- Share.Market

- 5 min read

- Published at : 10 Sep 2025 12:07 PM

- Modified at : 10 Sep 2025 12:31 PM

The shares of Century Plyboards (India), Capri Global Capital, Ircon International, and Edelweiss Financial Services are set for their record date on Thursday, September 11, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Century Plyboards (India) Ltd. has announced a dividend of ₹1 per equity share. It has a dividend yield of 0.10% TTM.

CenturyPly, founded in 1986, is a leading name in India’s interior infrastructure industry, offering a wide range of products, including plywood, laminates, veneers, MDF, particle boards, and doors, with a strong market share and brand presence.

In Q1 FY26, the company reported consolidated revenue growth of 16.3% YoY, supported by strong performances in plywood, laminates, and MDF, while standalone revenue rose 6.8% YoY. Consolidated EBITDA improved to 12.5% from 11.2% a year ago, aided by higher capacity utilization and contributions from the Badvel plant, even as particle board margins remained under pressure due to elevated timber costs.

Over the last five years, this stock has given multibagger returns of more than 400%.

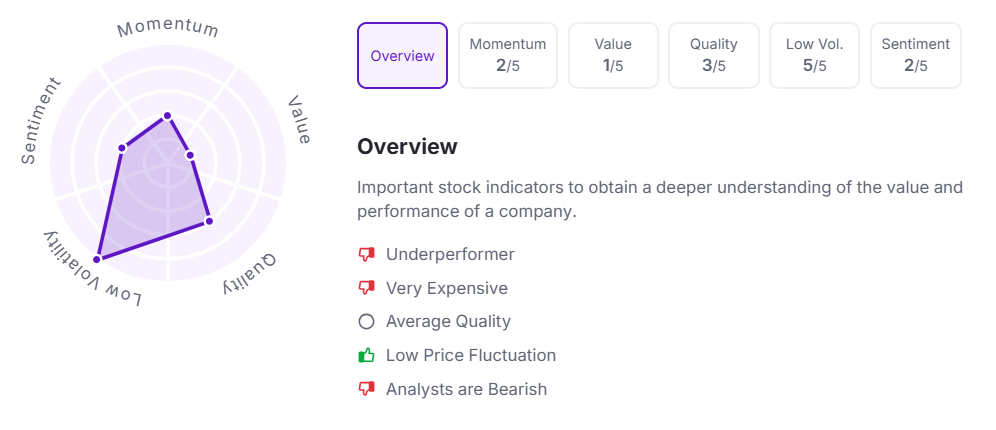

Let’s take a look at its Factor Analysis scores:

Capri Global Capital Ltd. has announced a final dividend of ₹0.20 per equity share.

Capri Global Capital Limited caters to underserved communities across India with offerings such as MSME loans, affordable housing loans, gold loans, and construction finance, supported by a wide branch network and strong in-house technology capabilities.

In Q1 FY26, the company reported AUM of ₹247,538 million, up 41.8% YoY, with gross loans rising 37.5% and disbursements up 50.8% YoY. Profitability strengthened with PAT of ₹1,749 million, a 131% YoY increase, while asset quality remained stable with gross NPAs at 1.67% and net NPAs at 0.99%.

Over the last five years, this stock has given multibagger returns of more than 265%.

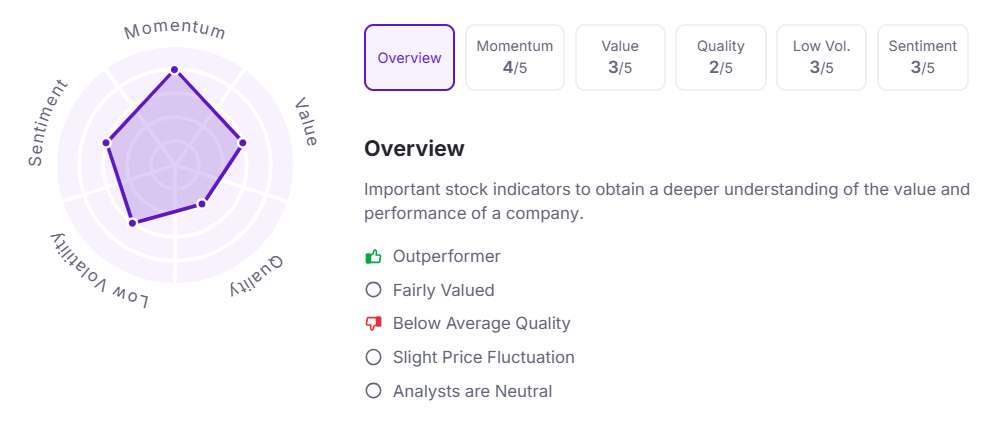

Let’s take a look at its Factor Analysis scores:

Ircon International Ltd. has announced a final dividend of ₹1 per equity share. It has a dividend yield of 1.00% TTM.

