- Share.Market

- 3 min read

- Published at : 16 May 2025 05:50 PM

- Modified at : 16 Jul 2025 07:37 PM

Central Depository Services (India) Limited (CDSL), Asia’s only listed depository, reported a strong performance for the full year FY25, driven by continued growth in investor participation, steady account additions, and expansion in digital services.

Financial Performance

The company announced a consolidated net profit of ₹526 crore for the year ended March 31, 2025, marking a 26% increase over the previous year. Revenue from operations rose 33% year-on-year to ₹1,082 crores.

Quarterly performance, however, saw some softness. In Q4FY25, consolidated income declined 7% to ₹224 crores, and net profit dropped 22% to ₹100 crores. The moderation was mainly due to a drop in revenue from IPO-linked activity and corporate actions, along with higher expenses.

The board has recommended a final dividend of ₹12.50 per share, subject to shareholder approval.

Business Highlights

CDSL became the first Indian depository to register more than 15.29 crore demat accounts, adding nearly 3.73 crore accounts during the year. The depository now works with over 570 depository participants and provides services to issuers, investors, RTAs, clearing corporations, and stock exchanges.

The company also enhanced its digital infrastructure and investor outreach in FY25. It launched eCAS in regional languages and introduced ‘Buddy Sahayta’, a multilingual investor chatbot. Integration with DigiLocker, investor APIs, and mobile services was strengthened.

CDSL’s subsidiaries contributed meaningfully to its service ecosystem. CDSL Ventures Ltd. (CVL), India’s largest KYC Registration Agency, closed the year with over 8.9 crore KYC records. Centrico Insurance Repository expanded access to paperless insurance services, while Countrywide Commodity Repository issued electronic warehouse receipts to support farmers and agri-markets.

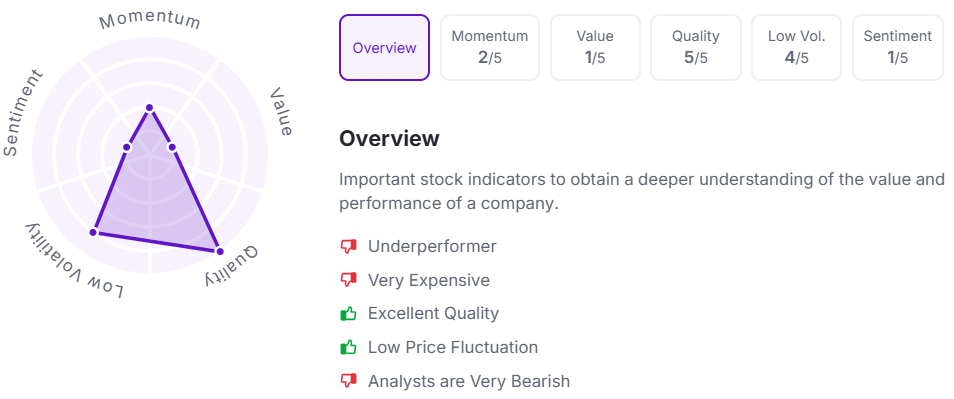

Over the last three years, CDSL has given multibagger returns of more than 150%. Let’s take a look at its Factor Analysis scores:

Looking Ahead

While the near-term financial performance saw some moderation, the company remains well-placed to benefit from the structural growth in investor participation and digital adoption in India’s capital markets.

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.