- Share.Market

- 7 min read

- Published at : 17 Jul 2025 10:45 AM

- Modified at : 17 Jul 2025 10:45 AM

The shares of Bharti Airtel, Kotak Mahindra Bank, HCL Technologies, Cummins India, and Dabur India are set for their record date on Tuesday, July 18, 2025.

To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Bharti Airtel Ltd. has announced a final dividend of ₹16 and a special dividend of ₹3

Bharti Airtel is a leading Indian telecommunications company, offering mobile, broadband, and digital services across Asia and Africa.

Bharti Airtel had a strong operational year operationally in FY2025. Their India margins improved to 48% even while rolling out expensive 5G networks.

The company cleaned up its balance sheet by paying off ₹42,000 crore of old high-interest debt, bringing its debt levels down to a comfortable 1.5 times earnings.

They generated ₹31,400 crore in operating cash flow. On the customer front, they added 5 million revenue-earning mobile users and now have 135 million people using their 5G network across 25,000 new cell towers.

Their broadband business picked up 8.1 lakh new customers. Airtel’s payments bank is doing well with 96 million monthly active users generating ₹2,900 crore annually. Their African operations also grew steadily at 3.5% with healthy margins of 35.9%.

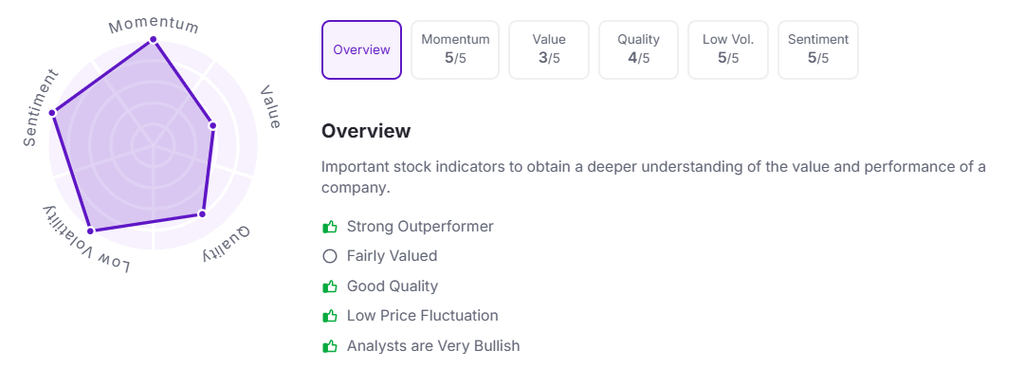

Let’s take a look at its Factor Analysis scores:

Kotak Mahindra Bank Ltd. has announced a final dividend of ₹2.50 per equity share and an additional ₹2.00 per equity share on July 19th.

Kotak Mahindra Bank is one of India’s top private banks, serving 5.3 crore customers through 2,148 branches nationwide.

The bank had a solid year in FY2025, earning ₹13,720 crore in core profits. They maintained healthy margins at 4.96% while growing their loan book by 13% to ₹4.78 lakh crore. Customer deposits also grew strongly to ₹4.99 lakh crore.

What’s impressive is their asset quality – bad loans dropped to just 0.31%, among the lowest in Indian banking. They’ve invested heavily in technology, achieving zero system downtime and launching new digital platforms like their redesigned mobile app.

Beyond banking, Kotak’s wealth management serves 60% of India’s richest families, while their mutual fund business ranks 5th largest nationally. Their broking arm holds a 12% market share, making them a complete financial services powerhouse.

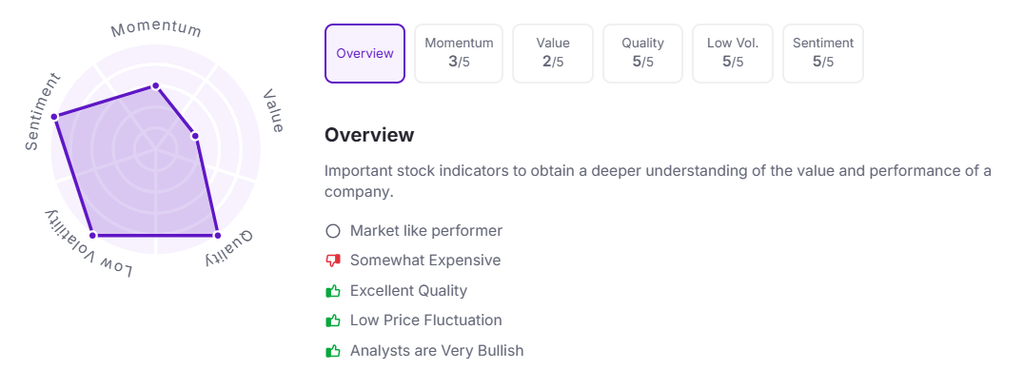

Let’s take a look at its Factor Analysis scores:

HCL Technologies Ltd. has announced an interim dividend of ₹12.00 per equity share.