Ircon International Limited, a Navratna public sector enterprise under the Ministry of Railways, is a leading turnkey construction company with expertise spanning railways, highways, metro projects, and international infrastructure assignments.

In Q1 FY26, the company reported consolidated revenue from operations of ₹1,786.3 crore, down from ₹2,287.1 crore in Q1 FY25, while profit after tax declined to ₹164.1 crore from ₹224.0 crore in the same period. The order book stood strong at ₹20,973 crore as of June 30, 2025, led by railway projects worth ₹15,724 crore, alongside highway and other infrastructure works.

Over the last three and five years, this stock has given multibagger returns of more than 315% and 325%, respectively.

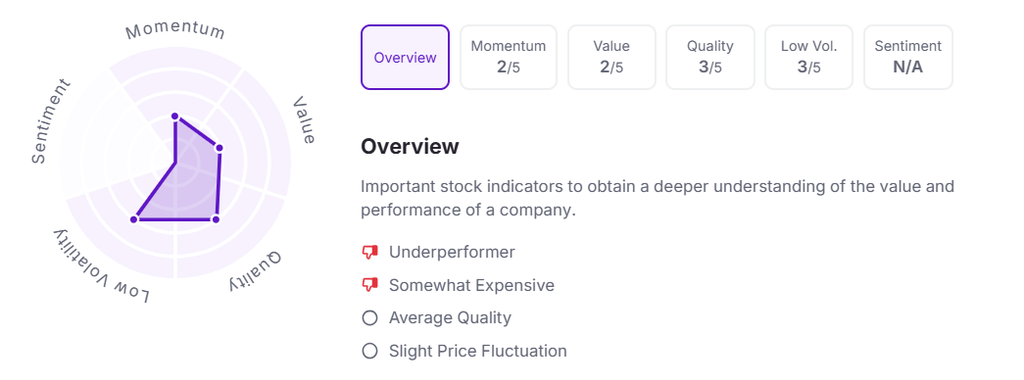

Let’s take a look at its Factor Analysis scores:

Edelweiss Financial Services Ltd. has announced a final dividend of ₹1.50 per equity share. It has a dividend yield of 1.30% TTM.

Edelweiss Financial Services Limited is a diversified financial services group with businesses spanning alternative asset management, mutual funds, asset reconstruction, corporate and housing finance, as well as general and life insurance, serving over 1.1 crore customers and managing assets of about ₹2.3 lakh crore.

In Q1 FY26, the company reported consolidated revenue of ₹2,281 crore and a pre-minority interest PAT of ₹103 crore, up 20% YoY, with post-MI PAT at ₹67 crore, up 13% YoY. Key growth drivers included a 38% YoY jump in mutual fund equity AUM to ₹72,600 crore, a 3.5x YoY surge in recoveries from the asset reconstruction business, and narrowing losses in the insurance segment.

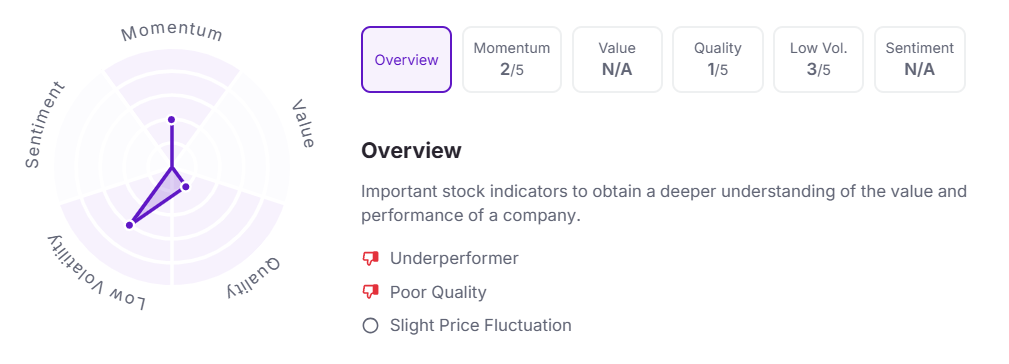

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:00 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.