- Share. Market

- 4 min read

- Published at : 04 Dec 2025 12:48 PM

- Modified at : 04 Dec 2025 07:03 PM

The shares of Computer Age Management Services, Hindustan Construction Company, and Hindustan Unilever are in focus for their record date on Friday, December 05, 2025.

Investors who wish to be eligible for the upcoming stock split, rights issue and spin off must have bought the shares before the ex-date and hold them at least till the record date.

Computer Age Management Services Ltd. has approved a stock split in the ratio of 1:5, meaning each equity share with a face value of ₹10 will be subdivided into five equity shares with a face value of ₹2 each. While the total value of investment will remain unchanged, the number of shares held by investors will increase, improving share affordability and market liquidity.

For Q2FY26, CAMS reported an all-time high quarterly revenue of ₹376.74 crore, up 3.2% y-o-y and a Profit After Tax of ₹114.94 crore, up 6.1% y-o-y.

Over the last five years, this stock has delivered multibagger returns of more than 170%.

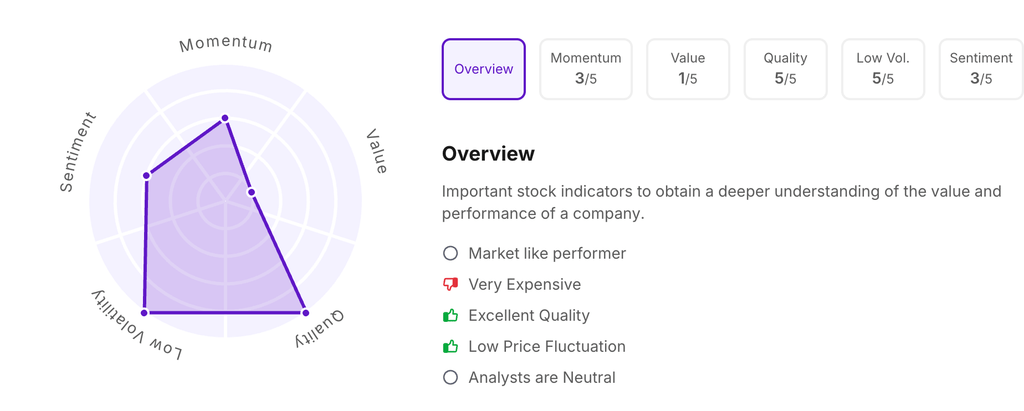

Let’s take a look at its Factor Analysis scores:

Hindustan Construction Company Ltd. has announced a Rights Issue in the ratio 277:630, meaning that eligible shareholders can apply for 277 rights equity shares for every 630 fully paid-up equity shares held. Each rights share is priced at ₹12.50, including a premium of ₹11.50 per rights equity share.

The issue will open on Friday, December 12, 2025, and close on Monday, December 22, 2025. This is the last day shareholders can apply for the rights equity shares.

The company reported a decline in financials for Q2 FY26, with Income from Operations falling 31.7% year-on-year to ₹960.7 crore, and Net Profit dropping 25.3% to ₹47.8 crore.

Despite the financial dip, they reported a robust order book at ₹13,152 crore, bolstered by securing ₹2,770 crore in new orders (including Patna Metro and Hindalco) and a strong bid pipeline of approximately ₹57,000 crore.

Over the last five years, this stock has given multibagger returns of over 300%

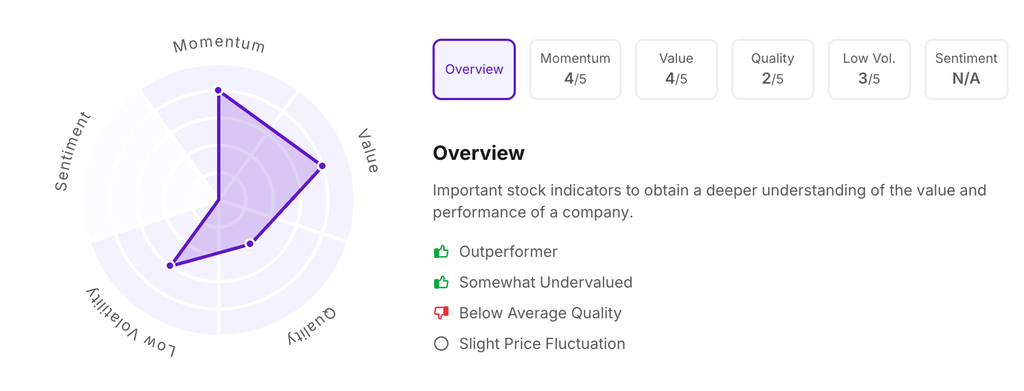

Let’s take a look at its Factor Analysis scores:

Hindustan Unilever Ltd. has announced the demerger of its Ice Cream Business Undertaking. The company aims to restructure this business by transferring it to Kwality Wall’s (India) Limited (KWIL) to create a leading listed ice cream company in India.

According to the Scheme, eligible shareholders will receive equity shares in KWIL in a 1:1 ratio, meaning one fully paid-up KWIL share for every HUL share held.

As per the company, the demerger will provide focused management with greater flexibility to deploy strategies suited to the Ice Cream businesses’ distinctive operating model and market dynamics. This move is expected to help the business realize its full potential.

For Q2FY26, the company reported Revenue from Operations of ₹16,034 crore, up 2% y-o-y and a Profit of ₹2,694 crore, up 3.8%.

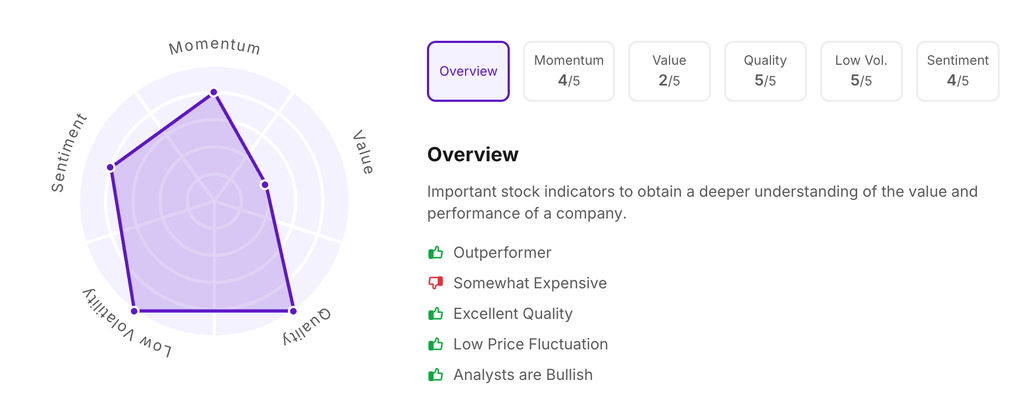

Let’s take a look at its Factor Analysis scores:

The stock prices mentioned are as of 12:40 pm.