- Share.Market

- 6 min read

- Published at : 30 Jul 2025 11:51 AM

- Modified at : 30 Jul 2025 12:15 PM

The shares of BPCL, Coforge, United Breweries, Balkrishna Industries, and Godrej Agrovet are set for their record date on Thursday, July 31, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Bharat Petroleum Corporation has announced a dividend of ₹5 per equity share. Its current dividend yield is 4.70%.

Bharat Petroleum Corporation Ltd. is a leading oil marketing company with strong refining, retail, and gas operations. In FY25, it posted a standalone profit of ₹13,284 crore and achieved record domestic sales of 52.4 MMT, with the highest PSU market share. BPCL also led in refinery GRM ($6.82/bbl), capacity utilization (115%), and throughput per outlet. It expanded its upstream gas portfolio, city gas network, and green energy initiatives, reinforcing its position as a high-efficiency, future-ready energy player.

Over the last three years, this stock has given multibagger returns of more than 100%.

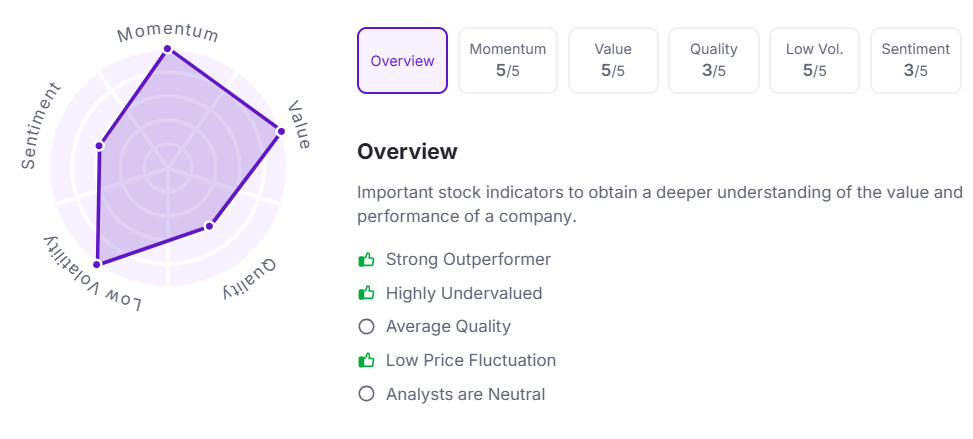

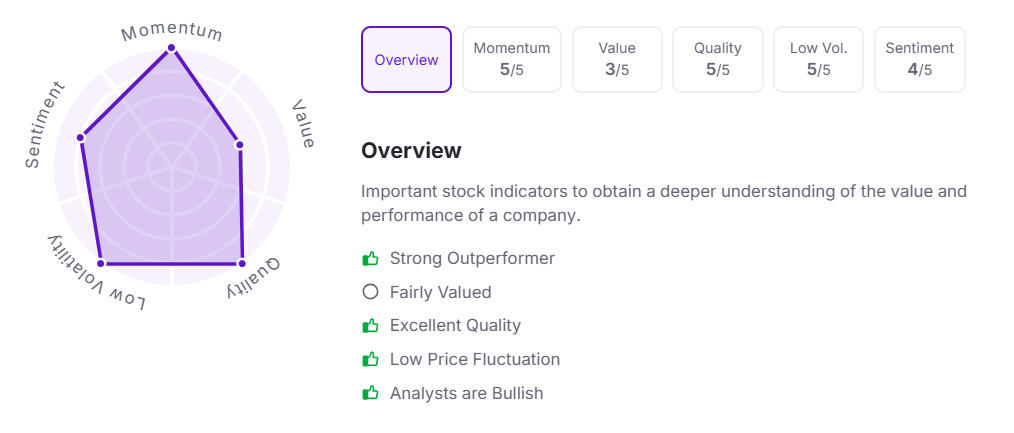

Let’s take a look at its Factor Analysis scores:

Coforge has announced an interim dividend of ₹4 per equity share. Its current dividend yield is 0.90%.

Coforge Ltd., a global digital services company, reported strong Q1FY26 results with USD 507 million in order intake and a 9.6% QoQ revenue growth in dollar terms. EBITDA margin rose to 17.5%, up 61 bps, while PAT jumped 138% YoY to ₹317 crore. The executable order book for the next 12 months stood at $1.55 billion, up nearly 47% YoY, backed by five large deal wins. Coforge continues to lead in AI innovation with platforms like AgentSphere and Forge-X.

Over the last three years, this stock has given multibagger returns of more than 115%.

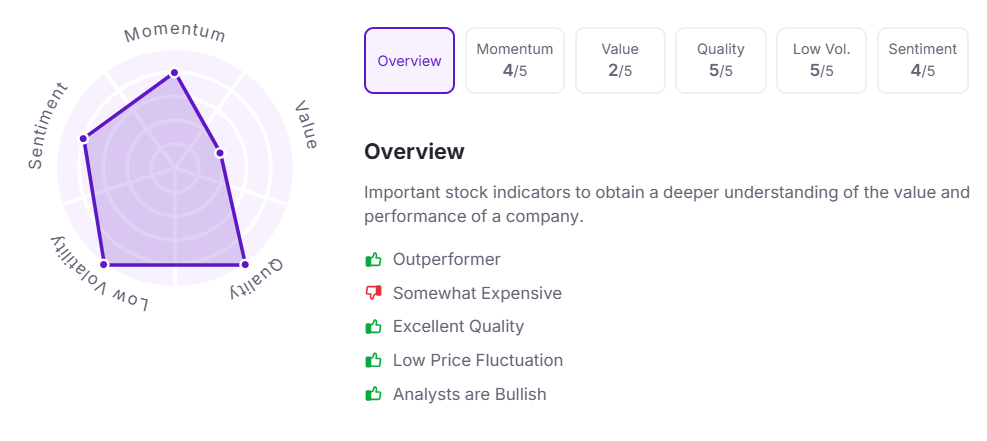

Let’s take a look at its Factor Analysis scores:

United Breweries has announced a final dividend of ₹10 per equity share.

