- Share.Market

- 6 min read

- Published at : 04 Aug 2025 11:41 AM

- Modified at : 04 Aug 2025 12:10 PM

The shares of Berger Paints, Chambal Fertilisers & Chemicals, DCM Shriram, Hyundai Motor India, and Ipca Laboratories are set for their record date on Tuesday, August 05, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Berger Paints (India) Ltd. has announced a dividend of ₹3.80 per equity share. It has a dividend yield of 0.60%.

Berger Paints, the country’s second-largest paint company with a global presence, reported a 7.3% YoY rise in Q4 FY25 consolidated revenue to ₹2,704 crore. Strong decorative volume growth and resilient industrial demand drove performance, with net profit up 18.1%. The company also achieved its highest gross margin in 12 quarters. For FY25, revenue rose 3.1% to ₹11,544.7 crore and net profit increased 1.1% to ₹1,182.8 crore.

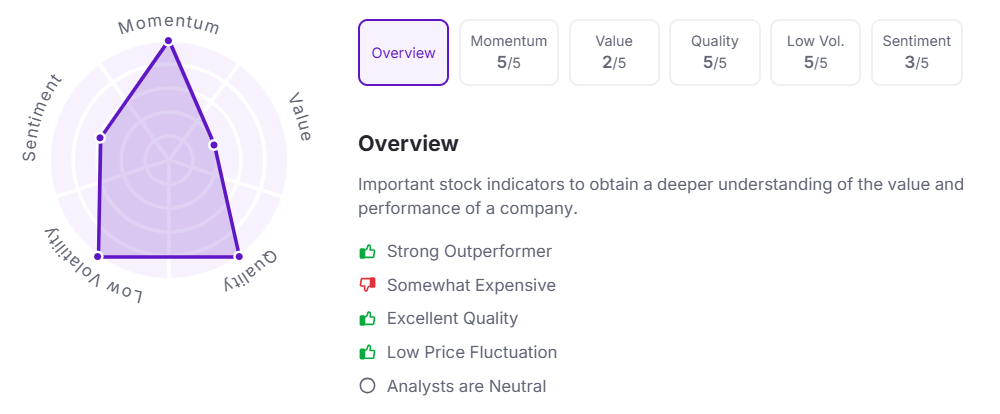

Let’s take a look at its Factor Analysis scores:

Chambal Fertilisers & Chemicals Ltd. has announced a final dividend of ₹5.00 per equity share. It has a dividend yield of 1.50%.

Chambal Fertilisers and Chemicals, one of India’s leading urea producers with a 15% market share, operates three advanced plants at Gadepan, Rajasthan, with a combined annual capacity of 3.4 million MT. The company caters to farmers across 10 states through an extensive network and has expanded into pesticides and agri-inputs under the ‘Uttam’ brand.

In Q1 FY26, Chambal reported a 16% year-on-year growth in standalone revenue to ₹5,698 crore, while PAT rose 16% to ₹638 crore. EBITDA dipped 1% to ₹929 crore, though consolidated PAT rose 23% to ₹838 crore, supported by strong volumes and a focus on sustainable agri solutions.

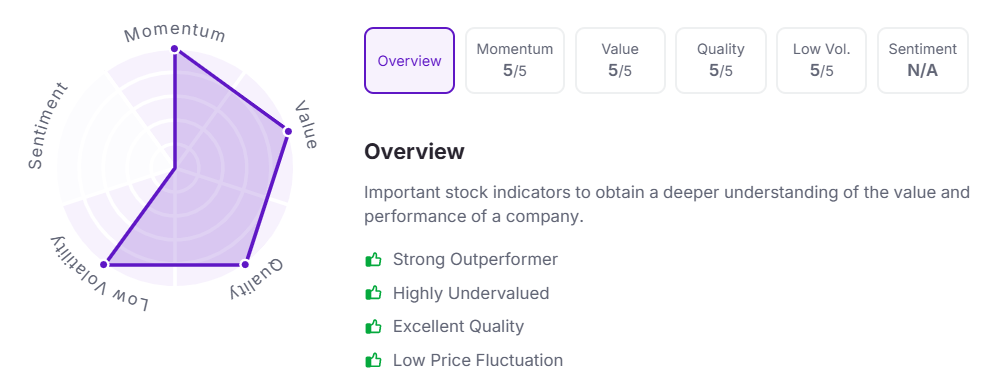

Let’s take a look at its Factor Analysis scores:

DCM Shriram Ltd. has announced a final dividend of ₹3.40 per equity share. It has a dividend yield of 0.40%.

