- Share.Market

- 3 min read

- Published at : 09 Jun 2025 04:19 PM

- Modified at : 16 Jul 2025 08:02 PM

Birla Estates Private Limited (BEPL), the real estate arm of Aditya Birla Real Estate Ltd., has announced a strategic investment of ₹420 crore (~USD 50 million) from the International Finance Corporation (IFC), a member of the World Bank Group. The investment will support two key residential developments in Thane and Pune, reinforcing Birla Estates’ commitment to sustainability and urban transformation.

The funding will be channelled through two Special Purpose Vehicles (SPVs), fully owned and controlled by Birla Estates. IFC will hold a 44% economic interest, while Birla Estates will retain 56%, with both entities jointly developing the projects.

Of the total investment, approximately ₹272 crore will go toward the Thane project, which spans 6.43 million sq. ft. of saleable area, while around ₹148 crore will support the Manjri project in Pune, covering 3.13 million sq. ft. The two SPVs will serve as dedicated platforms for the development and delivery of these residential assets.

The collaboration with IFC marks a significant milestone for Birla Estates as it expands its portfolio with a sustainability-first approach. K.T. Jithendran, MD & CEO of Birla Estates, remarked,

The investment comes on the back of a strong performance in the final quarter of FY25, where Birla Estates launched five projects across NCR, Bengaluru, and Pune, marking its biggest quarterly sales to date. The

company’s rapid expansion reflects its intent to become a leading player in India’s premium residential market.

Over the last three years, this stock has given multibagger returns of more than 195%.

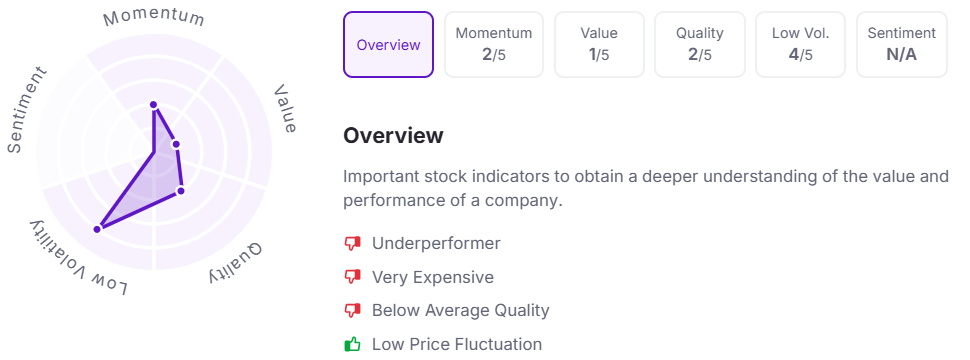

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.