- Share.Market

- 3 min read

- Published at : 18 Jun 2025 01:24 PM

- Modified at : 04 Dec 2025 07:36 AM

Delhivery Ltd. has received approval from the Competition Commission of India (CCI) to acquire a near-complete stake in rival logistics player Ecom Express Limited. The proposed transaction, first announced on April 5, 2025, involves the purchase of at least 99.4% of Ecom Express’s issued and paid-up share capital on a fully diluted basis, for a total consideration of up to ₹1,407 crore.

The green signal from the CCI marks a critical step forward for the deal, which is expected to significantly reshape India’s e-commerce logistics landscape by consolidating two major players in the last-mile delivery space.

This acquisition, once completed, will strengthen Delhivery’s presence in high-growth, technology-driven delivery networks, especially in Tier 2 and Tier 3 cities where Ecom Express has built deep operational strength.

It also aligns with Delhivery’s strategy to expand market share, streamline operations, and reduce overlaps in delivery infrastructure.

Post the announcement, Delhivery’s shares surged up to 2%, reaching an intraday high of ₹368.25.

About Delhivery

Delhivery is one of India’s largest logistics and supply chain companies, offering end-to-end services across parcel delivery, freight, warehousing, and cross-border logistics. With a tech-first approach and nationwide reach, it serves both large enterprises and e-commerce platforms across over 18,000 pin codes.

FY25 Results

Delhivery reported its first full-year profit in FY25, posting a net profit of ₹162 crore compared to a loss of ₹249 crore in FY24. Annual revenue rose nearly 10% to ₹8,932 crore, driven by growth in its part-truckload business and operational efficiencies. In Q4, the company reported a profit of ₹73 crore and EBITDA margin of 5.4%, marking a sharp turnaround from losses a year ago.

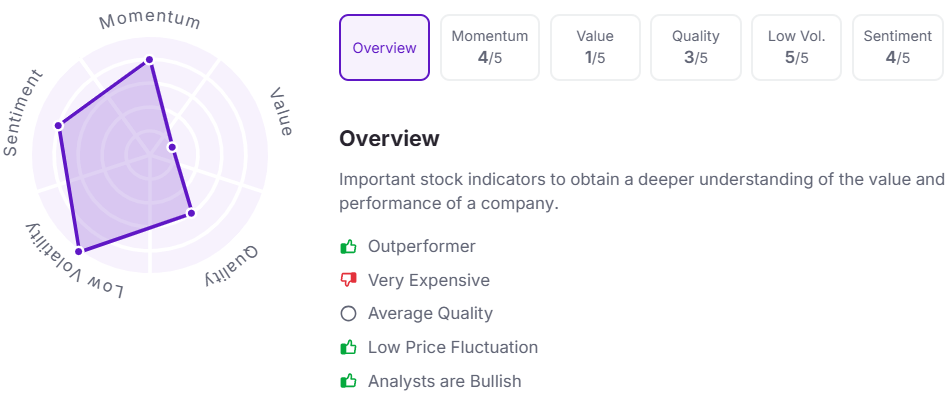

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.