United Breweries Ltd., India’s leading beer manufacturer and a HEINEKEN company, reported strong Q1FY26 performance with 11% volume growth, led by a 46% surge in premium brands. Net sales rose 16%, supported by pricing and premiumization, while EBIT grew 10% despite margin pressures from brand and supply chain investments. The company continues to gain market share and drive premium growth in India’s evolving beer market.

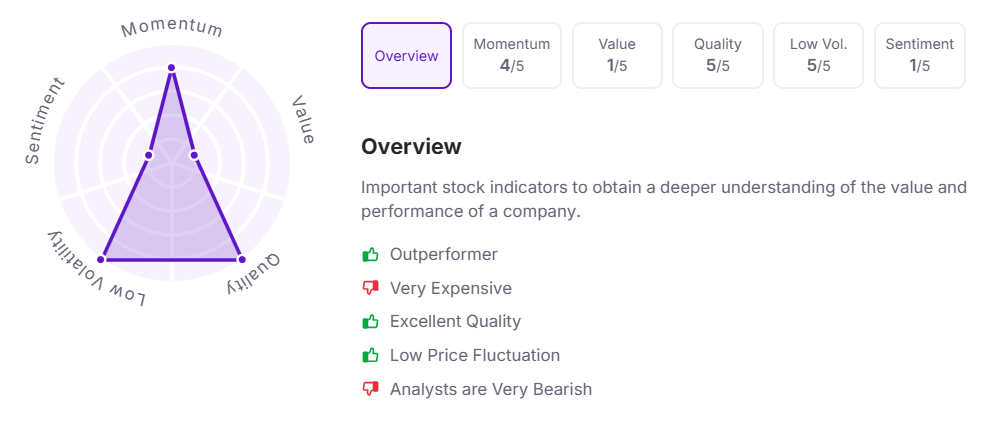

Let’s take a look at its Factor Analysis scores:

Balkrishna Industries has announced an interim dividend of ₹4 per equity share. Its current dividend yield is 0.60%.

Balkrishna Industries Ltd., a global leader in off-highway tires, reported Q1FY26 revenue of ₹2,759 crore, up 1% YoY, while profit declined 40% to ₹287 crore. The quarter saw margin pressure due to a lower export mix, with domestic volumes making up 35% of sales. EBITDA was impacted by weaker product mix, US tariff pressures, and lower volumes affecting cost absorption. Despite near-term challenges, BKT remains a trusted global brand with a strong presence across agriculture, construction, mining, and industrial sectors in over 160 countries.

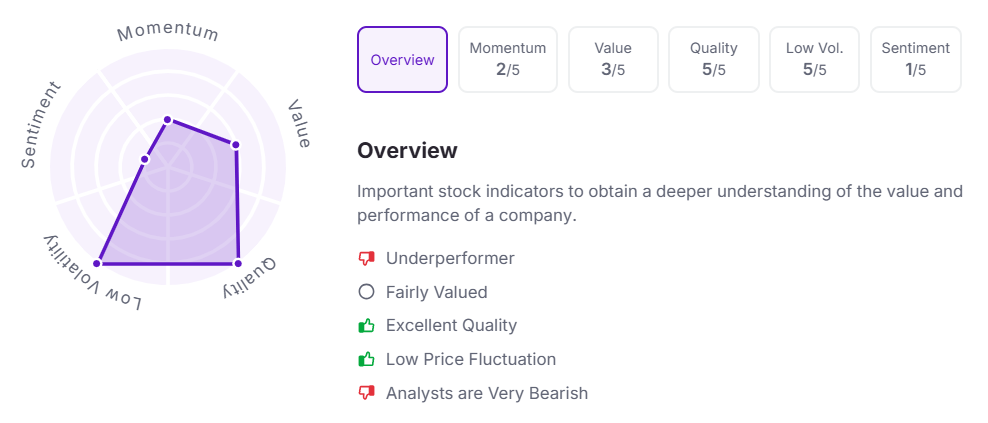

Let’s take a look at its Factor Analysis scores:

Godrej Agrovet has announced a final dividend of ₹11 per equity share. Its current dividend yield is 0.60%.

Godrej Agrovet Ltd. is a diversified agribusiness company with leading positions across animal feed, crop protection, oil palm, dairy, and poultry segments. In FY25, it reported consolidated EBITDA of ₹845 crore, up 12% YoY, despite a slight revenue dip to ₹9,383 crore. Profit before tax rose 12%, led by strong margin expansion in Crop Protection, Animal Feed, and Vegetable Oil businesses. Q4FY25 remained steady with flat revenue and ₹160 crore in EBITDA.

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 11:45 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.