Modified at : 16 Jul 2025 07:47 PM

The shares of Cera Sanitaryware and JSW Infrastructure are set for their record date on Tuesday, June 01, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Cera Sanitaryware Ltd. has announced a dividend of ₹65 per equity share.

Cera Sanitaryware Limited is a leading Indian manufacturer of sanitaryware, faucets, tiles, and wellness solutions. With a strong presence in both premium and mid-market segments, Cera has built its reputation on design, quality, and innovation.

Cera reported a steady financial performance for FY25, with total income rising 2.4% to ₹1,978 crore and PAT increasing 2.9% to ₹246 crore. In Q4, performance accelerated, with total income up 5.5% YoY to ₹594 crore and PAT jumping 14.7% to ₹86 crore.

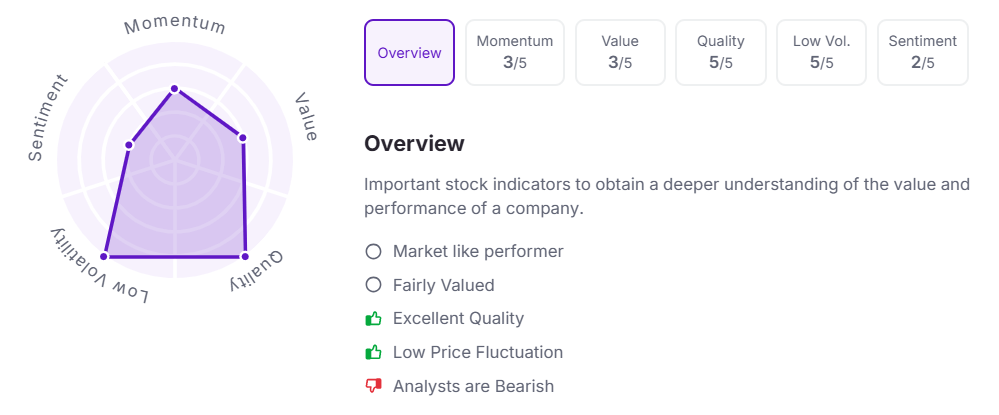

Let’s take a look at its Factor Analysis scores:

JSW Infrastructure Ltd. has announced a final dividend of ₹0.80 per equity share. Its current dividend yield is 0.20%.

JSW Infrastructure is India’s second-largest private commercial port operator. The company provides environmentally sustainable and mechanised cargo handling solutions for a diverse range of commodities. Its ports are equipped to handle large vessels and offer efficient turnaround times, making them preferred hubs for industrial clients. The company is now expanding into the logistics space by acquiring Navkar Corporation, aiming to offer integrated, end-to-end connectivity.

JSW Infrastructure reported strong growth in Q4 and FY25, driven by higher cargo volumes and increased third-party share. In Q4, PAT rose 57% YoY to ₹516 crore, supported by 5% growth in cargo handled and 14% growth in revenue. For FY25, the company handled 117 million tonnes of cargo (up 9% YoY), with third-party volumes rising 34%. Revenue for the year grew 20% to ₹4,829 crore, while PAT rose 31% to ₹1,521 crore

Over the last three years, this stock has given multibagger returns of more than 160%.

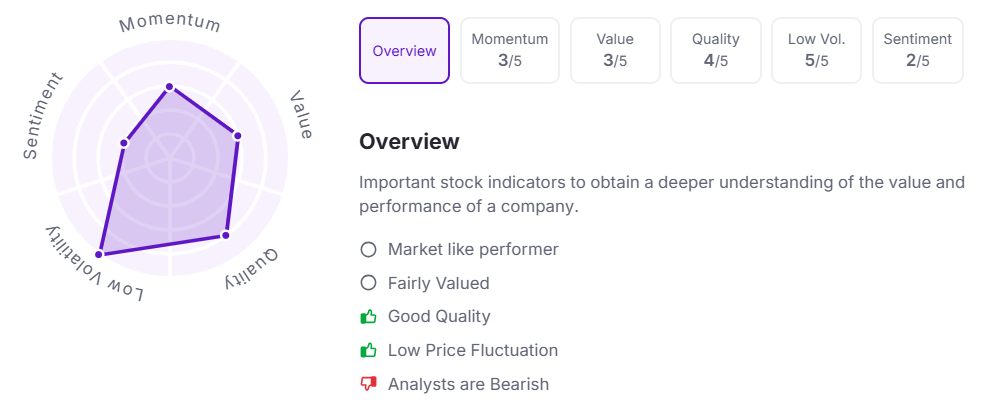

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:15 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.