- Share.Market

- 3 min read

- Published at : 13 Oct 2025 05:49 PM

- Modified at : 15 Nov 2025 11:15 AM

Shares of BLS International Services Ltd. fell up to 12%, reaching an intraday low of ₹276.95, after the company announced that it has been temporarily barred by the Ministry of External Affairs (MEA) from participating in new tenders for Indian Missions abroad for a period of two years. The stock hit a 52-week low as the market reacted to the restriction on future business with the Indian government.

The directive, issued by the MEA, restricts BLS International from bidding on new visa, passport, and consular outsourcing contracts with Indian embassies and consulates globally until October 2027.

Despite the sharp market reaction, BLS International sought to reassure investors by stressing that the order would not impact its immediate operations or financial performance. The company confirmed that all existing contracts with Indian Missions remain valid and will continue to operate as scheduled, ensuring no disruption to service for citizens abroad.

Furthermore, the company highlighted that the Indian Missions segment accounted for approximately 12% of its consolidated revenue and 8% of its EBITDA in the first quarter of the current fiscal year (Q1 FY26). This limited exposure is expected to mitigate any significant bearing on the company’s overall financial outlook.

BLS International described the debarment as a “procedural development within the visa outsourcing industry” and expressed confidence in a constructive resolution. The company has spent the last few years diversifying its business portfolio, which may provide a buffer against the loss of future MEA contracts.

This strategic expansion includes securing new and renewed contracts with government and institutional clients across the United States, UAE, Spain, Slovakia, Hungary, Poland, and Portugal. Domestically, the company has secured work through the UIDAI project in India. Recent acquisitions of iDATA and Citizenship Invest were also cited as moves that have strengthened its revenue mix and overall resilience.

While the two-year restriction places a definitive pause on new MEA business, the company is currently reviewing the order and committed to taking appropriate action to resolve the matter. For now, the focus remains on maintaining its current growth trajectory underpinned by a balanced global portfolio.

Over the last three and five years, this stock hasd delivered multibagger returns of more than 110% and 1,480%, respectively.

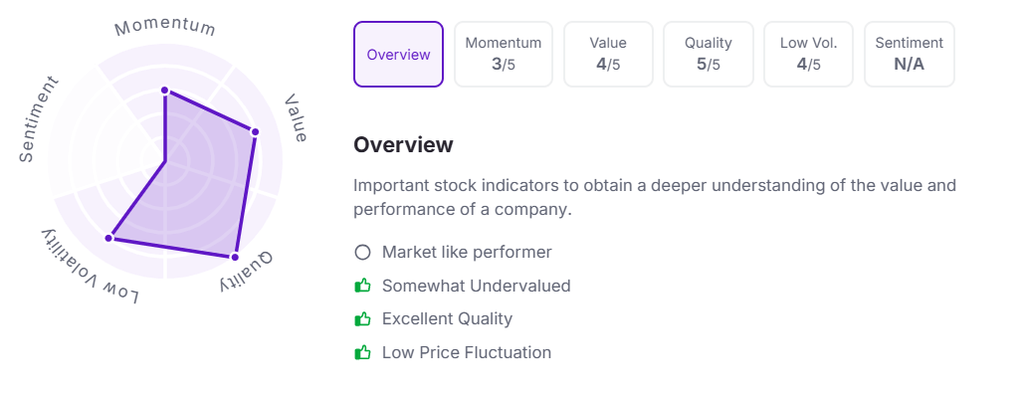

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.