- Share.Market

- 4 min read

- Published at : 01 Aug 2025 11:24 AM

- Modified at : 01 Aug 2025 11:55 AM

The shares of Britannia Industries, Deepak Nitrite, and Gail are set for their record date on Monday, August 04, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Britannia Industries Ltd. has announced a final dividend of ₹75 per equity share. Its current dividend yield is 1.30%.

Britannia Industries is one of India’s leading FMCG companies, best known for its iconic biscuits and bakery products. In the quarter ended March 2025, the company reported a 9% year-on-year growth in consolidated revenue to ₹4,376 crore, while net profit rose 4% to ₹559 crore.

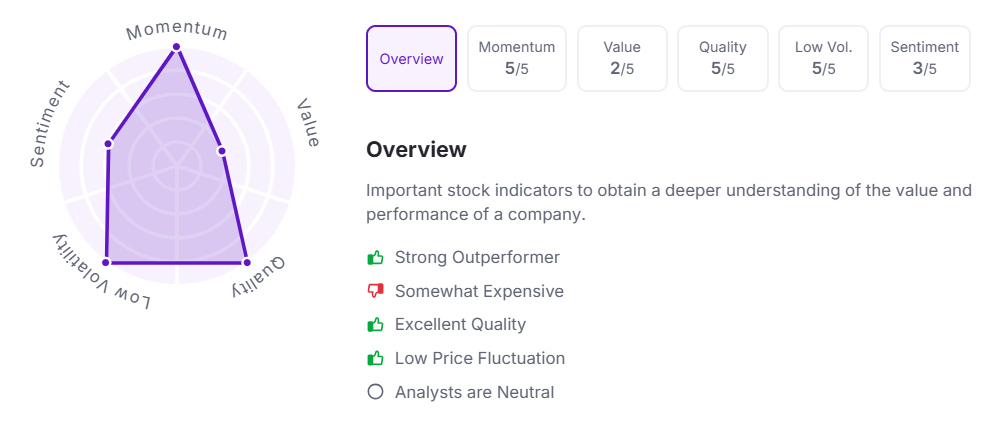

Let’s take a look at its Factor Analysis scores:

Deepak Nitrite Ltd. has announced an interim dividend of ₹7.5 per equity share.

Deepak Nitrite Limited (DNL) is a leading chemical intermediates company in India with a strong global footprint. In Q4FY25, the company reported a sequential recovery, with profit before tax more than doubling to ₹279 crore. Full-year revenue rose 8% to ₹8,366 crore. Growth was supported by higher volumes in advanced intermediates and improved performance at Deepak Phenolics, aided by debottlenecking and softer input costs.

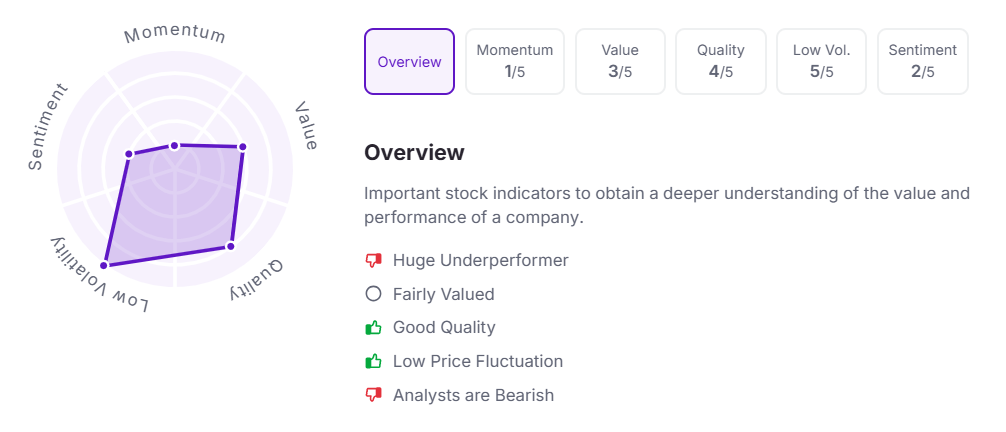

Let’s take a look at its Factor Analysis scores:

GAIL (India) Ltd. has announced a final dividend of ₹1 per equity share. Its current dividend yield is 3.70%.

GAIL (India) Limited, the country’s largest natural gas company with operations across the gas value chain, reported a 3% year-on-year rise in revenue to ₹34,792 crore in Q1 FY26. Profit after tax declined 31% to ₹1,886 crore. During the quarter, GAIL approved doubling the capacity of its Jamnagar–Loni LPG pipeline at a cost of ₹5,000 crore and retained its place in the FTSE4Good Index for the seventh consecutive year, underscoring its ESG commitment.

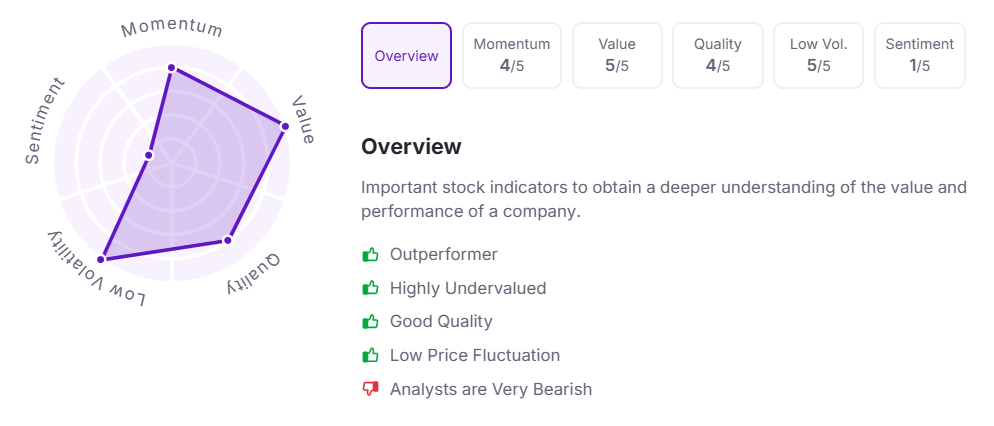

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:20 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.