- Share.Market

- 3 min read

- Published at : 16 May 2025 06:20 PM

- Modified at : 16 Jul 2025 07:37 PM

Bharat Heavy Electricals Limited (BHEL), India’s largest engineering and manufacturing PSU, reported a sharp recovery in its FY25 financial performance, led by improved execution, higher power sector orders, and strong order inflows across segments. The company also closed the year with its highest-ever annual order booking and outstanding order book, reflecting renewed momentum in large-scale project activity.

Financial Performance

For FY25, BHEL reported revenue of ₹28,339 crores, a 19% increase over the previous year. Profit after tax was recorded at ₹513 crores, up 97% from ₹260 crores in FY24. In Q4FY25, revenue rose 9% to ₹8,993 crores, while quarterly PAT stood at ₹504 crores up 4%.

The board has recommended a final dividend of ₹0.50 per equity share for FY25, subject to shareholder approval.

BHEL booked orders worth ₹92,535 crores in FY25, its highest ever in a single year, up from ₹77,900 crores the previous year. As of March 31, 2025, the total outstanding order book stood at ₹1,96,328 crores, its highest ever. The power sector continued to dominate the order book, contributing more than 80%, with the rest coming from industrial and export businesses.

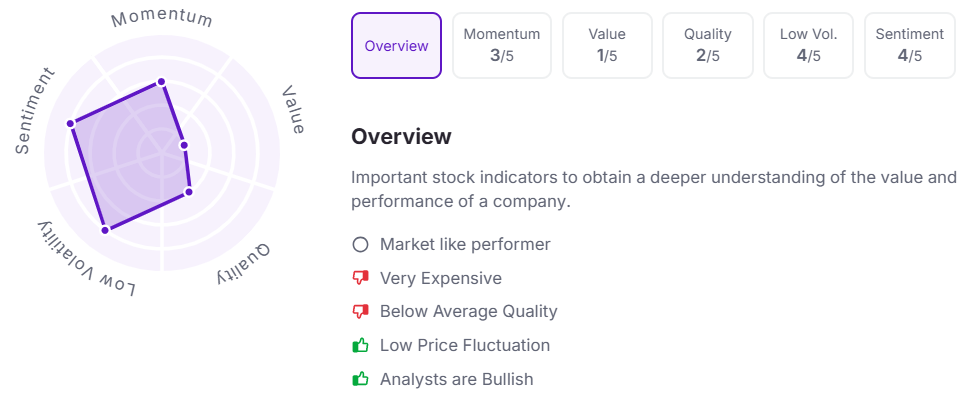

Over the last three years, this stock has given multibagger returns of more than 440%. Let’s take a look at its Factor Analysis scores:

Business Segments and New Orders

In Q4, BHEL secured significant orders across thermal EPC, boiler and turbine packages, and balance of plant systems. Key wins included orders for Adilabad, Ukai, Hasdeo, Koradi, and Raghunathpur projects. The company also won orders in transmission (765 kV substations), railways (diesel-electric tower cars), and marine and energy sectors, including defence and oil exploration systems.

Future Outlook

Backed by its highest-ever order book and a strong execution pipeline, BHEL enters FY26 with improved financial momentum. With continued government focus on power generation, manufacturing localization, and infrastructure expansion, the company is positioned to benefit from a revival in domestic project activity and long-term capex cycles.

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.