HCLTech is a global technology services company with over 223,000 employees serving clients across 60 countries in areas like IT services, engineering, and software.

The company had a decent quarter ending June 2025, generating ₹30,349 crore in revenue, up 8.2% year-over-year.

However, profits took a hit, dropping to ₹3,843 crore, a decline of nearly 10% from the previous year, although margins remained healthy at 12.7%.

What’s encouraging is their strong focus on AI and digital transformation. Digital services now make up 42% of their revenue and grew 15% annually.

They’re partnering with OpenAI and winning exclusive AI contracts across manufacturing, sports, and aerospace sectors.

Their client relationships are strengthening – they now have 54 clients paying over $50 million annually, up from 48 last year.

The company generated solid cash flows of $2.4 billion and maintained its 90th consecutive quarterly dividend payment, showing consistent shareholder returns.

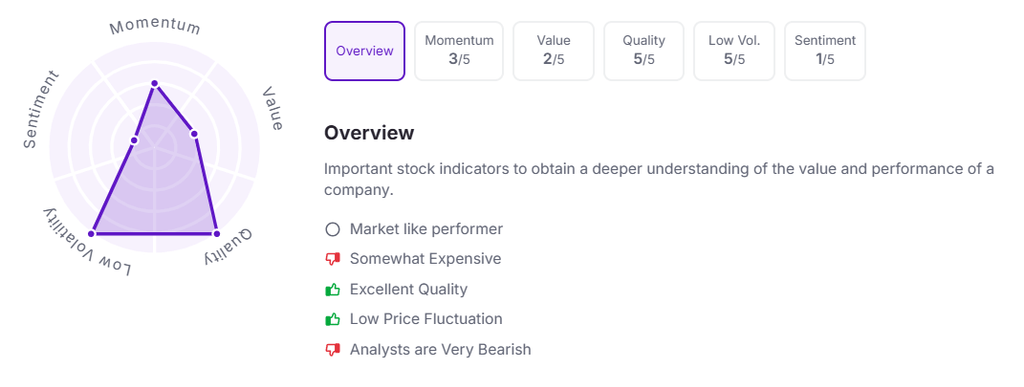

Let’s take a look at its Factor Analysis scores:

Cummins India Ltd. has announced a final dividend of ₹ 33.50 per equity share.

Cummins India is a leading manufacturer of engines, generators, and related technologies, serving domestic markets and exporting globally to the US, Europe, and other regions.

The company had a strong year in FY2025, crossing the ₹10,000 crore revenue milestone for the first time and up 15% from the previous year. Profits grew equally well to ₹1,906 crore, also up 15%, with healthy margins of 18.4%.

What’s notable is their strong cash generation – operating cash flows jumped 36% to ₹1,745 crore, showing the business quality. They’re also rewarding shareholders generously with a total dividend of ₹51.5 per share.

The company is innovating rapidly, being among the first to launch CPCBIV+ gensets and delivering over 23,000 units. They’re expanding into new sectors like railways and defense, while maintaining strong partnerships with Indian Railways. Their dealer network grew from 113 to 127 locations, and they achieved a customer satisfaction score of 90%.

Let’s take a look at its Factor Analysis scores:

Dabur India Ltd. has announced a final dividend of ₹5.25 per equity share.

Dabur India is a leading consumer goods company with a diversified portfolio spanning home & personal care, healthcare, and foods & beverages across domestic and international markets.

The company faced headwinds in FY2025, with revenue growing just 1.3%, primarily due to inventory corrections in Q2 to support distributor margins. Operating profits declined 3.5%, compressing margins to 18.4% from previous levels, while net profit fell 4.1% to ₹1,768 crore.

However, the international business showed resilience with 17.2% constant currency growth, now contributing 26% of revenues. Key markets like Egypt (55% growth) and Bangladesh (20% growth) drove this performance.

Domestically, the healthcare segment faced challenges with an 8.8% decline due to contracted winters affecting seasonal products like Chyawanprash and honey.

The home & personal care segment remained flat at ₹4,179 crore, though hair care and skincare showed positive momentum.

Management is implementing a strategic refresh focused on premiumization, portfolio rationalization, and GTM 2.0 initiatives, including distributor consolidation and emerging channel expansion to accelerate profitable growth.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 10:40 AM

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.