- Share.Market

- 3 min read

- Published at : 28 Jul 2025 06:14 PM

- Modified at : 28 Jul 2025 06:14 PM

Shares of CarTrade Tech Ltd.

surged up to 10% on Monday, reaching an intraday high of ₹2,140.90, after the company reported its highest-ever quarterly revenue and a more than twofold jump in net profit for the first quarter of FY26, backed by strong growth across all business segments.

Revenue and Profit at Record Highs

CarTrade Tech posted a 27% year-on-year (YoY) growth in revenue, reaching ₹198.5 crores in Q1FY26, its best-ever quarterly topline performance.

The company’s Profit After Tax (PAT) came in at ₹47.06 crores, a 106% YoY increase. Profit before tax also jumped 132% YoY, highlighting strong operating leverage and cost discipline.

The surge in profitability was broad-based, with contributions from its Consumer, Remarketing, and OLX India businesses, each delivering significant gains both in revenue and margins.

Segment Highlights

The Consumer Group recorded a 32% YoY growth in revenue and 79% increase in PAT, demonstrating scalable profitability from high-intent consumer traffic.

The Remarketing business, which facilitates vehicle auctions and enterprise sales via platforms like Shriram Automall and CarTrade Exchange, posted a 36% YoY rise in revenue and an exceptional 258% jump in PAT, reaffirming its leadership in vehicle remarketing with an annualized run-rate of 1.4 million listings.

Meanwhile, OLX India, which was integrated into CarTrade’s ecosystem last year, maintained its growth momentum, delivering a 71% YoY growth in profit on the back of cost optimization and platform synergies.

Platform Scale and Offline Reach

During the quarter, CarTrade attracted an average of 75 million monthly unique visitors, with 95% of the traffic being organic, underlining strong brand equity and content leadership. The company now has a presence in 500+ physical locations across India, including Shriram Automall yards, CarWale abSure and Signature dealers, and OLX India franchisees — significantly strengthening its last-mile presence.

Its combined platforms — CarWale, BikeWale, and OLX India — now cater to over 150 million unique users annually, highlighting the ecosystem’s depth, engagement, and cross-platform stickiness.

With sustained growth in consumer traffic, rapid expansion in the remarketing business, and increasing monetization across platforms, CarTrade Tech’s Q1 performance signals a strong start to FY26. The company’s continued investment in technology, coupled with its expanding footprint, positions it as a formidable player in India’s growing vehicle commerce and classifieds market.

Over the last three years, this stock has given multibagger returns of more than 200%.

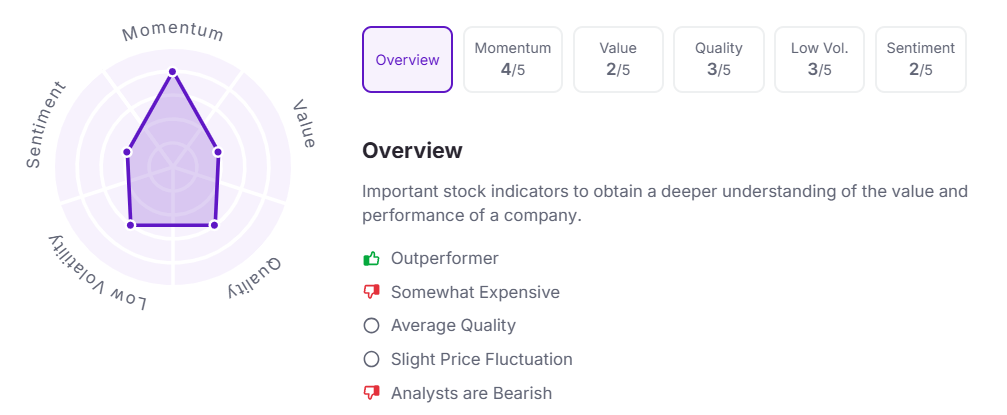

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.