DCM Shriram, a diversified conglomerate with interests across agri-inputs, chemicals, and building systems, reported a strong Q1 FY26 with net revenue rising 13% YoY to ₹3,262 crore. PAT rose 14% to ₹114 crore, supported by volume-led growth in chemicals and improved margins from cost efficiencies and lower input prices.

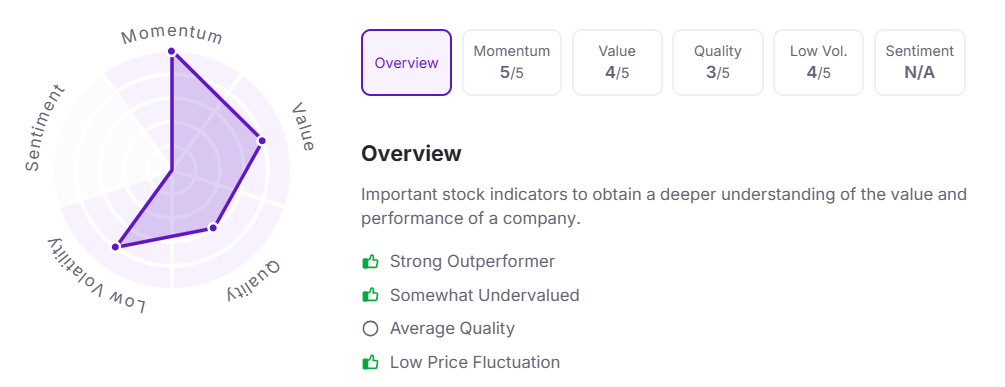

Let’s take a look at its Factor Analysis scores:

Hyundai Motor India Ltd. has announced a final dividend of ₹21.00 per equity share.

Hyundai Motor India, a key subsidiary of Hyundai Motor Company and a leading auto manufacturer in India, reported consolidated revenue of ₹1,64,129 million in Q1 FY26, with EBITDA at ₹21,852 million (13.3% margin) and PAT at ₹13,692 million. Growth was driven by a 13% YoY rise in exports, higher rural contribution, and increased CNG variant sales. Despite muted domestic demand, disciplined cost control and a strong export mix helped sustain margins. Flagship models achieved key milestones, while the company continued expanding capacity with new engine production at its Pune facility.

Ipca Laboratories Ltd. has announced a final dividend of ₹2.00 per equity share.

Ipca Laboratories, a fully integrated pharmaceutical company with a global footprint in over 120 countries, reported a strong Q4 FY25 performance. Consolidated net income rose 11% YoY to ₹2,272.5 crore, led by 11% growth in Indian formulations and 6% rise in export income. Consolidated EBITDA margin improved to 18.24%, up from 14.98% last year, while net profit before exceptional items nearly doubled to ₹270.8 crore, up 94% YoY. Standalone EBITDA margin stood at 21.19%, and net profit rose 36% to ₹216.5 crore.

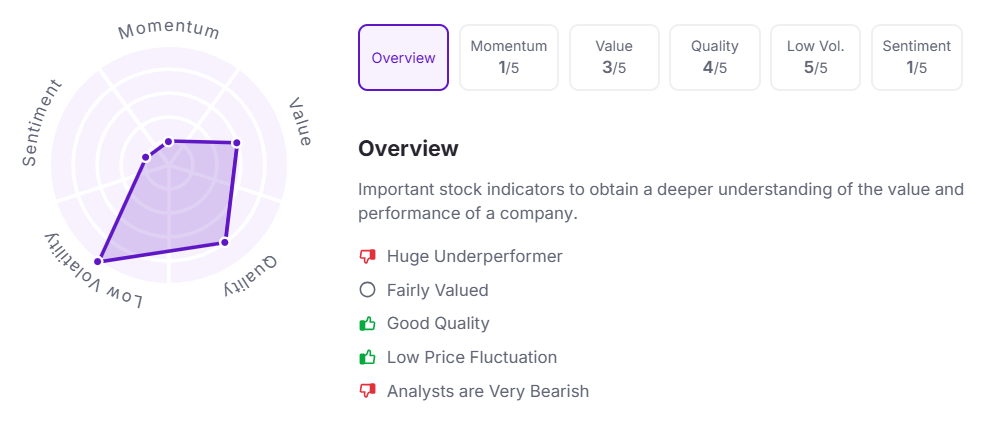

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:35 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.